Report Code: 11543 | Available Format: PDF

Surgical Equipment Market: Historical Size and Share Analysis, Future Growth Potential, Key Regions, Forecast till 2030

- Report Code: 11543

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

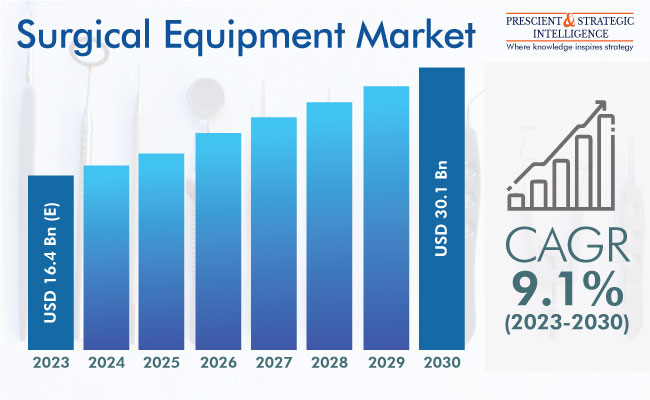

The global surgical equipment market revenue is USD 16.4 billion (E) in 2023, and it will advance at 9.1% CAGR during 2023–2030, to reach USD 30.1 billion by 2030.

The growth of the industry is attributed to the increasing cost of healthcare, rising incidence of lifestyle illnesses that necessitate surgery, large unmet surgical requirements, and surging elderly population. Moreover, a rising number of ambulatory surgical centers and advancing minimally invasive surgery technology are likely to fuel the progress of the industry during the projection period.

Additionally, the risk of developing disorders that necessitate surgery is higher among people 60 years of age or above than in the younger population. For instance, according to the Cleveland Clinic, doctors perform over 90% of the hip replacement surgeries on adults of age over 50 years.

Rising Preference for Robotic Assisted Surgery Is Strong Market Driver

The surging preference for robotic surgeries, because of their better precision, control, and flexibility than the traditional approaches, is likely to boost the advance of the industry. With this, market players continue to pursue the development of surgical robots and associated tools to meet the patient demand.

For example, in October 2022, Medtronic plc received approvals for its Hugo robotic-assisted surgery system to enter three markets and expand its application. The product has seamless and secure video recording options and advanced instrumentation and visualization and is portable, modular, scalable, and accessible.

Technological Advancements in Surgical Devices Are Key Market Trend

To enhance patient outcomes amidst the rising concerns over complications during surgeries, the tools utilized for such procedures are being technologically advanced. A key innovation here is the integration of lights in the instruments, especially retractors, to enable the surgeon to better see inside the body cavity. Similarly, handheld tools, especially those used for cutting into the flesh, now come with ergonomic designs, allowing surgeons to better grasp them and feel comfortable while operating on patients.

Electrosurgical Devices Category To Observe Fastest Growth

The surgical sutures and staplers category, based on product, holds a significant share in 2023, because of the surging usage of these instrument in wound closure procedures. Moreover, within the sutures and staplers category, staplers’ demand is rising swiftly because of their lower infection risk and faster healing of wounds over sutures.

Moreover, government initiatives and advancements in technology will boost the usage of sutures during the projection period. For example, Ethicon Inc. declared that the NICE has issued new instructions for medical technology in June 2021 that recommend the utilization of its Plus sutures in surgeries within the NHS. This has been done to prevent surgical site infections, as these sutures provide antibacterial protection.

The electrosurgical devices category is likely to observe the fastest growth during this decade, because of the surging requirement for these devices in laparoscopic surgeries. Thus, the key players in the industry are developing better electrosurgical devices.

The handheld surgical category also accounts for a significant share, and it will advance at a healthy rate during this decade. Most of the surgeries are still conducted by hand, which drives the demand for scalpels, retractors, trocars, gaspers, dilators, forceps, spatulas, and other handheld instruments. A key trend observed in this category is the shift toward disposable instruments because of their lower cross-contamination risk and cost-effectiveness.

Growing Requirement for Powered Surgical Staples Tools Is Key Opportunity

The increasing demand for powered surgical tools is one of the biggest opportunities in the market. With the increasing awareness of better post-operative outcomes, the demand for surgical tools powered by electricity and other forms of energy is rising. Such instruments include surgical drills, saws, surgical staplers, clip appliers, and radiofrequency electrosurgical devices, which are used to burn the skin and tissue and create openings in the body for surgeons.

Additionally, with the increasing demand for operational convenience, cordless, powered surgical tools integrated with batteries are being launched. Moreover, they are widely used in minimally invasive surgeries, the demand for which continues to burgeon with the rising patient demand for shorter surgeries and post-operative stay, less pain and scarring, and cost-effectiveness.

Plastic and Reconstructive Surgery Category To Observe Fastest Growth

The obstetrics and gynecology category, based on application, is a significant contributor to the surgical equipment industry. This is because of the surging number of births and the swift increase in the incidence of female reproductive organ disorders, which has resulted in a surge in gynecological surgery volume.

The plastic and reconstructive surgery category is expected to observe fast growth during the forecast period. The surging requirement to enhance one’s aesthetic appeal and technological advancements are likely to drive the progress of this category. Additionally, the increasing number of people choosing careers in the entertainment sector, which necessitates them to concentrate more on their appearance, as well as the increasing disposable income in China and India, will make aesthetic surgeries ever more popular.

| Report Attribute | Details |

Market Size in 2023 |

USD 16.4 Billion (E) |

Revenue Forecast in 2030 |

USD 30.1 Billion |

Growth Rate |

9.1% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Is Market Leader

North America is the largest contributor to the industry, and it will remain the largest throughout the projection period. This is attributed to the surging incidence of chronic illnesses and the mounting elderly population in the region. Moreover, the increasing consciousness about the advantages of surgical treatments and the mounting requirement for laparoscopic surgeries will boost the growth of the regional industry.

Furthermore, the existence of a developed healthcare infrastructure in the continent helps the industry grow because of the surge in the penetration of clinics, hospitals, and ambulatory services. Additionally, the rising health awareness and growing consumer expenses boost the demand for all kinds of surgical equipment in the region.

The APAC surgical equipment market is likely to observe the fastest growth during the forecast period. This is because of the speedy urbanization, surging count of healthcare facilities, growing incidence of chronic illnesses, and the huge population in the region. Furthermore, the increasing incidence of road accidents is driving the growth of the industry in APAC. As per the WHO, approximately 93% of the road accidents across the world occur in underdeveloped and developing nations, and they are a main cause of death among young adults and children.

Key Players in Surgical Equipment MarketInclude:

- Integra LifeSciences Holdings Corporation

- Erbe Elektromedizin GmbH

- KLS Martin Group

- CONMED Corporation

- Ethicon Inc.

- Zimmer Biomet Holdings Inc.

- Aspen Surgical Products Inc.

- Smith & Nephew PLC

- Medtronic plc

- Alcon Inc.

- Ethicon Inc.

- Medicon eG

- Becton, Dickinson and Company

- B. Braun Melsungen KG

- Boston Scientific Corporation

- Stryker Corporation

- Meril Life Sciences Pvt. Ltd.

- KARL STORZ SE & Co. KG

- Olympus Corporation

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws