Market Statistics

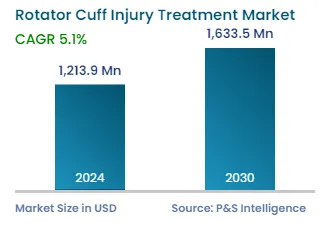

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1213.9 Million |

| 2030 Forecast | USD 1633.5 Million |

| Growth Rate(CAGR) | 5.1% |

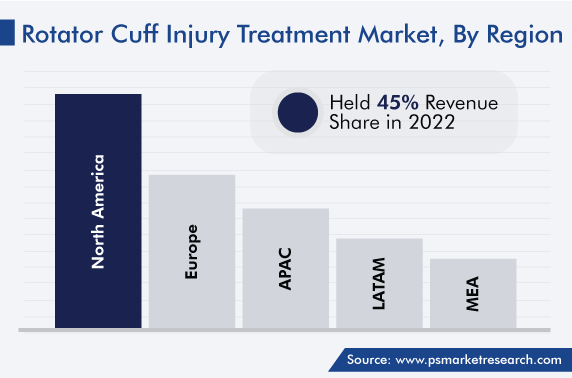

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12501

Get a Comprehensive Overview of the Rotator Cuff Injury Treatment Market Report Prepared by P&S Intelligence, Segmented by Treatment (Surgical Treatment, Physiotherapy, Pharmaceutical Treatment), Injury Severity (Full-Thickness, Partial-Thickness), Cause (Acute, Degenerative), End User (Hospitals, Specialty clinics), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1213.9 Million |

| 2030 Forecast | USD 1633.5 Million |

| Growth Rate(CAGR) | 5.1% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global rotator cuff injury treatment market revenue stood at USD 1,213.9 million in 2024, which is expected to observe a CAGR of 5.1% during 2024–2030, to reach USD 1,633.5 million.

This can be attributed to the surging incidence of shoulder injuries due to sports, technological enhancements in arthroscopic surgery devices, and increasing osteoarthritis problem in the geriatric population.

Sports and physical activities can cause high physical stress on the shoulder, leading to rotator cuff tendonitis, which causes pain and weakness in the shoulder, thus limiting the movement of the arm. Athletes engaged in sports such as baseball, handball, tennis, and volleyball regularly fall on their shoulders. Additionally, with the increasing number of vehicles on the road, the frequency of traffic accidents is rising, many of which result in injury to the rotator cuff.

Moreover, over the next few years, there would be an increase in the demand for minimally invasive surgical devices on account of the rising demand for minimally invasive operations. Additionally, rising in the expansion of research & development efforts and launch of the efficient therapies during the projected period leads to rise in the market for treating rotator cuff injuries. The market for treating rotator cuff injuries will expand at an even faster rate in the future due to the large unmet need for current treatments and advancements in medical technology.

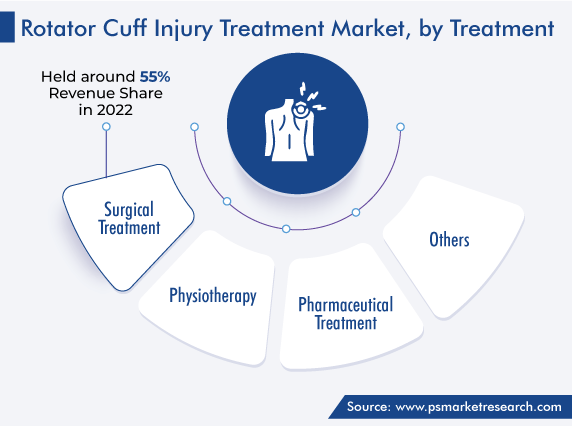

The surgical treatment category accounted for the largest revenue share, around 55%, in 2022, and it is further expected to maintain its dominance during the forecast period. This is owing to the high incidence of rotator cuff injuries and the favorable medical reimbursement for their treatment.

Moreover, the growing awareness of the benefits of an arthroscopic repair, including its low risk of complications, quick recovery, and low incidence of post-operative infections, is expected to significantly contribute to the category’s growth.

Furthermore, medical device companies are actively involved in the development of advanced surgical solutions for rotator cuff injury treatment. For instance, in July 2021, Stryker InSpace launched a subacromial balloon space, which provides comfort to patients suffering from severe rotator cuff tears.

Additionally, the physiotherapy category will have significant growth during the forecast period. This is credited to the fact that athletes often use this as the first approach for the management of such injuries. Additionally, the increase in the geriatric population is a major factor helping in the growth of this category, as aged people prefer this treatment over surgical procedures.

The pharmaceutical drugs category is also expected to record healthy growth in the market. The easy availability of medications, such as non-steroidal anti-inflammatory drugs and steroids, plays important role in making the treatment of rotator cuff injuries accessible and cost-effective.

The increasing number of sports injuries is the major factor augmenting the market growth. Around 3.5 million sports-related injuries occur every year in the U.S. Additionally, three-quarters of all sports injuries happen in the upper extremities. Tennis, Baseball, handball, and volleyball players remain at an omnipresent risk of physical trauma due to falls, arm stretching, and other events. Such incidents can cause shoulder injuries, including rotator cuff contusions, worsen the existing injuries, or also result in the development of tendinopathy in rotator cuff tears.

The partial-thickness category accounted for the larger revenue share, over 60%, in 2022, and it is further expected to maintain its position during the forecast period. This is ascribed to the fact that the chances of abnormalities, such as osteoarthritis or bone injuries, increase with age, and they may be traumatic for athletes, especially if caused by an injury.

However, most commonly, partial-thickness tears are seen in people over the age of 50, and they may be chronic or related to minor trauma. As per a study published by the National Library of Medicine, the problem may have a greater scale than reported originally, as the identification of intra-tendinous lesions, which result in over half of the cases of partial-thickness defects, has been difficult.

The degenerative category will witness the faster growth during the prediction period, with a CAGR of more than 6%. This will be owing to the fact that the poor vascularity of the rotator crescent is directly linked to age. As people age, the rotator cuff can undergo degenerative changes, which often results in shoulder dysfunction. A degenerative cuff tear may not be immediately problematic, owing to its gradual onset and often undetectable nature.

Many people with a degenerative tear can function normally. Moreover, 20–40% of the people aged 61–69 suffer from these tears, but feel no noticeable weakness or pain. Tears are known to progress from tendinopathy first to partial-thickness tears and, then, to full-thickness tears, with time. Prospective research has challenged Earlier hypotheses that such problems originate at the anterior supraspinatus tendon insertion, which is adjacent to the bicep tendon.

Regenerative biologics are a fast-expanding technology that has the potential to profoundly alter sports orthopedics. Despite the advent of sophisticated sutures, the high failure rates have led many researchers to choose biological therapy to speed up the healing of a wound. Numerous manufacturers, including Smith+Nephew, Zimmer, Johnson & Johnson (through its DePuy Division), and Stryker, are intensifying their efforts to diversify their product offerings in this market. In addition, the emergence of numerous new companies creating novel regenerative biologics is going to lead to potentially effective cures for rotator cuff problems.

For instance, in March 2020, in a critical preclinical trial, ORTHO-R biopolymer, developed by Ortho Regenerative Technologies Inc., yielded positive results. This chitosan-based biopolymer matrix is a mucoadhesive that serves as a biodegradable scaffold. It is combined with the platelet-rich plasm of patients to create biologics, which further helps increase the healing rate of tendon injuries. With orthobiologics continuing to be advanced, invasive orthopedic surgeries will likely transition to a minimally invasive technique.

Drive strategic growth with comprehensive market analysis

Based on Treatment

Based on Injury Severity

Based on Cause

Based on End User

Geographical Analysis

The market for rotator cuff injury treatments valued USD 1,213.9 million in 2024.

Surgeries are preferred in the rotator cuff injury treatment industry.

The key trends in the market for rotator cuff injury treatments are the development of effective orthobiologics and shift from open to minimally invasive surgeries.

Specialty clinics dominate the rotator cuff injury treatment industry.

North America is the largest regional market for rotator cuff injury treatments, while APAC will witness the highest CAGR.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages