Europe Electric Scooters and Motorcycles Market Analysis

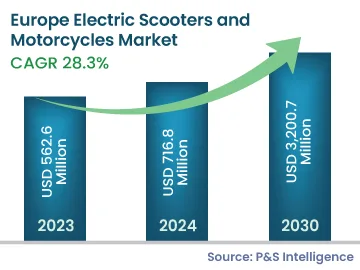

The European electric scooters and motorcycles market was valued at USD 562.6 million in 2024, which is expected to grow at a CAGR of 28.3% during the forecast period 2024–2030. The major factors responsible for the growth of the market are rising traffic concerns in major European countries and apprehensions regarding greenhouse gas emissions, leading to several government initiatives and the deployment of electric scooters for sharing services.

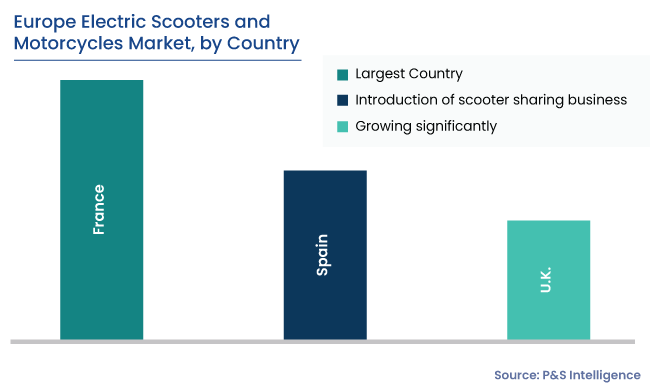

Electric motorcycles and scooters-sharing services have added the element of convenience to the daily commute of the general public, especially for those not owning any vehicle. With the launch of these services, users can travel to their destinations without having the need to own vehicles and bear secondary charges, including maintenance, insurance claims, and parking.

The consumer can make payments according to the distance travelled by them with a starting registration cost. Nowadays, more than 50 scooter-sharing service providers operate in Europe, offering services in more than 50 cities.