Market Statistics

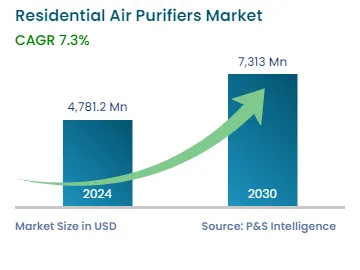

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4,781.2 Million |

| 2030 Forecast | USD 7,313 Million |

| Growth Rate(CAGR) | 7.3% |

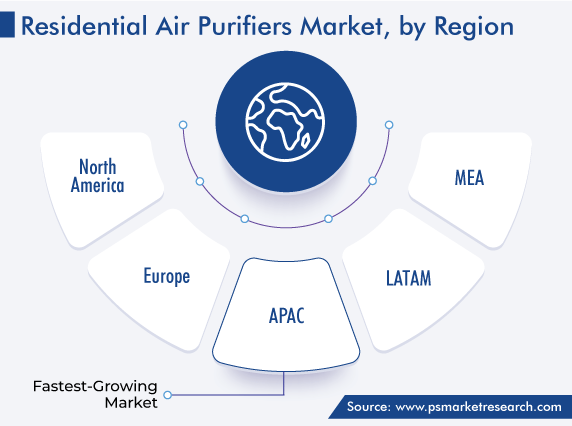

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12578

Get a Comprehensive Overview of the Residential Air Purifiers Market Report Prepared by P&S Intelligence, Segmented by Filtration Technology (HEPA, Activated Carbon, Ionic Filters), Type (Portable /Stand Alone Air Purifiers, In-Duct Air Purifiers), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4,781.2 Million |

| 2030 Forecast | USD 7,313 Million |

| Growth Rate(CAGR) | 7.3% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The residential air purifiers market size stood at USD 4,781.2 million in 2024, and it is expected to grow at a CAGR of 7.3% during 2024–2030, to reach USD 7,313 million by 2030.

The rapid development of the market is credited to the rising interest of the public in smart homes, government laws for air quality monitoring and control, and rising concerns related to the health and environmental complications of pollution. Additionally, the requirement for energy-efficient equipment and the continuous research and development by the players to bring advanced products help in the market advance.

The other key factor aiding the growth of the market apart from the rising level of pollutants is the increasing cases of airborne diseases across the globe. Further, people are more conscious of their health than before, which, along with the improving standard of living with the rise in the disposable income, drives the market. Thus, the rising awareness of the public regarding the harms of various pollutants propels the adoption of air quality control equipment, especially in metropolitan cities.

Clean and fresh air is becoming the new standard for people post the COVID-19 pandemic. They are opting for efficient air conditioner and purifier units that can not only provide relief from the scorching heat but also maintain appropriate levels of ventilation, allowing people to breathe fresh air. Hence, the adoption of standalone purifying devices among consumers is increasing due to the need for clean and contaminant-free air.

Moreover, governments around the globe have implemented certain guidelines in this regard. For instance, during COVID, the Singapore government had proposed guidelines to keep indoor air clean and listed a few portable air cleaners, such as AiRazor AR-100, Airify AP1402, Cleanroom 250, Cleanroom H13, Defender Air Cleaner, and HealthPro 250, and others that could be useful in providing clean and pathogen-free air. Additionally, the article suggests the use of ionizers, electrostatic precipitators, and other electronic air cleaning technologies for keeping the air clean and gaining protection against viruses.

The extensive research and development on environment conservation have introduced several advancements in pollutant monitoring technology that provide real-time information on the emission of greenhouse gases, PM, and other hazardous chemicals. Different government organizations and air quality monitoring and purification system vendors are actively involved in research activities to develop, implement, and evaluate new air quality approaches and technologies.

Advancements in sensors, IoT platforms, and mobile technologies have led to the development of better air quality monitoring and purification products that are portable and have a low cost. Some products also have smartphone-app-integrated sensors that can measure the air quality. In this regard, big data analytics powered by machine learning is being applied to data sets on weather and traffic to understand the dynamics of air pollution.

The high-efficiency particulate absorbing (HEPA) filter technology held the largest share, of more than 42%, in 2022. This is due to the high performance and ability of HEPA filters to trap and remove airborne particles and enhance the surrounding environment. The technology was made by the U.S. to filter harmful radioactive particles, as it even removes fine particles of 0.3 microns in size. It is highly effective in trapping and filtering airborne particles, such as smoke, dust, and microbes, such as Bacillus subtilis, Aspergillus niger, Staphylococcus epidermidis, and Penicillium citrinum.

Moreover, manufacturers are using additional filters, such as activated carbon and ionizers, to increase the efficiency of the HEPA technology at filtering viruses, volatile organic compounds, and other micro particles that may cause diseases.

Therefore, the activated carbon filters category is expected to grow with a CAGR of 7.7% during the forecast period. Due to the larger surface area of carbon particles, the trapping capacity for smoke, odors, and gases increases.

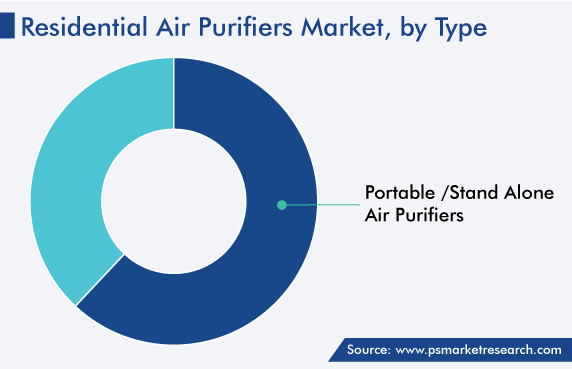

The portable/standalone category dominated the residential air purifiers market, with a share of 67%, in 2022.

Due to the easy maintenance and user-friendliness of these variants for homes, because of their portability, they are widely used to alleviate poor indoor air quality. In today’s world, their adoption is driven by the rising prevalence of airborne diseases, such as asthma, COPD, and even lung cancer. Additional features, such as multiple filtration layers and smart sensors connected to a mobile app via the internet, offer a higher convenience for indoor or household purposes.

Moreover, in-duct purifiers are expected to experience the faster growth, with a CAGR of around 7.4%, during the forecast period. These products are used along with furnaces in an HVAC system to ensure that the air that enters the house is contaminant-free. Furthermore, the growth of the category will be due to the rising awareness regarding the low outdoor quality and lung-related disorders that can result from it. Therefore, with the rising concerns for the indoor environment and health and the increasing disposable income, the adoption of such filters is burgeoning in homes.

Drive strategic growth with comprehensive market analysis

Due to the rapid urbanization in the region, especially India and China, which is leading to the rising pollution level, the fastest growth, of 7.9%, is expected in APAC. Additionally, the region is home to a large number of market players, which results in the easy availability of these HVAC components.

Moreover, the Government of China has imposed strict laws in response to the growing concern because of the rising pollution in the country. Additionally, the leading manufacturers in the country are focusing on the launch of products that are advanced and energy-efficient, to gain an edge over other market players. For instance, Xiaomi Corporation and Koninklijke Philips N.V. are offering technological advanced products in the country.

Similarly, India has some of the most-polluted cities, thus observing a rising need for these products. Therefore, the major market players are targeting the Indian market with new appliances. For instance, Scosche introduced its AFP2-SP FrescheAir, a portable HEPA air purifier, in May 2022. Similarly, in 2022, Electrolux launched its new range of air purifiers. Additionally, Xiaomi Corporation had launched the Mi Air Purifier 3 in 2019 in the country.

Moreover, the residential air purifiers market in North America is expected to witness a growth rate of around 7.3% in the coming years, owing to the increasing number of respiratory disorder cases, rising awareness regarding the environmental and health implications of air pollution, and increasing pollution level. Additionally, with the increasing industrialization rate, the emission of toxic chemicals into the air is rising, thus adding to the air pollution problem. For example, the Kanawha River Valley in West Virginia is home to the highest concentration of chemical plants in the U.S. Residents in and around this area have historically suffered from a lot of diseases attributed to the emission of harmful chemical vapors.

Moreover, according to research on air pollution in North America, oil sands have been found to be a leading source of air pollution. Oil sand operations are a major source of secondary organic aerosols, which lead to numerous negative health effects. Due to the rise in the emission of such pollutants in the region, the demand for air quality monitoring and purification systems is likely to increase in the future.

Based on Filtration Technology

Based on Type

Geographical Analysis

The 2024 size of the market for residential air purifiers was USD 4,781.2 million.

The residential air purifiers industry is driven by governments’ indoor air quality control regulations and growing awareness of breathing clean air.

HEPA the most-popular technology in the market for residential air purifiers.

Technological advancements are trending in the residential air purifiers industry.

The market for residential air purifiers will witness the highest CAGR in APAC.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages