Report Code: 10484 | Available Format: PDF | Pages: 270

Self-Monitoring Blood Glucose Devices Market Size and Share Analysis by Type (Strips, Glucose Meters, Lancets), Application (Type-1 Diabetes, Type-2 Diabetes), End User (Hospitals & Clinics, Homecare Settings, Diagnostic Centers) - Global Industry Demand Forecast to 2030

- Report Code: 10484

- Available Format: PDF

- Pages: 270

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The global self-monitoring blood glucose devices market generated USD 25.3 billion revenue in 2023, and it is projected to witness a CAGR of 9.7% during 2024–2030, to reach USD 48.2 billion by 2030.

The growth in the market is attributed to the increasing prevalence of diabetes, surging population of geriatric people, technological advancements, booming awareness of diabetes care, rising number of obese inhabitants, and favorable health insurance and reimbursement scenario.

Strips Continue To Outsell All Other Types of Devices

On the basis of type, the sale of strips held the largest share of 40% in 2023. These strips are made of disposable plastic and impregnated with glucose oxides, which help in determining the sugar level. These cost-effective glucose measuring strips can also be used for testing the ketone level in the blood.

Further, various advancements have been brought about in these strips as well as in the technologies used to manufacture them. For instance, some of the monitoring strips can be reused, and other types do not require a meter, as the sugar level can be determined by matching the color of the strip against the chart.

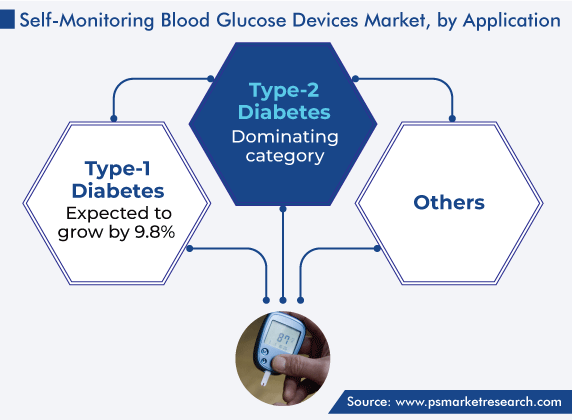

Usage of Self-Monitoring Blood Glucose Devices Highest for Type 2 Diabetes

Self-sugar-measuring gadgets find application in the monitoring of type 1 diabetes, type 2 diabetes, and a few other diseases. Among all applications, type 2 diabetes held the largest share, of over 50%, in 2023. Type 2 diabetes is a common lifestyle disease that can cause major health complications, particularly in the blood vessels of the kidneys, the eyes, and the nerves. Some of the major complications of the disorder are diabetic nephropathy and diabetic retinopathy.

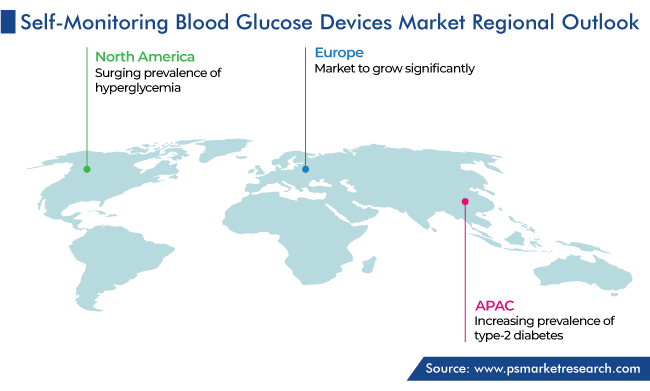

North Americans Most Extensively Self-Monitor and -Manage Diabetes

Geographically, North America held the largest share, of 55%, in 2023. This can be attributed to the increasing prevalence of hyperglycemia and growing aging population, which have made hyperglycemia one of the major lifestyle diseases in North America. In addition, the increasing pace of technological advancements and the frequency of the launch of innovative products are driving the growth in the region.

Technological Advancements in Self-Testing Instruments Are Biggest Trend

Technological advancements in SMBG gadgets are a key trend being observed in the global SMBG market, as the usage of new-age instruments reduces the time taken to test sugar levels compared to the traditional methods used in laboratories. Moreover, most of these devices are portable and convenient to carry. Further, many smartphone apps help patients suffering from hyperglycemia control their health through education on this condition, healthy diet, and nutrition, physical activity, weight management, measuring sugar levels, and adhering to medication schedules. Many companies have launched mobile sugar checkers, which can be connected to a smartphone, with the sugar level data fed to the mobile app.

Rising Diabetes Incidence with Booming Geriatric and Obese Populations

The aging population is increasing rapidly around the world. According to the World Population Prospects report of the UN, the share of people aged 65 years or above would increase from 10% in 2022 to 16% by 2050. Aging acts as a major driver for the growth of the self-measuring blood glucose devices market as geriatric people are more prone to diabetes than younger ones.

The unprecedented aging rate observed in the global population is a major contributor to the diabetes incidence, and older persons represent one of the fastest-growing segments of the diabetic population. In developing countries, the rise in the prevalence of chronic non-communicable diseases, including cancer, diabetes, and heart disease, hints at changes in the lifestyles and diets, as well as aging.

It is further expected that nearly 8 in 10 of the world’s older persons will be living in developing regions by 2050. It is also stated that the number of persons aged 60 years or over in developing regions is expected to increase to 1.7 billion by 2050.

Moreover, according to the ADA, the epidemic of type 2 diabetes in the U.S. is clearly linked to the increasing count of obese people. The projections by the CDC further suggest that even if the increase in the diabetes incidence rates stabilizes, the prevalence will double in the coming two decades, due to the growing aging population. Older adults with hyperglycemia are at a substantial risk of both acute and chronic microvascular and macrovascular complications of the disease, thus leading to an increasing usage of SMBG devices globally.

| Report Attribute | Details |

Market Size in 2023 |

USD 25.3 Billion |

Market Size in 2024 |

USD 27.6 Billion |

Revenue Forecast in 2030 |

USD 48.2 Billion |

Growth Rate |

9.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type, By Application, By End User, By Region |

Explore more about this report - Request free sample

Availability of Reimbursements for Self-Diagnosis Technologies Making Care More Accessible

The favorable reimbursement regulations for SMBG devices in many countries, including the U.S., the U.K., Germany, France, Italy, Spain, and Japan, are another important factor driving the market growth.

In the U.S., according to the Centers for Medicare and Medicaid Services (CMS), such devices and accessories are covered under Medicare part B. For the insulin-dependent, Medicare covers up to 100 lancets and test strips every month and one lancet every six months. In addition, for patients who do not depend on insulin, coverage is provided for up to 100 lancets and test strips every three months and one lancet every six months. With these reimbursement policies in place, people are easily able to purchase the associated instruments to keep their disease in check.

In the same way, in many emerging economies, such as China and India, the government support for healthcare, including the provision of insurance, is improving. For instance, the Chinese Ministry of Human Resources and Social Security (MOHRSS) periodically issues national guidance listing the range of medical diagnosis and treatment items that provincial authorities can partially reimburse and the treatment costs and products that cannot be reimbursed.

Reimbursement pricing is based upon medical diagnosis. For instance, blood glucose testing services will have a price code, but the devices used to analyze glucose levels, such as strips and meters, will not. Therefore, the availability of health insurance and positive reimbursement policies for SMBG devices is an important factor driving the growth of the market.

Rising Disease Awareness Propelling Usage of Self-Diagnosing Technologies

Various programs and campaigns have been initiated by the International Diabetes Federation (IDF) and other diabetes associations, NGOs, and health departments to create awareness among people regarding the effects of the disease and the correct methods of management. World Diabetes Day, celebrated on November 14 every year, is one such initiative. It is a key campaign led by the IDF and over 230 national diabetes associations in 170 countries and territories.

Proper health education could relay the benefits of self-testing by teaching patients about the optimal timing and frequency of monitoring, procedures to interpret results correctly, taking an appropriate diet, exercising, and making pharmacologic-therapy adjustments in response to SMBG devices’ readings. In 2022, on the occasion of World Diabetes Day, governments worldwide emphasized their focus on providing better access to quality diabetes education to healthcare professionals and patients.

Self-Monitoring Blood Glucose Devices Market Competitive Landscape

The intensity of rivalry in the market is medium-to-high. Moreover, there is a moderate degree of product differentiation among the existing players. Additionally, these products have higher prices in comparison to the traditional methods used for diagnosing and checking sugar levels.

In addition, there is a moderate threat of new entrants, as every incoming player has to abide by the stringent regulatory standards set by governments. Further, the capital required for research and development activities is moderate, which acts as an additional barrier for companies willing to enter the market. Still, there have been a number of product launches in recent years.

For instance, in December 2022, Dexcom Inc. received the FDA approval for Dexcom G7 for all types of hyperglycemic patients of ages two years and more in the U.S.

Top Self-Monitoring Blood Glucose Device Manufacturers Are:

- Johnson & Johnson Services Inc.

- ARKRAY Inc.

- Nova Biomedical

- Bionime Corporation

- Medtronic plc

- B. Braun Melsungen AG

- Abbott Laboratories

- Bayer AG

Market Size Breakdown by Segment

This report offers deep insights into the self-monitoring blood glucose devices market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

- Strips

- Glucose Meters

- Lancets

Based on Application

- Type-1 Diabetes

- Type-2 Diabetes

Based on End User

- Hospitals & Clinics

- Homecare Settings

- Diagnostic Centers

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for self-monitoring blood glucose devices valued USD 25.3 billion in 2023.

Strips hold the largest self-monitoring blood glucose devices industry share.

Home-based care is trending in the market for self-monitoring blood glucose devices.

Type 2 diabetes is the most-prominent application in the self-monitoring blood glucose devices industry.

APAC will the fastest-growing market for self-monitoring blood glucose devices.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws