HVAC Market Analysis

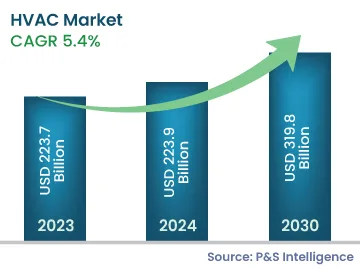

The HVAC market size stood at USD 223.7 billion in 2023, and it is expected to grow at a CAGR of 5.4% during 2024–2030, to reach $319.8 billion by 2030.

The varied global climatic conditions and the strong need to maintain an ambient environment in a building are the key reasons that will positively impact the market over the forecast period. In recent times, smart features and higher energy efficiency have been the key purchase criteria for most customers, and the trend is expected to gain traction over the next few years.

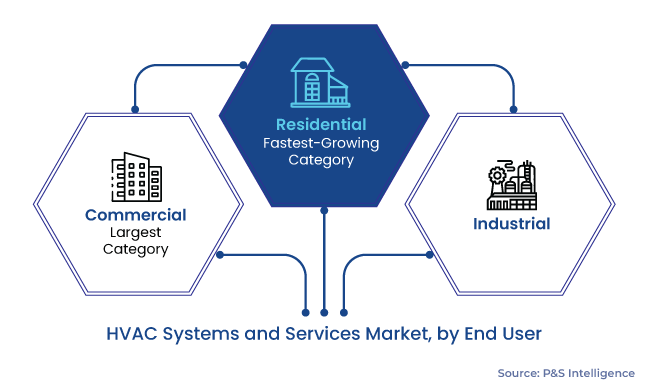

The global product sale is being propelled by the rapid pace of urbanization and industrialization. As a result, the number of companies, manufacturing units, and residential complexes that utilize such equipment is experiencing a high rate of increase.

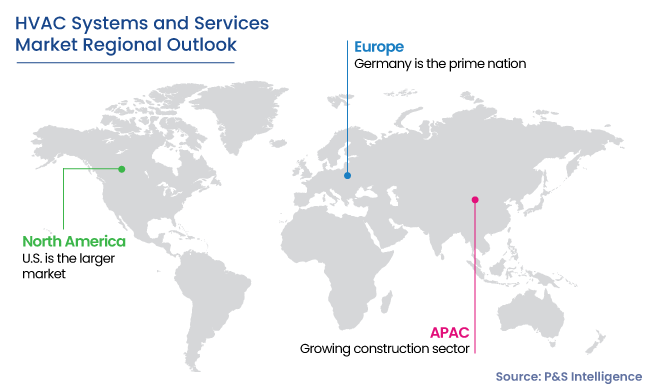

Moreover, global warming, predominately due to greenhouse emissions, has led to a rise in the temperature, which has been a major driving force for the demand for heating, ventilation, and air conditioning across the globe. According to NASA’s Goddard Institute of Space Studies (GISS), since 1980, the average global temperature has increased by 0.5 degrees C per year. Furthermore, some parts of North America and almost the whole of the MEA and APAC experience subtropical and hot climates, resulting in intensely hot and humid summers.

Moreover, climate change has resulted in an inflated use of cooling equipment in the summer and of furnaces, boilers, and unitary heaters in the winter. Climate change impacts building power consumption and air conditioning loads, which vary depending on the ambient temperature and humidity.

In addition, the energy efficiency of these systems is projected to improve as a result of the new regulatory requirements. This has paved the way for smart controls to be included in buildings' modern heating and air conditioning units. Further, the growing population, increasing consumer disposable income, and booming commercial construction activities are creating prospects for future equipment demand.

Hence, players in the industry are gradually shifting their focus on reducing the heating and cooling capacity of their models, while decreasing their electricity consumption. Several OEMs are focusing on green initiatives to reduce greenhouse emissions and manufacturing costs. Therefore, in recent years, there has been a major thrust toward eco-friendly temperature-control units, which are those that consume less power and operate on renewable sources of electricity, thereby reducing costs.

Additionally, developing countries such as China, India, Indonesia, Thailand, Brazil, and Mexico, are witnessing significant economic growth, which has resulted in a rise in the purchasing power of middle-class families.

Therefore, to improve their foothold in the HVAC equipment market, various businesses are increasing their product range, by developing HVAC equipment with advanced technologies. Moreover, in recent years, the HVAC market has seen a number of developments geared at making systems not only more efficient but also more environment-friendly.