Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,781.9 Million |

| 2030 Forecast | USD 4,971 Million |

| Growth Rate(CAGR) | 10.2% |

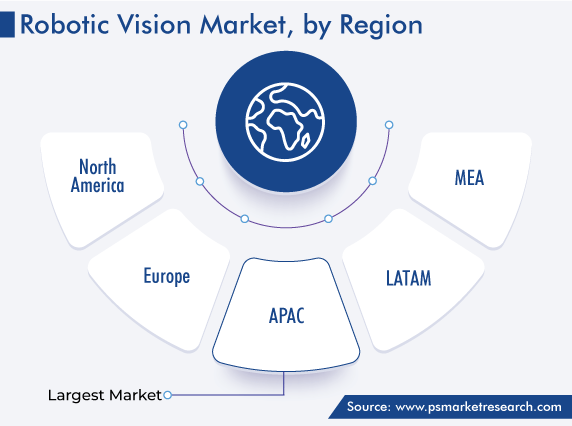

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Report Code: 12572

Comprehensive Overview of the Robotic Vision Market Report Prepared by P&S Intelligence, Segmented by Type (2D Vision Systems, 3D Vision Systems), Component (Hardware, Software), Deployment (Robotic Guidance Systems, Robotic Cells), Application (Welding and Soldering, Material Handling, Packaging and Palletizing, Painting, Assembling and Disassembling, Cutting, Pressing, Grinding, and Deburring, Measurement, Inspection, and Testing), End User (Automotive, Electronics, Aerospace, Food & Beverage, Medical & Healthcare), and Geographic Regions. This Report Provides Insights from 2019 to 2030

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,781.9 Million |

| 2030 Forecast | USD 4,971 Million |

| Growth Rate(CAGR) | 10.2% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The robotic vision market size stood at USD 2,781.9 million in 2024, and it is expected to advance at a compound annual growth rate of 10.2% during 2024–2030, to reach USD 4,971 million by 2030. The growth can be primarily ascribed to the rising requirement for quality inspection, the increasing adoption of cognitive humanoid robots, and the surging demand for quality products as well as safety in industries.

Various features of such systems, including high repeatability, non-contact inspection, and minimal cost, are fueling their demand and are becoming more popular for quality control in several sectors. The existing ways of checking the quality of products and controlling the same relied completely on human inspection. During a human inspection, performance can decline due to weariness and repetition. It is possible that some minor faults remain unnoticed, which can cause trouble. Due to these reasons, the focus is increasing on the use of robots, which, in turn, will propel the growth of the industry.

Due to the introduction and acceptance of advanced technologies, the medical and healthcare industry has seen vast advancements in various surgeries, including orthopedic surgery and hysterectomy, which ensure the procedures with more effectiveness and take shorter recovery time. They are also used for the distribution of medicines and handling sensitive materials in hospital settings. Further, they play an important role in telemedicine in connecting doctors with patients even in remote locations.

The 2D category dominates the industry. This is because 2D vision systems are more reliable and easy to operate. Moreover, these are less expensive and are suitable for various general applications, and are known to process images faster.

Whereas, the 3D category is also growing at a significant rate over the coming years. This can be ascribed to its greater manufacturing flexibility and high precision, and it enables the automation of tasks and can perform complicated tasks. It is also able to differentiate objects and perceives human form.

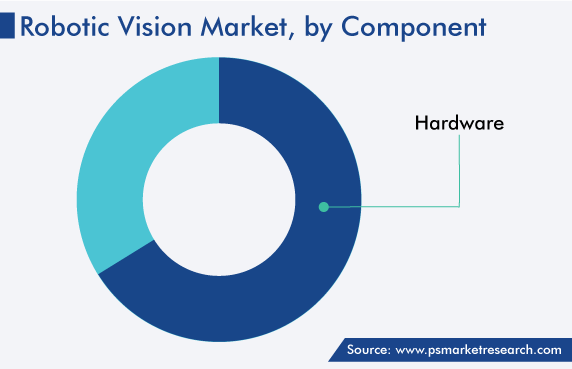

The hardware components accounted for the major share, of around 71%, in 2022, and the category is expected to witness the same trend in the forecast period as well. This is ascribed to the low costs of hardware components such as lighting, cameras, frame grabbers, processors, and controllers. Several applications need custom-built cameras with various specifications including sensor size and focal length. In addition, the increasing deployment of machine systems and the growing adoption of robots to automate repetitive processes are boosting the growth of the market in this category.

Based on deployment, robotic guidance systems are leading because of their wider use in collaborative robots and can reduce costs. Additionally, they can also increase the manufacturing process efficiency. In the automotive industry, these are efficient and versatile, and they usually provide secondary feedback signals using sensors to robots.

Whereas, the demand for robotic cells is expected to witness the fastest growth in the coming years. This can be attributed to their higher efficiency and accuracy, as the position of cameras remains the same. In this, such systems are fixed so that target objects can be presented in a defined orientation and position. They are also used to automate critical and repetitive inspection tasks and are able to cover the areas that are difficult to access the target objects.

The assembling and disassembling category is projected to grow at the highest CAGR, of 10.6%, during the forecast period. This can be due to the automation of complex assembly operations, which are difficult to perform with simplified programming that they can understand. Further, objects are picked and placed using automation technology with the help of robotic vision systems by determining the position and orientation of objects. This also increases productivity at a lower cost.

The demand for material handling systems is also growing, ascribed to the use of reliable and more precise processes for better production quality. Moreover, the possibility of real-time monitoring and reduced cycle times also boosts the market growth in this category. They also aid in moving materials from one place to another, especially for short distances such as in a building. It can limit or replace the role of labor with the use of automation in handling materials.

The automotive industry is extensively using automation technology for high-quality assembly and disassembly of various components. In the industry, with the increasing use of ADASs, the need for various components, such as camera-led lighting and V2X, would be important components for automation and intelligence. The drivers are provided with a safety net, with the use of 2D and 3D machine vision and intelligent transportation systems (ITSs). The advancements of such technologies help mitigate human error, aiding drivers with tools at the wheel. These features save human lives and help them not to commit mistakes, hence reducing the chances of accidents.

Besides, robotic vision systems are also used in palletizing and packaging, which need high precision. The boxes of various sizes and shapes are placed on top of one another, which is a challenge for humans to place them accordingly. Robots are employed for this work because they offer safety and speed, compared to manual palletizing. In addition, they are also flexible and save more space, compared to fixed machinery.

Drive strategic growth with comprehensive market analysis

North America has a significant position in the robotic vision market with a market share of around 28% in 2022. This is attributed to the faster adoption of new and advanced technologies and high disposable income in the region. Along with these, the surging investments in the development of such technologies by companies and the increasing deployment of robots across several sectors are driving the regional market. In industrial automation, such systems are used for the management of several important functions. Also, various manufacturers have initiated the employment of automation to automate procedures, which require repetitiveness.

In North America, the U.S. market holds the leading position, and it will grow at a CAGR of 9.8% in the coming years. This is attributed to the rising adoption of 3D vision systems in industrial robots and the government has implemented various initiatives to boost the economy of the country.

For instance, the national robotics initiative aims to accelerate the development and use of such advanced technologies and fund R&D activities related to such projects. In 2021, the U.S. installed approximately 35,000 units of robots. Among these, the automotive industry installed around 10,000; whereas, the metals and machinery industry installed almost 4,000 robots in the country. Thus, the huge installation of robots in different industries in the country is boosting the growth of the industry.

The APAC market is growing significantly, due to the rising deployment of such systems for the inspection and scanning of the quality of objects in several industries in the region. In addition, the demand is also increasing for improved inspection systems that enable zero-defect and high-quality products. Moreover, the increasing government initiatives in several countries, including Singapore, India, China, and South Korea, for attracting FDI in the manufacturing sector is also contributing to the growth of the regional market.

Based on Type

Based on Component

Based on Deployment

Based on Application

Based on End User

Geographical Analysis

The robotic vision market size stood at USD 2,781.9 million in 2024.

During 2024–2030, the growth rate of the robotic vision market will be around 10.2%.

Automotive is the largest end user in the robotic vision market.

The major drivers of the robotic vision market include the surging use of smart cameras and quality products in industries, the increasing trend of quality control of products, and the rising adoption of cognitive humanoid robots.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages