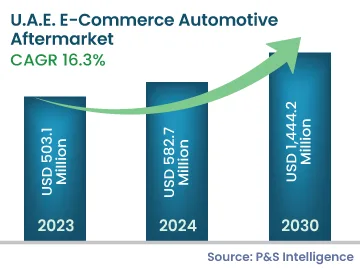

What will be the worth of the U.A.E. E-Commerce Automotive Aftermarket by 2030?+

The U.A.E. E-Commerce Automotive Aftermarket is projected to reach a worth of USD 1,444.2 million by 2030.

What is the CAGR of the U.A.E. E-Commerce Automotive Aftermarket from 2024 to 2030?+

The CAGR for the U.A.E. E-Commerce Automotive Aftermarket from 2024 to 2030 is 16.3%.

What are the key drivers of market expansion in the U.A.E. E-Commerce Automotive Aftermarket?+

The key drivers include rising customer awareness and convenience, a growing number of do-it-yourself (DIY) customers, increased road accidents, and rising vehicle sales.

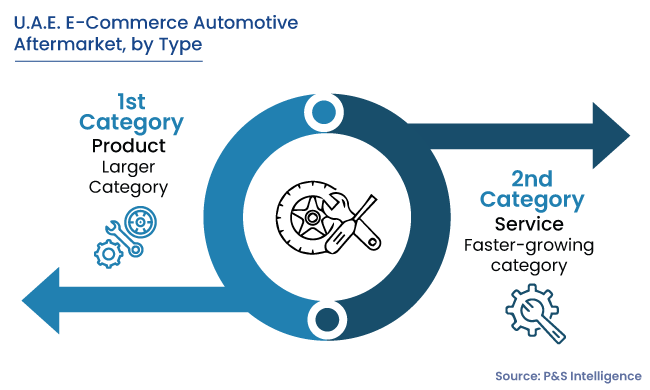

Which category generated the highest revenue in the U.A.E. E-Commerce Automotive Aftermarket in 2023?+

In 2023, the product category generated revenue exceeding USD 0.3 billion, making it the highest revenue-generating category.

What is the fastest-growing category in the U.A.E. E-Commerce Automotive Aftermarket?+

The service category is expected to experience the fastest growth with a CAGR of 16.5% during the forecast period.

How competitive is the U.A.E. E-Commerce Automotive Aftermarket?+

The U.A.E. e-commerce automotive aftermarket is currently fragmented because of the existence many of local participants. However, it is progressively moving toward consolidation.