Report Code: 11888 | Available Format: PDF

Cold Chain RFID Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2024-2030

- Report Code: 11888

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

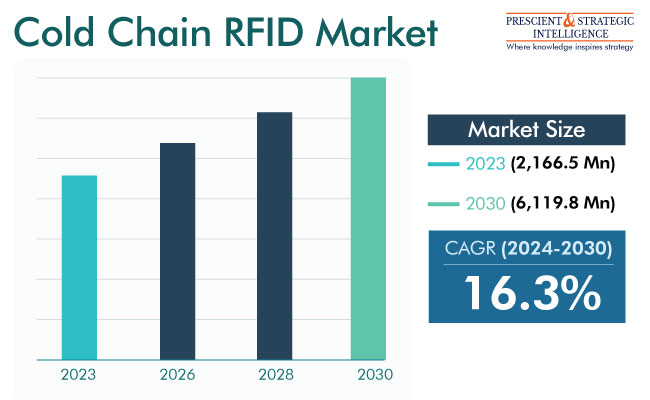

The cold chain RFID market revenue is USD 2,166.5 million (E) in 2023, and it will propel at 16.3% compound annual growth rate during 2024–2030, to reach USD 6,119.8 million by 2030.

The development in the cold chain industry is projected to be powered by the changes in consumer preferences and increase in online retail sales. Moreover, the demand for cold chain solutions is increasing in emerging economies due to the rising number of organized retail outlets. The market development can also be credited to technical improvements and the increasing requirement to guarantee shipment safety, integrity, and efficiency. The development in the back-end IT infrastructure and front-end equipment utilized to gather and report instantaneous information on shipments is also evident.

Moreover, the industry is expected to advance as a result of the rising expenditure on cold chains and the various government initiatives aimed at reducing food waste. As per the WWF, every year 1.3 billion tonnes of food is wasted, and if the world stopped wasting food, almost 8% of the GHG emissions attributed to humans could be reduced. The rising acceptance of technologies such as RFID and automation in cold chain applications offers substantial development opportunities for the industry.

The World Trade Organization and many bilateral free-trade agreements have generated prospects for exporters, to drive the trade of perishable foods duty-free. These initiatives include the North America Free Trade Agreement and European Union Free Trade Agreement.

Because of the growing consumer knowledge, the refrigerated storage industry in emerging economies is propelled by a shift from carbohydrate-rich diets toward protein-rich foods. This raises the demand for refrigerated supply chains as meats decompose quicker than grains and cereals. Moreover, in the coming years, because of the increasing income of consumers, it is projected that China will observe a considerable growth rate.

The consumption of meat has doubled in the 20 years from 1998 to 2018 and has increased four-fold since the 1970s. By 2050, worldwide meat consumption is estimated to be between 470 million tonnes and 560 million tonnes. This would mean that people will consume twice as much meat in 2050 as in 2008.

Growing Spending on IT Solutions for Cold Chain Logistics

The growing IT expenditure in cold storage logistics also propels the development of the industry, by providing improved inventory management and enhancing the overall effectiveness of cold chains. By spending on progressive technologies, such as RFID, cloud computing, and IoT, cold storage workers can screen and manage their inventory in the real time, in turn, decreasing the danger of food waste and spoilage. Essentially, the increasing need for temperature-sensitive items has increased the requirement for real-time cold chain monitoring.

Additionally, numerous nations have strict guidelines governing the transportation and storage of unpreserved food, to guarantee its safety and quality. Compliance with these guidelines often requires a strong cold chain system, which can be attained with the support of IT systems. Such systems are essential for abiding by these guidelines as they offer real-time readings on humidity and temperature levels, location tracking, and data analytics.

RFID is a method for monitoring products, be it food, electronics, pharmaceuticals, or even automotive or aerospace components. Their movement along the supply chain can be tracked by utilizing the data attained from RFID tags. The data can also be used to keep an eye on food products’ temperature. In order to implement an efficient and reliable cold chain, it is essential to screen and trace all the things from production to consumption.

RFID Solutions for Product Storage Stage Are Widely Demanded

On the basis of type, the industry is divided into monitoring, storage, packaging, and transportation components. The storage category is leading the cold chain RFID market, a situation that will likely remain unchanged till 2030. The industry growth can be credited to a rising fondness for frozen, packaged food among people, driven by their changing lifestyles and dietary patterns. As such food items might stay inside on-site refrigeration systems for days, keeping a track of their location and time in storage is essential.

| Report Attribute | Details |

Market Size in 2023 |

USD 2,166.5 Million (E) |

Revenue Forecast in 2030 |

USD 6,119.8 Million |

Growth Rate |

16.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Rising Importance of Cold Chain RFID in Healthcare

Based on industry, the pharmaceutical & biomedical category is expected to witness a high CAGR. In order to supply healthcare products, it is essential to have a proper refrigerated supply system. Almost all pharmaceuticals are temperature-sensitive, and the risk of damage is even greater with biologics, which are derived from animal and human tissues. Moreover, the booming international trade of vaccines since the pandemic has raised the demand for cold-chain solutions as well as RFID to ensure that only genuine products are being circulated.

Tags Category Is Dominating Market

Based on product, the cold chain RFID industry is divided into software & services, tags, and readers, and others. Among these, the tags category holds the largest market share, credited to the increasing need for tags in the food & beverage sector in APAC and North America. Being a vast industry that continuously reels under the risk of fraudulent products, RFID tags are vital to track the location of the cargo along the supply chain. The risk is even greater with pharmaceuticals, with fake medicated drugs a major health concern around the world.

The software & services category is set to experience substantial growth during the projection period. This is credited to the growing need for real-time temperature screening in cold-chain logistics, for which software is essential. The software includes not only that is integrated into the hardware itself but also that with which data storage, analysis, and sharing are enabled.

Passive RFID Category Is Holding Larger Revenue Share

On the basis of technology, the industry is bifurcated into active and passive, of which the passive category is dominating the market. Passive RFID systems do not require a battery and are driven by the electromagnetic power generated by an RFID reader. Therefore, these systems are substantially smaller in size than those that utilize the active RFID technology. Since space can be a constraint in the cold chain, the small size of RFID systems can help accommodate this very technology.

Companies Offering Cold Chain RFID Solutions:

- Alien Technology

- Checkpoint Systems Inc.

- Impinj Inc.

- Nedap N.V.

- RFID4U (eSmart Source Inc.)

- Invengo Technology BV

- GAO RFID Inc.

- Avery Dennison Corporation

- Sato Holdings Corporation

- Maka RFID

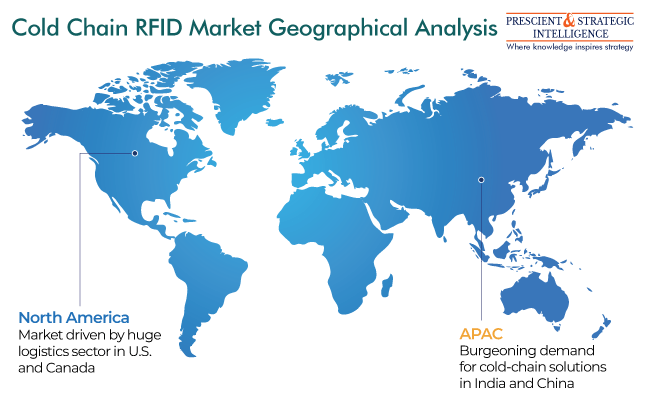

North America Is Generating Highest Revenu

The North American region is contributing the highest revenue to the industry, and it will also remain at the top spot during the projection period. The continent has a lot of development opportunities for businesses preparing to make long-term investments, due to the growing usage of connected devices and a large customer base.

For instance, in June 2023, Americold and Canadian Pacific Kansas City started a partnership for the co-location of Americold’s warehouse amenities on the Canadian Pacific Kansas City network. The key purpose of the co-operation is the optimization of temperature-measured logistics throughout North America by constructing a facility in Kansas City. This is being done to integrate value-added services and cold storage and connect key industries in the U.S. Midwest and Mexico.

The APAC region will be the fastest-growing market, mainly because of the rising government expenditure on logistics infrastructure expansion and the booming usage of warehouse management systems (WMS). China contributes significantly to the APAC market because of the technological improvements in the packing, processing, and storage of fish items.

China is the world's biggest market for cold chains, boosted by the growing demand for temperature-sensitive food & beverages, pharmaceuticals, and chemicals. The nation is witnessing a transition from a construction- and manufacturing-led nation to a customer-led economy. The increasing pace of inventions in the pharmaceutical industry in China is also projected to fuel the requirement for cold chain RFID solutions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws