Market Statistics

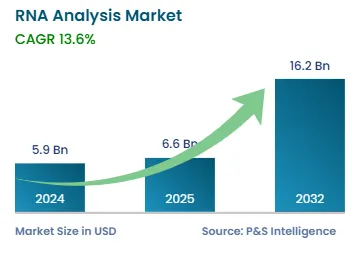

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 5.9 Billion |

| 2025 Market Size | USD 6.6 Billion |

| 2032 Forecast | USD 16.2 Billion |

| Growth Rate(CAGR) | 13.6% |

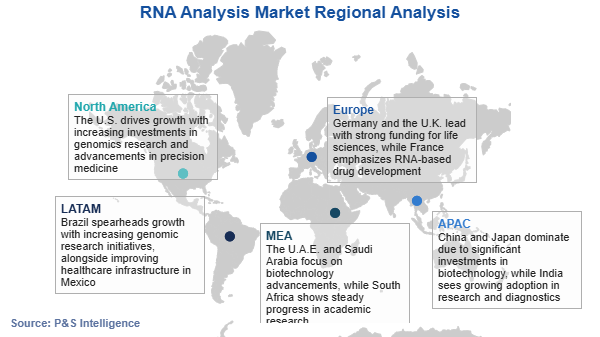

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

| Largest End User Category | Biotechnology and Biopharmaceutical Companies |