Satellite Launch Vehicle Market Analysis

Explore In-Depth Satellite Launch Vehicle Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 12387

Explore In-Depth Satellite Launch Vehicle Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

The market is dominated by the LEO category, with around 50% revenue share in 2024. It is also the fastest-growing category, with 3.6% CAGR. Satellites operating in LEO offer faster communications and low-latency networking and are easy to set up, thus ideal for deployment. Moreover, huge investments by government and private organizations are being made to deploy satellites in LEO. For instance, Space Exploration Technologies Corp. is developing the “Starlink” satellite internet constellation in the low earth orbit. Further, according to a private organization, there are about 3,700 satellites in LEO.

Furthermore, the GEO category is set to follow LEO, as satellites made for the geostationary orbit offer superior telecommunication and observation functionalities. According to the same source, there are about 560 GEO satellites orbiting the earth.

The following orbits have been considered:

With 75% market share in the satellite launch vehicle market, the commercial category dominates the launch activity segment. It will also be the fastest-growing category in the forecast period, with 4.0% CAGR.

This can be attributed to the growing number of commercial satellite launches, in tune with the commercialization of space exploration programs. The growing commercial activities, including satellite navigation, satellite television, and commercial satellite imagery, along with the decreasing costs for launch and space hardware, are the major reasons for the category’s domination.

The report offers insights into these launch activities:

The nano and micro payload category holds the largest revenue share, in 2024, and it will also witness the highest CAGR, over this decade. The growth in the number of nanosatellites and the integration of composites to reduce satellite weight will propel the use of nano and micro payload launch vehicles. As it is not feasible to carry small payloads in large launch vehicles, as larger rockets cost more to manufacture and operate, launch vehicles specially designed to carry nano and microsatellites are expected to offer market players lucrative opportunities in the forecast period.

The segment is categorized as follows:

Communication applications dominate the market in 2024. This is primarily due to the increasing need for 5G and satellite connections in several commercial fields, such as logistics and shipping, automobiles, and civilian aircraft. Moreover, the increase in internet users and volume of data, together with the increasing demand for low-latency transmission, are driving the market category.

The highest CAGR, of 4.2%, is expected in the earth observation & remote sensing category. This is attributed to the growing demand for accurate weather forecasting and government’s rising focus on environmental monitoring, urban planning, and disaster management. Moreover, earth observation is done for military surveillance purposes and to offer high-resolution commercial satellite imagery for diverse applications, from navigation to project progress monitoring.

The below-mentioned applications are considered:

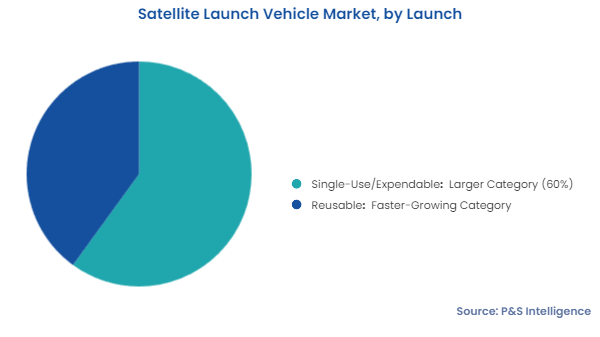

The single-use/expendable category holds the larger share, of 60%, in 2024 as these vehicles emerged earlier than reusable ones. This is why they have been the traditional choice of space exploration companies for launching satellites and other kinds of payloads into space.

The reusable bifurcation will grow faster, over the forecast period. This is attributed to the lower cost of developing these rockets as the same one can be used repeatedly. SpaceX’s Falcon 9 is partially reusable, while the Starship is fully reusable. Amidst the growing competition in the space launch industry, where cost is key, reusable rockets can offer cost-effective services to satellite owners and operators.

Below are the segment categories:

The multistage bifurcation is both the larger and faster-growing category. Because they are larger, multistage rockets can carry more fuel, thus offering the ability to put satellites in higher orbits. They can also carrier heavier loads and multiple satellites, which can offer cost-effectiveness in case more than one satellite needs to be launched in short time. Saturn V (NASA), Ariane 1, 2, and 4 (ESA), and GSLV and PSLV (ISRO) are all multistage rockets.

The segment is divided as below:

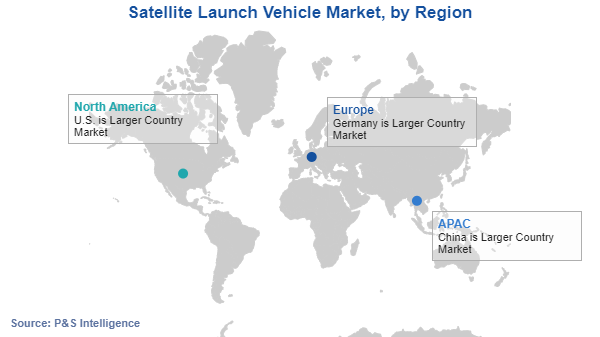

The regional breakdown of the market is as follows:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages