Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,798.2 Million |

| 2030 Forecast | USD 3,932 Million |

| Growth Rate(CAGR) | 13.9% |

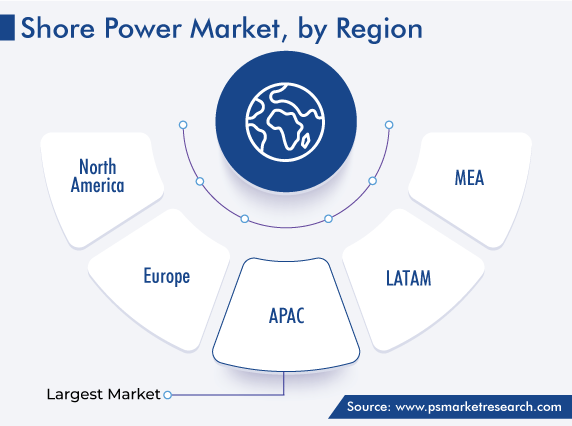

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Report Code: 12615

Get a Comprehensive Overview of the Shore Power Market Report Prepared by P&S Intelligence, Segmented by Installation Type (Shoreside, Shipside), Connection (New Installation, Retrofit), Component (Transformers, Switchgear Devices, Frequency Converters, Cables and Accessories), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,798.2 Million |

| 2030 Forecast | USD 3,932 Million |

| Growth Rate(CAGR) | 13.9% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The shore power market size stood at USD 1,798.2 million in 2024, and it is expected to advance at a compound annual growth rate of 13.9% during 2024–2030, to reach USD 3,932 million by 2030. This is primarily ascribed to the rising demand for minimizing noise pollution and carbon emissions. Moreover, installations of shore power systems are required at a larger scale because they operate with higher efficiency and are widely used for electricity generation and desalination.

The demand for such facilities is also fueled by various other factors including the subsequent rise in the number of luxury ships and the establishment of retrofit systems in the shipping industry. Also, various initiatives taken by governments in order to reduce greenhouse gas (GHG) emissions from ports have offered major opportunities for players operating in the shore power sector.

In addition, the rising number of passengers aboard cruise ships aids in the expansion of the market. According to the Cruise Lines International Association's State of the Cruise Industry Outlook report, in 2020, from July through mid-December, there were more than 200 sailings. The usage of such facilities is known to facilitate the maintenance of the ship's generator engines and reduce noise. Shore power is the provision of shoreside electricity to a ship at berth while its main and auxiliary engines are shut down.

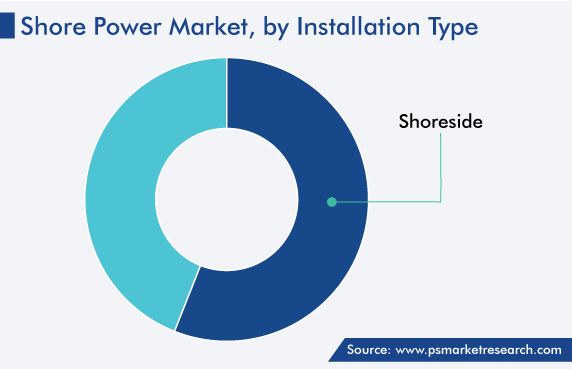

Based on installation type, the shoreside category dominates the market, accounting for a share of more than 58% in 2022. This is because it helps cargo ships and LNG carriers to minimize carbon emissions during the docking of ships for berthing.

Whereas, the shipside category is expected to register faster growth during the forecast period, owing to the necessity of electricity for important functions, including air conditioning, refrigeration, and running onboard computers. The energy is supplied from the port, eliminating the requirement for generators. It also aids in reducing noise and air pollution in densely populated, sensitive areas. The landside electricity supply can also be used as a charge at some places as an alternative to shipboard energy storage systems, and for short distances, electric power is available for protected waterways.

The new installation category holds the major share in the industry, owing to its increasing demand with upgraded infrastructure and strict environmental regulations in various countries. Moreover, in order to receive energy from a local grid or an outside source, ships are required to be properly equipped. This mandates the effective implementation of shore power. Also, the ships are required to be retrofitted with explicit electrical equipment, such as wiring, connectors, switchgear, and transformers, while most of the new ships are now being designed and built with this equipment as an integral part of their electrical system architecture.

The new installation category is also expected to dominate the market over the coming years because the process of retrofitting shore power in prevalent vessels is way costlier against a new installation, eventually sometimes adding up to twice as much as incremental to new-build investments. During construction at ports, including integrated planning and execution, low installation costs are the advantages of the new installation of these systems.

On the other hand, retrofit installation is rapidly gaining attention, owing to the advancements in technologies and tools. Basically, in retrofitting, shipowners get the flexibility to modify the existing vessels and develop them into sustainable ones in response to new safety and environmental regulations implemented worldwide. The advancements in tools and technologies have increased the demand for retrofit installations, propelling the market globally.

The frequency converters category is expected to witness the highest growth in the coming years. This can be because they aid in minimizing the use of diesel fuel and significantly reducing carbon emissions. These converters allow a ship to be power-driven by an electrical grid of a port, even though the vessel might have a different operational voltage. Also, energy is conserved with the help of frequency converters by reducing the consumption of diesel fuel. Further, while at the port, these systems also bring down air pollution caused by operating the engine unnecessarily.

The usage of onshore electricity is known to save money by reducing the consumption of gasoline to power yachts and boats while in port. Moreover, it helps in reducing greenhouse gas emissions while docked produced by auxiliary diesel engines. Thus, governments of various countries are investing in this maritime energy technology with an aim of lowering GHG emissions are expected to fuel the growth of the market over the coming years.

For instance, in June 2022, Enova, a Norwegian government enterprise, supported five new shore projects in the country with about USD 3.4 million. Enova has provided support for a total of 119 shore power projects with more than USD 84.2 million since 2016. In addition, in February 2022, port authorities and government ministers from across the globe signed a shore power declaration at the One Ocean Summit. It is also joined by the European Investment Bank, and the shareholders are decided to make their best efforts to install a shoreside electricity supply by 2028, particularly for container and cruise vessels.

Drive strategic growth with comprehensive market analysis

APAC has the leading position in the shore power market, and it will hold the same spot in the coming years as well, with a value of USD 1,415 million in 2030. This is attributed to the presence of some of the global largest and busiest ports and the rising use of such systems in the region.

In APAC, the Chinese market holds the leading position, and it will grow at a CAGR of more than 13% during the forecast period. This is attributed to the increasing number of terminals at ports and the rising investments to improve the marine infrastructure in the country. Since, January 2019, China has mandated new domestic vessels to be equipped for shoreside electricity and enforced 0.5% sulfur emission control areas (ECAs). Additionally, the government is funding to increase the building of these systems and improve their infrastructure. These are the major reasons boosting the demand for shore power in the nation.

In addition, the Indian market is also growing significantly, owing to factors including the reduction in the cost of fuels for shipping companies, the increasing adoption of renewable energy, and the surging focus on minimizing air pollution. For instance, in September 2021, the Union Ministry for Ports, Shipping, and Waterways, India, announced that the government aims to meet 60% of electricity demand at major ports through wind and solar energy.

Moreover, under the Paris Agreement, India's Nationally Determined Contributions (NDC) for 2021–2030 plans to reduce emissions intensity by 33–35% by 2030. Thus, the rising government plans and focus on the development of shore power in the country have driven the Indian market.

The North American market is growing significantly, owing to the increasing focus on the reduction of retrofit and low-frequency noise and emission at ports. According to the United States Environmental Protection Agency (USEPA), pre-existing shore power installations are expanding at several ports, for example, three planned projects at the ports of Philadelphia for container ships and Miami and Galveston for cruise ships.

Further, ports have seen increasing installations of these systems, to typically produce zero onsite emissions. In most cases, with the increasing generation of electricity through renewable sources, emissions from energy generation facilities that supply electricity to shore power installations are lesser than related auxiliary engine emissions occurring at the dock.

This report offers deep insights into the shore power industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Installation Type

Based on Connection

Based on Component

Geographical Analysis

The shore power market size stood at USD 1,798.2 million in 2024.

During 2024–2030, the growth rate of the shore power market will be around 13.9%.

Frequency Converters is the fastest growing component in the shore power market.

The major drivers of the shore power market include the increasing cruise passenger traffics, the rising noise and air pollution from port operations, the surging government-led initiatives to reduce greenhouse gas emissions, and the increasing investments in shore power projects and renewable electricity projects.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages