Report Code: 10012 | Available Format: PDF | Pages: 180

Industrial Refrigeration Systems Market Research Report: By Equipment Type (Compressors, Condensers, Evaporators, Controls), Refrigerant Type (Ammonia, Carbon Dioxide, Hydrofluorocarbon), Application (Food & Beverages, Chemicals & Pharmaceuticals, Oil & Gas) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10012

- Available Format: PDF

- Pages: 180

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

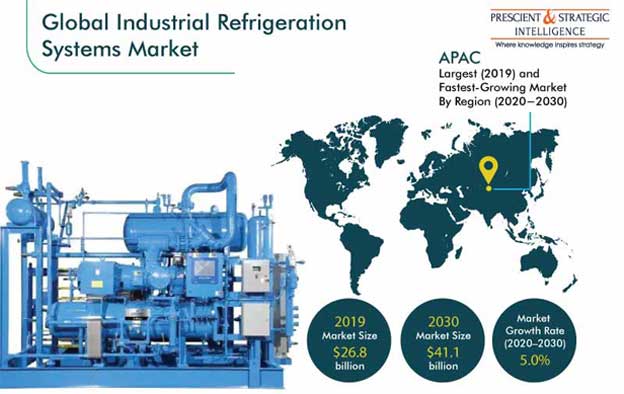

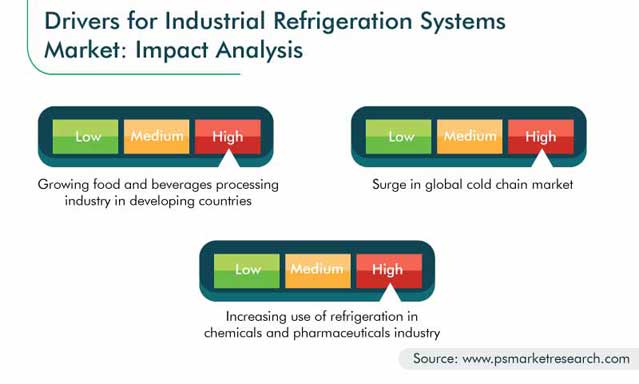

The industrial refrigeration systems market revenue is expected to grow from $26.8 billion in 2019 to $41.1 billion in 2030, at a CAGR of 5.0% during 2020–2030. The market is primarily being driven by the rising use of refrigerators in the chemical and pharmaceutical industries and growing food processing and cold chain sectors.

However, the market has witnessed subdued growth in 2020 due to the COVID-19 pandemic. Market players are facing issues such as the cancellation of orders and unavailability of raw materials, because the production of the final equipment and supply of raw materials and components, especially from China, have reduced tremendously. Besides, the restrictions on the import–export of products have hit the supply of refrigeration systems.

Highest Number of Compressors Sold

The compressors category of the equipment type segment generated the highest revenue between 2014 and 2019. This category is further classified into reciprocating, screw, centrifugal, and scroll. Among these, the reciprocating category held the top position in the market for industrial refrigeration systems owing to the easy availability, extensive popularity, and excellent performance of reciprocating compressors. Moreover, the minimal heat generation and least energy losses of these compressors have boosted their adoption in oil refineries and chemical plants.

Controls Category To Exhibit Fastest Growth

The controls category is expected to witness the fastest growth under the equipment segment of the industrial refrigeration systems market till 2030. This will be due to the mushrooming demand for control modules to improve the functionality and efficiency of such systems. Advanced control and monitoring systems offer cost and energy savings, by making the appliances energy-efficient, reducing the failure frequency due to human error, and automating the operations.

Carbon Dioxide (CO2) To Demonstrate Fastest Growth

The CO2 category of the refrigerant type segment will record the fastest growth in the industrial refrigeration systems industry during 2020–2030 owing to the low toxicity and non-flammable characteristics of this gas. Several industries are preferring CO2 as it is designated a ‘natural refrigerant’ and has a negligible impact on the environment. Moreover, there are no impending laws regarding the phasing out of CO2, owing to which it is being pitched as a long-term refrigerant alternative.

Food and Beverages Sector To Be Fastest Adopter of Refrigerators

The food and beverages category will display the fastest growth in the application segment of the market for industrial refrigeration systems till 2030. This will be due to the vast demand for industrial refrigerators from food processing companies and refrigerated warehouses. Additionally, major countries are making hefty investments in improving their cold chain infrastructure, because refrigeration is a vital part of the food and beverages sector. These systems are used to preserve edible items without hampering their quality or destroying their nutritional content.

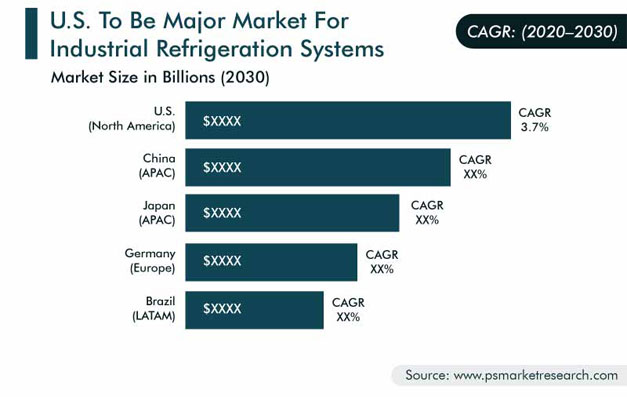

Asia-Pacific (APAC) To Continue Its Dominance till 2030

The industrial refrigeration systems market of the APAC region is expected to generate the highest revenue in the future, primarily on account of the presence of numerous industrialized nations and their vast population. Additionally, many regional countries are investing in the development of world-class cold-chain infrastructure. For example, Government of India approved 27 new integrated cold chain projects worth $67.1 million (INR 743 crore), under the Pradhan Mantri Kisan Sampada Yojana (PMKSY), a scheme under which the government is developing r integrated cold chain and value-added infrastructure, in September 2020.

Increasing Inclination toward Eco-Friendly Refrigerants Is Key Trend

Governments across the world have implemented stringent rules related to refrigerants based on halogen compounds. For instance, in 2015, the European Union (EU) implemented the F-gas regulations to ban the usage of certain refrigerants, based on their Global Warming Potential (GWP). The regulations prohibit the use of fluorinated greenhouse gases with a GWP of 2,500 or more for the maintenance or servicing of refrigeration equipment with a 40-ton or more of CO2 equivalent (CO2e) charge size, from January 1, 2020. Such norms are expected to encourage other regions to follow a similar path and adopt cleaner refrigerants.

Flourishing Cold Chain Industry To Be Major Growth Driver

Another key factor propelling the industrial refrigeration systems market is the rising sales of biotech drugs and biologic products, which were already worth more than $340 billion in 2019. Special logistics solutions are used for maintaining the quality of these temperature (2–8 °C)- sensitive products during their transportation from manufacturers to patients, hospitals, pharmacies, and clinics. The increasing consumption of these products in developing and developing countries is driving the growth of the cold chain in the pharmaceutical industry.

With this, the global logistics expenditure on the cold chain is expected to rise to over $18.6 billion in 2022 from $15.9 billion in 2019. The high dependence on cold storage is resulting in considerable growth in the cold warehouse capacity, which will boost the demand for industrial refrigeration systems.

Increasing Adoption of Refrigeration in Chemical and Pharmaceutical Sectors Supporting Market Growth

The chemical, oil refining, and petrochemical industries require refrigeration to condense gases, preserve compounds, and dehumidify the air. Refrigeration systems are used by pharmaceutical companies for cold sterilization of tissue samples, biologics, and medical devices. Further, the chemical industry requires advanced refrigeration to maintain the temperature of raw materials and finished and semi-finished goods. Most of the pharmaceuticals, biologics, bioengineered drugs, and vaccines that are derived from living cells need to be kept in stable temperatures to remain viable. Thus, the industrial refrigeration systems market will continue to grow with the expansion of these industries.

| Report Attribute | Details |

Historical Years |

2014-2010 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$26.8 Billion |

Forecast Period CAGR |

5.0% |

Report Coverage |

COVID-19 Impact Analysis, Market Trends, Drivers, Restraints and Opportunities, Value Chain Analysis, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Market Share Analysis, Major Country Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Equipment Type, Refrigerant Type, Application, Region |

Market Size of Geographies |

U.S., Canada, France, Germany, Italy, Russia, Spain, U.K., China, India, Australia, Japan, South Korea, Brazil, Mexico, Saudi Arabia, Turkey, U.A.E., South Africa |

Secondary Sources and References (Partial List) |

Heating, Refrigeration and Air Conditioning Institute of Canada (HRAI), Association of European Refrigeration Component Manufacturers (ASERCOM), Brazilian Association of Refrigeration, Air Conditioning and Heating (ABRAVA), China Refrigeration and Air-conditioning Conditioning Industry Association, American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE), Global Cold Chain Alliance (GCCA), Refrigeration Service Engineers Society (RSES) |

Explore more about this report - Request free sample

Partnerships and Product Launches Rank High among Strategic Developments in Market Outlook

In order to expand their reach, consolidate their position, and grab a larger share of the global industrial refrigeration systems market revenue, players operating in the industry are focusing on partnerships. As per analysis, product launch is another important strategy followed by the market participants to cater to their customers with advanced product offerings.

In November 2019, Danfoss India launched an incompressible computational fluid dynamics (ICFD) defrost module, a product specially designed to improve defrost performance and reduce energy consumption in industrial refrigeration applications.

Similarly, in July 2019, The Chemours Company and Axima Refrigeration France partnered on the use of the Opteon XL A2L-class refrigerants for commercial refrigeration, before the next European F-Gas hydrofluorocarbon (HFC) cap and phase-out are implemented in 2021.

Key players in industrial refrigeration systems market report are:

-

Trane Technologies plc

-

Carrier Global Corporation

-

Hussmann Corporation

-

Dover Corporation

-

Daikin Industries Ltd.

-

Johnson Controls International PLC

-

Midea Group Co. Ltd.

-

Industrial Frigo SRL

-

GEA Group Aktiengesellschaft

-

Emerson Electric Co.

-

BITZER Kühlmaschinenbau GmbH

-

Danfoss A/S

-

Star Refrigeration Ltd.

-

Mayekawa Mfg. Co. Ltd.

Industrial Refrigeration Systems Market Size Breakdown by Segment

The industrial refrigeration systems market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Equipment Type

- Compressors

- Reciprocating

- Screw

- Centrifugal

- Scroll

- Condensers

- Air-cooled

- Evaporative

- Water-cooled

- Evaporators

- Shell and tube

- Bare tube

- Finned

- Plate

- Controls

Based on Refrigerant Type

- Ammonia

- Carbon Dioxide (CO2)

- Hydrofluorocarbon (HFC)

Based on Application

- Food & Beverages

- Chemicals & Pharmaceuticals

- Oil & Gas

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Asia-Pacific (APAC)

- China

- Japan

- India

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East & Africa (MEA)

- U.A.E.

- South Africa

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws