E-Commerce Automotive Aftermarket Future Prospects

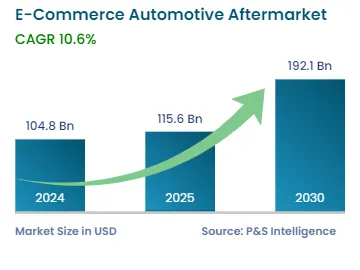

The e-commerce automotive aftermarket size will stand at an estimated USD 104.8 billion in 2024, and it will advance at a CAGR of 10.6% during 2024–2030, reaching USD 192.1 billion by 2030. This will primarily be due to the increasing number of DIY customers. Other major driving factors for the market are the convenience offered by online shopping channels and growing market.

The availability of a wide range of products and hassle-free transactions with timely delivery are resulting in a shift to the online purchasing of automotive replacement parts from getting them at the traditional brick-and-mortar stores. A large number of e-retailers, such as Alibaba Group Holding Ltd., Amazon.com Inc., and Wal-Mart Stores Inc., offer automotive components, thus making the access easy for consumers.

Vehicle compatibility requirements and the specifications of the products and services offered in the market make it trivial and complicated for regular customers to evaluate them and estimate their cost against the value they would be deriving out of them. Hence, to avoid purchasing overpriced products, customers are opting for e-commerce automotive aftermarket platforms because of the freedom allowed to them to navigate through the product offerings without getting affected by the sales tactics one needs to be wary of during an offline purchase, thereby bridging the trust deficit between the retailer and the customer.

Furthermore, e-commerce allows for extensive research and comparison on prices, features, compatibility, specifications, delivery times, offers, and other aspects, which makes it easier for DIY and do-it-for-me (DIFM) customers to compare products from multiple online sources; this is not always possible at brick-and-mortar stores. These additional advantages are driving the market.

DIY vehicle owners and auto enthusiasts take up the task of upgrading their vehicles themselves. While mechanics and maintenance and service centers have traditionally been the core customer base for auto parts suppliers, DIY enthusiasts have lately come to account for a significant percentage of the aftermarket component sales through e-commerce platforms. The automotive aftermarket is expected to benefit from the customer base now including car owners and enthusiasts, apart from maintenance and service centers.