Southeast Asia HVAC Market Analysis

The Southeast Asian HVAC market generated revenue of USD 20.8 billion in 2023, which is expected to witness a CAGR of 6.9% during 2024–2030, to reach USD 33.0 billion by 2030. This is primarily due to the increasing pace of infrastructure development and growing hospitality industry.

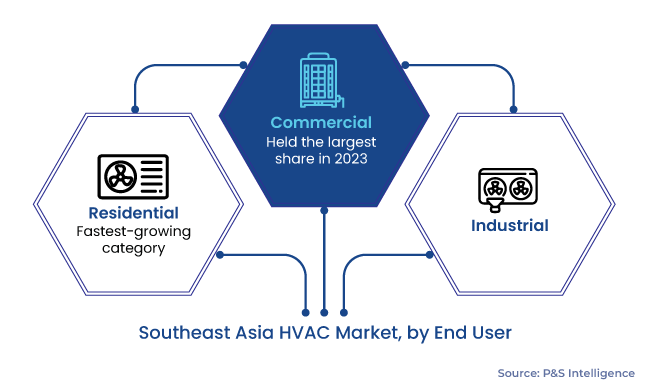

Moreover, the market growth is driven by the rising number of commercial buildings and the energy-saving policies of regional countries, which are making people replace their conventional HVAC appliances with energy-efficient ones.

For instance, in the Philippines, the Department of Energy (DoE) has published energy efficiency guidelines under the Philippine Energy Labeling Program (PELP) for ACs, refrigerators, TV sets, and lights. These guidelines encourage the implementation of the Energy Efficiency Performance Rating (EEPR) system, along with specific mechanical, electrical, and plumbing (MEP) standards, which AC products must follow. The use of IoT and other energy-efficient technologies will further boost the market in the Philippines.