SD-WAN Market Analysis

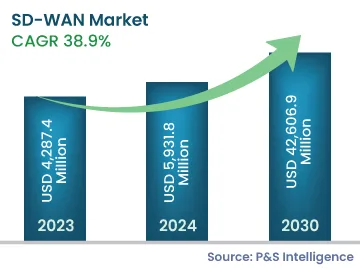

The SD-WAN market generated revenue of USD 4,287.4 million in 2023, which is expected to witness a CAGR of 38.9% during 2024–2030, to reach USD 42,606.9 million by 2030. This will be mainly due to the rapid shift from traditional SD-WAN solutions, rise in the adoption of digitization, high spending on cloud computing technologies, growth in the awareness of cyber threats, and boom in the need for a centralized network management system.

The surging smartphone and mobile internet penetration is a major factor supporting the adoption of SD-WAN solutions across various sectors. IT organizations around the world are recognizing the need for WAN optimization solutions to lower the WAN cost and tackle issues in network performance. Hence, market players are upgrading their virtual and physical WAN optimization product portfolios to provide industries with enhanced application performances.

Some major advantages provided by such solutions include greater virtual flexibility, cloud-ready network infrastructure, improved user experience, augmented business productivity, secure optimization, and better performance of SaaS applications.

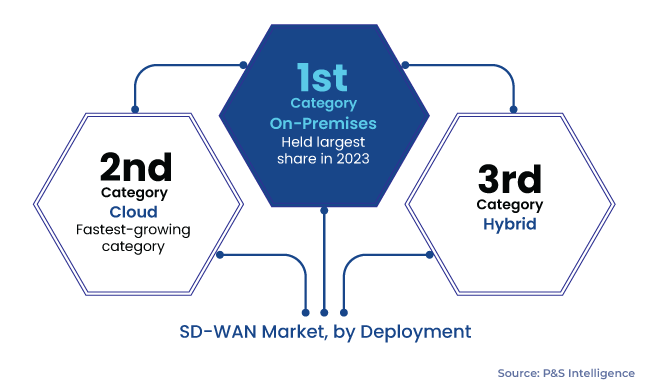

Moreover, the advancement in hybrid cloud connectivity is driving the adoption of SD-WAN among enterprises focusing on enhanced IT performance. Advanced SD solutions, combined with private circuits and public internet, offer organizations a higher network uptime, secure access to applications in enterprise data centers from branch locations, dynamic multi-path optimization, and cost reduction, for enhanced enterprise scalability and performance.

With the growing concern regarding network management complexities owing to the lack of IT resources, organizations are looking for managed SD-WAN to replace their traditional WAN architecture. Managed services include the implementation and management of networks distributed across different branch locations of organizations. As the threat of data breaches has increased in recent years, the demand for managed services has surged among enterprises.

Thus, managed service providers (MSPs) are augmenting their offerings through the multi-vendor strategy to deliver simplified operations to organizations. Additionally, they are offering service agility and differentiated services according to business needs.