Report Code: 11729 | Available Format: PDF | Pages: 135

Two-Wheeler Hub Motor Market Research Report: By Vehicle Type (E-Bikes, E-Scooters and Motorcycles), Motor Power (<0.5 kW, 0.5-1.5 kW, 1.5-4 kW, >4 kW), Motor Architecture (Brushed Motor, Brushless Direct Current Motor, Permanent Magnet Synchronous Motor, Induction Motor), Motor Type (AC Motor, DC Motor), End Use (OEM, Aftermarket), Regional Outlook (U.S., Canada, Italy, France, Belgium, Germany, U.K., Austria, Spain, Switzerland, Netherlands, China, India, South Korea, Japan, Indonesia, Malaysia, Singapore, Philippines, Thailand) - Global Industry Size Analysis, Competitive Share and Growth Forecast to 2024

- Report Code: 11729

- Available Format: PDF

- Pages: 135

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

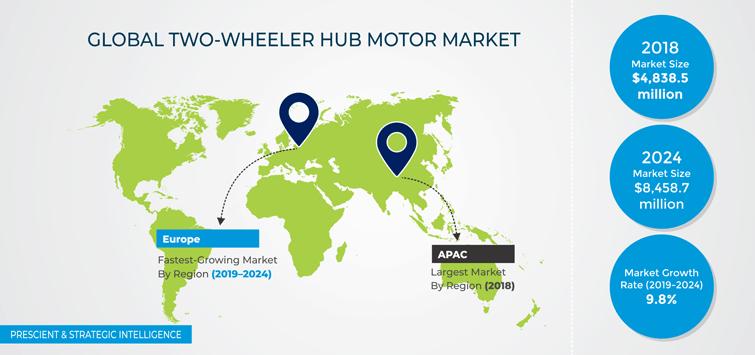

The two-wheeler hub motor market revenue stood at $4,838.5 million in 2018, and it is predicted to be more than $8,458.7 million by 2024. Furthermore, the market is predicted to progress at a CAGR of 9.8% from 2019 to 2024. The market recorded sales of 59,103.0 thousand units in 2018, and this number is predicted to rise to 107,729.0 thousand by 2024, exhibiting a CAGR of 10.6% between 2019 and 2024.

Across the globe, the market for two-wheeler hub motors is predicted to demonstrate the fastest growth in Europe in the forthcoming years. This will be due to the fact that electric two-wheelers are rapidly replacing their gasoline counterparts in European countries, especially since the enactment of the Euro 4 emission standards in 2016. These standards were enacted for regulating the capacity and performance of two-wheelers, and their most significant impact has been on two-wheelers with engines of more-than-125-cc capacity.

Market Dynamics

The mushrooming popularity of high-power motors is one of the key trends currently being witnessed around the world. Major automakers, such as Vectrix, BMW AG, and Zero Motorcycles Inc., are developing electric motorcycles with motor power of more than 30 kilowatts (kW). Moreover, these two-wheeler hub motor market players intend to launch models with an even higher motor power soon.

For instance, Zero Motorcycles announced in 2018 that it plans to launch a dual-sport electric motorcycle, named Zero DS ZF7.2. This motorcycle will be 8.0% faster and have a 35.0% more-powerful motor than the previously launched models. Additionally, several manufacturers of traditional motorcycles have announced plans to launch high-power electric models in the coming years. For example, Harley-Davidson Inc. will launch its high-power electric motorcycle LiveWire by the end of 2019. This model will have a driving range of up to 235 km on a single charge.

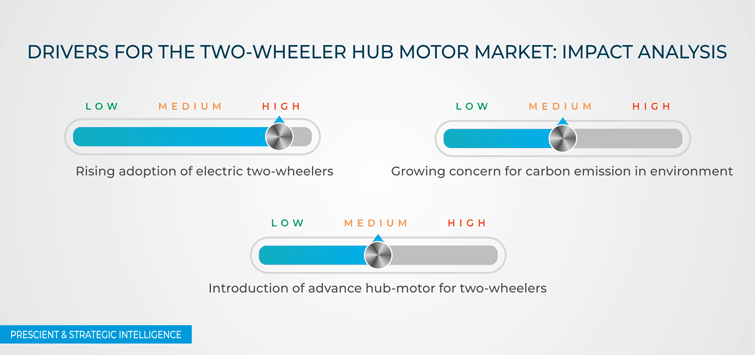

The growing deployment of electric two-wheelers is the major factor supporting the demand for such motors. Due to the soaring concerns over the rapid environmental degradation because of the surging carbon emissions by traditional fuel-based vehicles, the sales of electric two-wheelers have grown explosively over the last few years. In addition, electric two-wheelers are increasingly being preferred by many governments over the conventional light motor vehicles (LMVs), thereby fueling the revenue surge in the two-wheeler hub motor industry.

Segmentation Analysis

Both the e-scooters and motorcycles and e-bikes categories, under the vehicle type segment, held similar shares, in terms of volume, in the two-wheeler hub motor market in 2018. In the coming years, the e-scooters and motorcycles category is predicted to exhibit the higher growth rate (12.3%) in the market, primarily because of the rising deployment of these vehicles by customers and public sharing companies on account of their increasing cost-effectiveness and maintenance convenience than gasoline variants.

The <0.5 kW category dominated the industry in 2018, within the motor power segment, and this trend is predicted to continue in the coming years. This is ascribed to the ballooning usage of low-power motors in a majority of the e-bikes being sold across the globe.

The induction motor category is predicted to demonstrate the fastest growth (25.8% CAGR), in terms of volume, in the upcoming years, under the motor architecture segment. This is credited to the growing requirement for high-power electric motorcycles, which mostly have induction motors.

The market was dominated by the DC motor category, under segmentation by motor type, in 2018. DC motors allow for a better speed variation, provide a higher starting torque, and help in quick stopping, reversing, and starting. Moreover, these motors are easier to maintain than AC motors.

The aftermarket bifurcation is predicted to demonstrate the faster growth within the end use segment of the two-wheeler hub motor market in the forthcoming years. The average life of a hub motor is shorter than that of the electric two-wheeler in which it is used. Therefore, the growing deployment of these vehicles is pushing up the replacement rate of hub motors around the world.

Regional Outlook

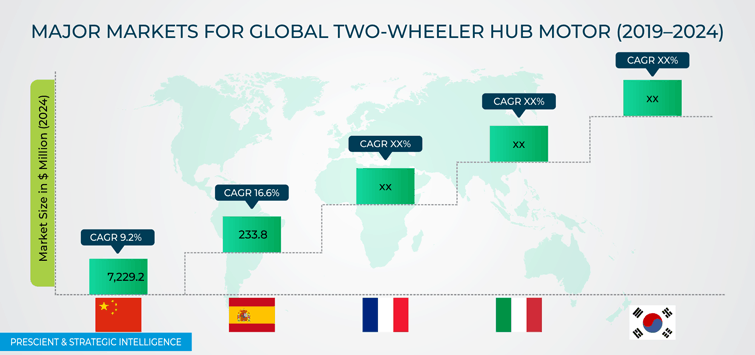

The Asia-Pacific (APAC) region dominated the market for two-wheeler hub motors in 2018, and it is predicted to maintain its market dominance in the coming years. This is ascribed to the expansion of the Chinese market, which alone held nearly 97.6% of the worldwide market share, in terms of value, in 2018. This was due to the early adoption of electric two-wheelers in the country because of the favorable government regulations. Moreover, in China, the market is predicted to reach a value of $7,229.2 million by 2024.

The market is predicted to exhibit the highest growth rate in the European region in the forthcoming years on account of the implementation of strict emission norms, such as the Euro 4 standards. These norms are encouraging the deployment of EVs in urban areas, especially those that have high carbon emission rates. In this region, the two-wheeler hub motor market is predicted to exhibit the fastest growth in Belgium, with a CAGR of 24.8%, between 2019 and 2024.

Competitive Landscape

The global two-wheeler hub motor market is highly fragmented, with the top six players accounting for less than 40.0% revenue in 2018. The market comprises numerous unorganized players, especially in China. Most of the electric two-wheeler manufacturers use hub motors provided by local Chinese players, making the market scrappy and diverse. The major players operating in the market are Yadea Technology Group Co. Ltd., Robert Bosch GmbH, Ananda Drive Techniques Co. Ltd., Jiangsu Xinri E-Vehicle Co. Ltd., and Zhejiang Luyuan Electric Vehicle Co. Ltd.

Recent Strategic Developments of Major Two-Wheeler Hub Motor Players

In recent years, the major players in the two-wheeler hub motor market have taken several strategic measures, such as product launches, mergers and acquisitions, and facility expansions, to gain a competitive edge in the industry. For instance, in July 2019, Robert Bosch GmbH announced that it would take up 50.0% stake in MAGURA Bike Parts, a subsidiary of MAGURA, in order to introduce a joint-venture under the name MAGURA Bosch Parts & Services GmbH & Co. KG. The development is aimed at achieving a closer cooperation between the two companies in the distribution of service and replacement parts. Moreover, the development is intended to strengthen and expand Bosch’s services in the e-bike market in Europe in the long run.

Key Questions Addressed/Answered in the Report

- What is the current scenario of the global two-wheeler hub motor market?

- What are the emerging technologies for the development of two-wheeler hub motors?

- What is the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws