Market Statistics

| Study Period | 2019 - 2030 |

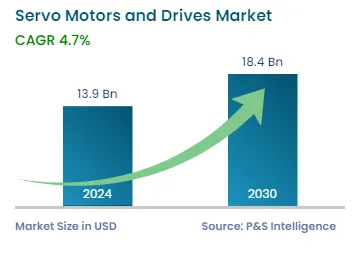

| 2024 Market Size | USD 13.9 Billion |

| 2030 Forecast | USD 18.4 Billion |

| Growth Rate(CAGR) | 4.7% |

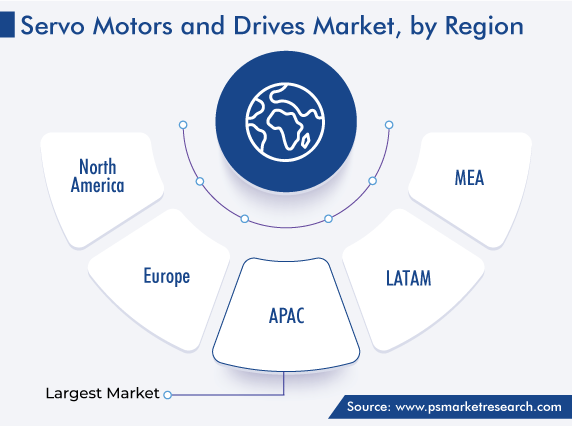

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Report Code: 12618

Get a Comprehensive Overview of the Servo Motors and Drives Market Report Prepared by P&S Intelligence, Segmented by Offering (Hardware, Software and Services), Product Type (Servo Motors, Servo Drives), Voltage (Low Voltage, Medium Voltage, High Voltage), System Type (Linear System, Rotary System), End User (Automotive & Transportation, Semiconductor & Electronics, Food Processing, Textile, Petrochemical, Pharmaceuticals and Healthcare, Packaging, Printing and Paper), Material Used (Stainless Steel), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 13.9 Billion |

| 2030 Forecast | USD 18.4 Billion |

| Growth Rate(CAGR) | 4.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The servo motors and drives market size stood at USD 13.9 billion in 2024, and it is expected to advance at a compound annual growth rate of 4.7% during 2024–2030, to reach USD 18.4 billion by 2030.

The growth can be primarily ascribed to the advancements in technology, the implementation of government policies such as Minimum Energy Performance Standards (MEPS) in several countries, and the rise in the demand for energy-efficient systems. Moreover, one of the most significant benefits of such systems is the flexibility in machine tool operations, along with the increasing smart manufacturing initiatives in order to grow productivity and enhance reliability in various industrial processes is fuelling the market growth.

Additionally, in various countries, governments are taking initiatives and focussing on increasing the number of installations of energy-efficient equipment, so as to reduce energy consumption at residential, industrial, and commercial levels.

Furthermore, an increase in the need for automated systems in different industries has fuelled the demand for motion controllers to measure torque, position, and speed, so as to maintain the efficiency and quality of processes. The number of wires and connections required for controls is minimized by the use of encoders and these also ensure safe operations in automated systems and machines. In addition, these minimize repetitive work, enhance quality, lower overall costs, and facilitate a reduction in manual labor.

In order to withstand harsh environments, the design of encoders is becoming more reliable. Due to the longer life span of encoders as compared to their alternatives such as potentiometers, they are mostly preferred. The increasing demand for feedback control systems is majorly supported by increasing automation, which, in turn, drives the adoption of encoders in these systems.

Rapid Industrialization Across Emerging Economies Boosts the Demand

In the last few years, with the rising advancements in industrial processes, the output has increased along with greater precision, lower costs, and fewer labor requirements. With the advancing automation, a large number of companies are focusing on replacing traditional motors with servo motors because they simplify operations and enhance the outputs.

They are also known to provide better feedback, improved accuracy, and more control. Therefore, companies have been involved in the launch of advanced products. For instance, in March 2021, Yaskawa Electric Corporation launched the AC servo drives Σ-X Series to enhance customers’ added value with the industry’s best motion performance and digital data solution. It is used in various applications including electronic component mounting machines, machine tools, semiconductor and LCD manufacturing equipment, packaging machines, metal processing machines, industrial robots, and other general industrial machinery.

In addition, the rising use of industrial robots in a wide range of pick-up, assembly, and manufacturing applications across the electrical/electronics, metal, automotive, and other sectors is propelling the market growth. As per the International Federation of Robotics, in 2021, there were around 322 industrial robots for every 10,000 employees in China. Hence, the rising industrialization across emerging economies and the increasing adoption of robotics are expected to boost the demand for servo motors and drives.

Based on offering, the hardware category holds a major share. This is attributed to the increasing use of different components and rapid industrialization across the world. Moreover, it is required for the setting up of automation systems and is known to offer accuracy and proper torque with low maintenance costs and precision.

The rotary systems category is expected to witness the highest growth rate in the coming years. This can be attributed to factors such as eliminating the requirement for pulleys, gearboxes, and other mechanical equipment through the development of direct-drive rotary systems. This has led to the minimized energy consumption, faster settling times, and enhanced control of the load directly connected to servo motors. High torque density, high resolution, and precision feedback are the other advantages offered by rotary systems. They are also useful for various applications in industries, such as healthcare, packaging, food processing, transportation, printing, textile, and automotive.

The low voltage category is projected to witness significant growth in the coming years, attributed to the rising use of low-voltage servo motors for applications, such as mobile robots. The low voltage can be maintained at a low cost. It can be used with both low-power and high-power applications. Moreover, the rising development of residential sectors, growing agricultural activities, and increasing small-scale industries across the world are contributing to the adoption of low-voltage drives.

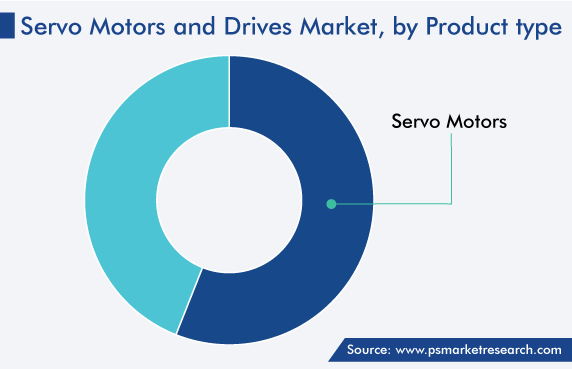

Based on product type, the servo motors category accounted for the largest revenue share, of more than 56%, in 2022. This is due to the replacement of traditional belts, gears, and pulleys with servo motors, to eliminate the issues of wear and failure. These also increase reliability, machine throughput, and productivity.

Furthermore, they are specially designed to receive inputs from controllers and computer sensors, so that they can execute precise activities, such as robotics, CNC machining, and advanced automated manufacturing. Governments are also involved actively in the achievement of digitization across established and emerging countries. Thus, the growing industrial desire for high-speed and precision operations will increase the use of servo motors and amplifiers.

The automotive & transportation category accounted for a significant revenue share in 2022. This is ascribed to the advancements in automation technologies. With the rising acceptance of energy-efficient international standards, the development of automation technologies, and the inclusion of control components in motors, the servo motors and drives market is gaining traction. In automotive and transportation applications, these are used to control the speed of vehicles. To control the rotational speed, they are used in a closed-loop system that employs position feedback and includes both AC and DC motors.

In automobiles, they are used in systems, such as fuel injection, anti-lock brake, and cruise control. In addition, robots are majorly used in automotive assembly lines for various purposes such as material handling, automated chassis assembly, and painting. Also, in the last few years, in order to decrease several issues on the shop floor, lower operating expenses, increase productivity, and improve returns and efficiency, automakers have automated their factories by using such systems and drives.

The stainless steel category dominates the industry. This is due to several factors including hygiene, easy cleaning, high-drive performance, and vast availability of steel products. Moreover, the internal structure of steel drives is designed smoothly and is effective in removing heat losses outwards. The enhanced heat removal capacity significantly improves the drives’ performance directly in practical usage.

Drive strategic growth with comprehensive market analysis

APAC has the leading position in the servo motors and drives market, and it will hold the same position in the coming years as well, with a value of USD 7,721 million in 2030. This is attributed to the growing end-use industries and the rapid industrialization in the region. In addition, automated multiple manufacturing processes, the increased need for accuracy, and repeatability are being served by such motors. They can be switched on and off during their operations for less power usage and save up to 65% of energy. Moreover, they also possess brushless design, and because of this, they have catered to various applications across harsh and demanding sectors, such as defense, food and beverage, and oil and gas.

In APAC, the Chinese market holds the leading position, and it will grow with a CAGR of more than 6% in the coming years. This can be attributed to the surging adoption of smart manufacturing in various sectors of the country.

Furthermore, the market in North America is growing at a significant rate. This is attributed to the long-term renewable energy growth in the region, and these systems are known to adjust the angle of solar panels to harness solar energy and point wind turbines in the direction of the wind. In the U.S., wind and solar PV developers are rapidly completing projects in order to avail federal tax incentives. The state-level policies and corporate power purchase agreements (PPAs) are significant factors that speed up project completion in the country. Thus, these factors drive the demand for servo motors and equipment in the region.

This fully customizable report gives a detailed analysis of the servo motors and drives industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Offering

Based on Product Type

Based on Voltage

Based on System Type

Based on End User

Based on Material Used

Geographical Analysis

The servo motors and drives market size stood at USD 13.9 billion in 2024.

During 2024–2030, the growth rate of the servo motors and drives market will be around 4.7%.

Automotive & Transportation is the largest end user in the servo motors and drives market.

The major drivers of the servo motors and drives market include the growing consumer electronics sales, increasing adoption of energy-efficient systems, and the rising rate of automation in industries.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages