Report Code: 11704 | Available Format: PDF | Pages: 250

Skin Replacements and Substitutes Market Size and Share Analysis by Product (Acellular, Cellular), Class (Class III, Class II, Class I), Application (Burns, Ulcers, Cosmetic Surgery), End User (Wound Care Clinics and Hospitals, Beauty and Cosmetics Industry) - Global Industry Demand Forecast to 2030

- Report Code: 11704

- Available Format: PDF

- Pages: 250

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Skin Replacements and Substitutes Market Size & Share

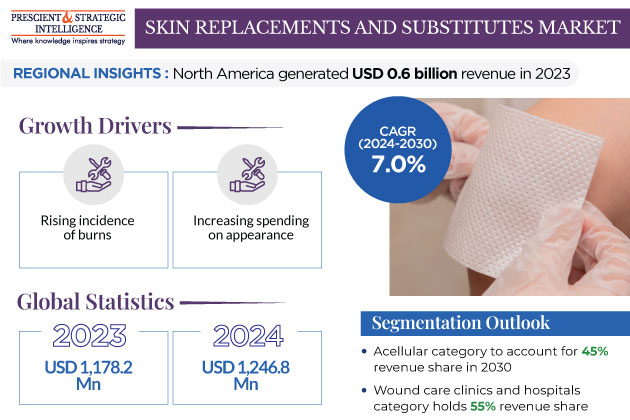

The revenue generated by the skin replacements and substitutes market stood at USD 1,178.2 million in 2023, and growing at a CAGR of 7.0% during 2024–2030, it is on the path to reaching USD 1,869.2 million by 2030. This is because of the increasing population, rising spending on appearance, surging incidence of burns and skin diseases, and escalating life expectancy all over the world.

Moreover, the rising popularity of minimally invasive surgeries, growing incidence of diabetic foot ulcers and vascular diseases, expanding geriatric population, advancing healthcare industry, and surging government investment are the major drivers for the market growth. In addition, the demand for tissue-engineered skin substitutes is rising because of the high popularity of skin grafts and the spreading awareness of different treatment options.

The funding provided by large companies and governments for R&D in regenerative medicine will also support the market growth. The skincare industry is also driven by the growing usage of the 3D printing technology for skin reconstruction by L’Oreal, Proctor & Gamble, and many other companies.

Rising Number of Burn Cases

The increasing burns incidence is one of the strongest drivers for the market. The World Health Organization says that approximately 0.18 million people die of burns every year, while in India alone, over 1 million people are affected by them. The number of burn cases is lower in high-income countries, while it is a major cause of disability-adjusted life years (DALYs) in low- and middle-income countries. Further, non-fatal burns are a chief cause of morbidity. The majority of the cases are reported in homes and workplaces, among which most happen accidentally.

Contact with ionizing radiation, sunlight, electricity, or heat can destroy the skin tissue. The usage of skin replacements (artificial skin) to close wounds caused by various factors that can lead to tissue necrosis, thus requiring immediate assistance, is a proficient way to meet the deficiency in donor skin grafts.

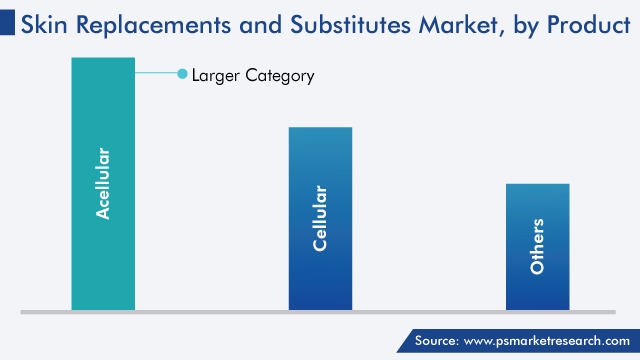

Acellular Substitutes Are Market Leader

In the product segment, the acellular category is expected to dominate the skin replacements market, with revenue share of around 45% in 2030. An acellular skin replacement can be performed on any demographic. It is appropriate for the pediatric population, and it can be used in excised and superficial wounds. The campaigns conducted by governments all over the globe educate the population about the uses and significance of biologics for wound repair, which, in turn, increases the demand for acellular variants.

Compared to traditional therapies, acellular skin replacements are efficient and cost-effective when healing chronic wounds. The goal is to construct a graft that is functional and can restore, improve, and maintain damaged tissues throughout the healing process. Biological skin substitutes consist of a supplementary extracellular matrix, which helps in the re-epithelialization and speedy recovery of the damaged skin. Few of the cellular allogenic substitute products are Grafix, GrafixPL Prime, and Dermagraft, which consist of sustainable fibroblast. The first composite skin graft approved by the FDA was GraftSkin, and it is used in the case of venous and neuropathic diabetic ulcers.

The process of skin grafting involves surgically removing skin from a healthy part of the body, called the donor site, and using it to cover the damaged part of the body, called the recipient site. Skin grafts are of three types, split-thickness, to treat burns; full-thickness, to treat intense and big wounds, where maximum elasticity is needed; and composite, which offer underlying support to the skin.

Rising Awareness of Benefits of Skin Replacements

The skin is the largest organ of the body, composed of the epidermis and dermis. It creates a protective barrier for the internal organs against toxins, heat, cold, and microorganisms; therefore, it should be intact to perform its function. Burns, infections, and several dermatological diseases, which are rising in incidence in all age groups, damage the skin’s layers, which has increased the global demand for biological skin substitute products.

Artificial skin is easy to store and sterilize, and it can be used to replace the damaged area; therefore, it is used in the case of ulcers, cosmetic surgeries, and burns. Severe burn injuries can destroy both layers of the skin, which results in permanent skin loss, as the destroyed dermis does not have the capability to regenerate. The issue can only be resolved with replacements or substitutes.

They are an effective way to prevent fluid loss from wounded areas and enhance the release of small proteins called cytokines, to help generate keratinocytes and release growth factors, thus hastening the wound healing process. They also act as a temporary protective cover for the wound bed during healing. Thus, as people become aware of all these advantages in an era when appearance is taken seriously, the market will continue to prosper.

Expanding Availability of Different Skin Replacement and Substitute Materials

Biologics, which include human and animal tissue; biosynthetic, and synthetic are the three kinds of skin grafting materials. Further, the materials are grouped into class I, class II, and class III. Class I consists of temporary, impervious dressing material, which functions like an epidermal barrier. Class II consists of single-layer, durable substitutes, which could be processed skin or fabricated with collagen or other extracellular matrix proteins, such as swine collagen membranes, dermal matrix of bovine origin, and dermal matrix of human origin.

Class III consists of composite skin substitutes, which replace both the dermal and epidermal layers. They can be human skin substitutes and those produced by tissue engineering. Class III is further divided into allografts and xenografts. Grafting from one member to another of the same species is known as allografting, whereas transplanting between members of different species is known as xenografting. The skin replacement graft’s thickness, pore size, and interconnecting pores should be optimum for the re-epithelialization process.

Wound Care Clinics and Hospitals Are Larger End Users

Based on end user, wound care clinic and hospitals held 55% revenue share in 2023, the largest in the segment. These healthcare centers employ a professional staff and use the latest wound dressing products and surgical instruments. Additionally, most tertiary-care hospitals house specialized burn care units with advanced technology, to deal with wound debridement, pain management, and infection prevention, which might not be available in other, smaller medical facilities. This is why patients prefer hospitals for treatment, as the closure of wounds here is done by experts with proper caution and hygiene.

They also provide monitoring services and follow-up care for burn patients, which is essential to ensure proper healing and recovery. Further, dedicated wound care clinics are gaining attention as they are accessible with shorter waiting durations and advantageous for patients with chronic wounds who need to make regular visits.

Another end user with a growing market share is beauty clinics and cosmetic centers, where plastic surgeries are being conducted in increasing numbers. As per the latest report of the International Society of Aesthetic Plastic Surgery (ISAPS), around 14.9 million surgical and 18.8 million non-surgical cosmetic procedures were conducted around the world in 2022. Traditionally offering mostly elective procedures, cosmetic centers have now also started providing some necessary treatments, such as procedures on skin damaged by burns, surgery, violence, and other reasons.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,178.2 Million |

Market Size in 2024 |

USD 1,246.8 Million |

Revenue Forecast in 2030 |

USD 1,869.2 Million |

Growth Rate |

7.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Class; By Application; By End User; By Geography |

Explore more about this report - Request free sample

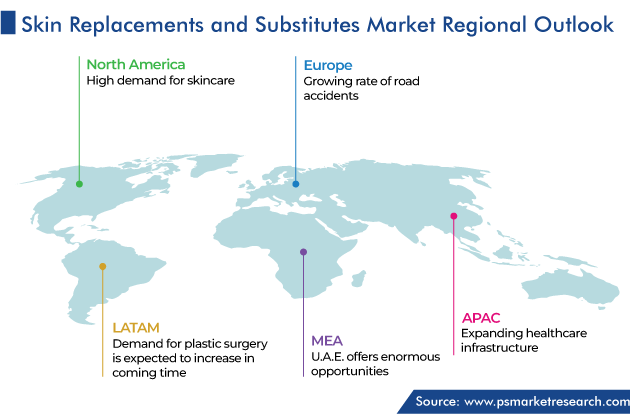

North America Dominates Market

Geographically, North America dominates the market, with around USD 0.6 billion revenue in 2023, due to the burgeoning spending on skincare, growing awareness of the appearance enhancing treatments available, increasing pace of advancements in healthcare technology, and presence of sophisticated medical facilities.

Further, collaborations among players and the regular launches of new products after the FDA’s approval fuel the biological skin substitutes market. For example, in December 2022, Vericel Corporation received USFDA approval for NexoBird for the removal of graft eschar in adults with deep partial-thickness or full-thickness thermal burns. In this regard, the increasing number of burn cases is expected to be a key contributor to the market growth in the region.

APAC Is Fasting-Growing Market

Asia-Pacific will be the fastest-growing skin replacements and substitutes market, with a CAGR of 7.5%, over the forecast period. The increase in the level of medical/cosmetic tourism in developing countries, such as China, Japan, and India, contributes to the market growth. Further, the expanding healthcare infrastructure in these countries provides abundant market opportunities and attracts stakeholder to enlarge their portfolios.

In addition, the incidence of underlying conditions, such as diabetes and venous diseases, is increasing because of the changing lifestyle habits and expanding geriatric population. This propels the incidence of diabetic foot ulcers and, thus, propels the demand for dermatological procedures. Chronic ulceration is majorly seen in people over 65 years of age. Further, the demand for medical care among burn patients is approximately 20 times more in the Western Pacific region than the Americas. To these people, skin replacement is being provided in the form of skin grafting, thus driving the market

Key Players Offering Advanced Skin Replacements and Substitutes Are:

- Acelity L.P. Inc.

- MiMedx Group Inc.

- Organogenesis Inc.

- Vericel Corporation

- FUJIFILM Cellular Dynamics Inc.

- Smith & Nephew plc

- Integra LifeSciences Holdings Corporation

- AlloSource

- MatTek Corporation

Market Breakdown

This report offers deep insights into the skin replacements and substitutes market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Product

- Acellular

- Cellular

Segment Analysis, By Class

- Class III

- Allografts

- Xenografts

- Class II

- Cultured epithelial autografts

- Collagen scaffolds

- Acellular dermal matrices

- Class I

- Amniotic membranes

- Synthetic skin

Segment Analysis, By Application

- Burns

- Ulcers

- Cosmetic Surgery

Segment Analysis, By End User

- Wound Care Clinics and Hospitals

- Beauty and Cosmetics Industry

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The 2023 size of the market for skin replacements and substitutes is USD 1,178.2 million.

The skin replacements and substitutes industry will reach USD 1,869.2 million by 2030.

The market for skin replacements and substitutes is propelled by the rising incidence of burns and skin diseases, increasing disposable income, and surging appearance consciousness.

The acellular category dominates the skin replacements and substitutes industry.

Wound care clinics and hospitals have the highest value in the market for skin replacements and substitutes.

North America is the largest skin replacements and substitutes industry shareholder.

The fastest-growing market for skin replacements and substitutes is APAC.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws