Healthcare Supply Chain Management Market Future Prospects

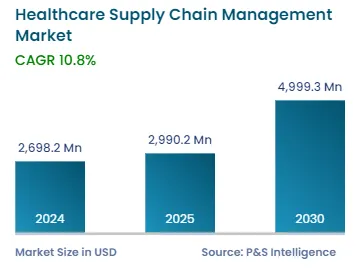

The healthcare supply chain management market will generate an estimated revenue of USD 2,698.2 million in 2024 and is projected to grow at a CAGR of 10.8% from 2024 to 2030, reaching USD 4,999.3 million by 2030. The major factors propelling the growth of the market include the pressure of cost reduction on the healthcare industry, adoption of GS1 standards, along with the increasing investments by healthcare providers and related product manufacturers in healthcare supply chain management solutions.

To address issues in the supply chain of the healthcare industry, a large number of startups are being launched across the globe. For instance, StratMed connects hospitals and manufacturers for the purchase of medical supplies at reduced costs. Few other startups that are trying to make a difference in the industry include Aknamed, Inneate, Feiyi, Veratrak, and Hashprix.

The market experienced the positive impact of the COVID-19 pandemic, as the demand for medical supplies and other related products across the globe spiked significantly. Cold chain companies that delivered vaccines and other medicines, which require temperature control, during the pandemic embraced technological upgradations and new modes of operations. For instance, UPS, which acted as one of the major cold-chain companies to supply temperature-controlled medical supplies, including vaccine doses, was able to deliver on-time with the help of advanced SCM technology.

However, the crisis amplified the issues or gaps in healthcare supply chain management, such as a lack in the adoption of enhanced technology for managing the supply chain functioning, along with a strong dependence on overseas manufacturing. To combat such issues, healthcare companies are investing in SCM solutions.