U.A.E. Diesel Generator Set Market Future Prospects

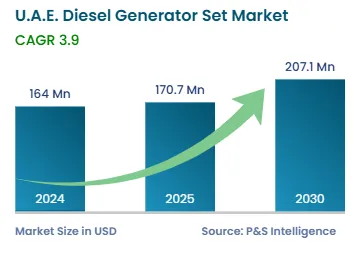

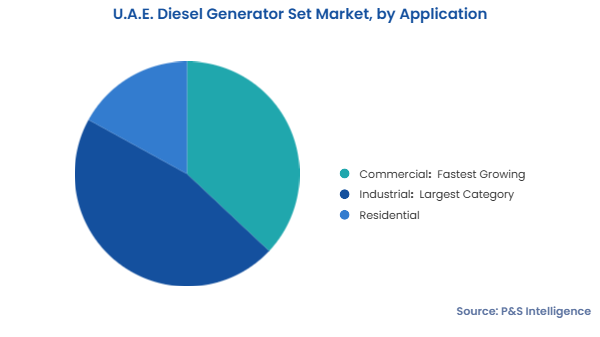

The U.A.E. diesel generator set market will generate an estimated revenue of USD 164.0 million in 2024, and it is projected to grow at a CAGR of 3.9% from 2025 to 2030, reaching USD 207.1 million by 2030. The substantial growth is attributed to the rising demand for prime and backup power sources, primarily in residential buildings, retail stores, office spaces, hospitals, and hotels. Furthermore, the market growth is driven by the high-volume demand for medium- and high-power diesel gensets from the commercial sector and the growth in the construction, mining, energy & power, oil & gas, and manufacturing industries.

There are several infrastructure developments taking place within the U.A.E. For instance, the Urban Master Plan of Dubai aims to enhance urban mobility and connectivity. U.A.E. is also scheduled to host the World Expo in the year 2025 in Dubai and requires a reliable source of power to meet the demands arising through large visitor inflow and events.

As the U.A.E. continues to move forward into a balanced mix of its energy portfolio, diesel gensets will always play a fundamental role in generating backup power at peak demand periods. Improvements in efficiency and reliability in diesel gensets with newer technologies and the latest smart monitoring systems, including IoT, are making diesel generator sets more attractive to consumers across all sectors.