Motion Control Market Future Prospects

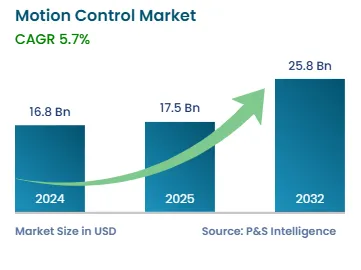

The global motion control market size is USD 16.8 billion in 2024 and it is expected to advance at a CAGR of 5.7% during 2025–2032, to reach USD 25.8 billion by 2032. The major factors credited for the growth of the market include the increasing demand for industrial robots and the integration of components with motion control systems, for ease of use.

Additionally, the evolving motion control standards and protocols are boosting the market. For instance, OPC UA TSN is a protocol for controlling entire systems, whereas message queuing telemetry transport (MQTT) is a more-lightweight protocol related to the communication between two applications. MQTT is typically applied in one product. It, for instance, enables a sensor or a drive to extract data from a device and send it to the cloud.

Moreover, the digitization of manufacturing processes, especially with the Industry 4.0 revolution, is driving the market growth. Mechatronics motion control is the key to successful industry 4.0 initiatives. For instance, smart servo technology enables cost-effective, more-efficient, greener, safer, and smaller machinery.