Radioligand Therapy Market Analysis

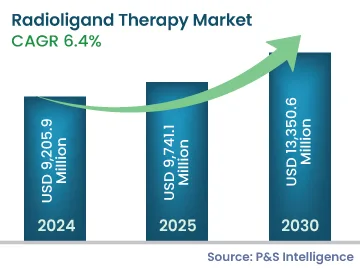

The radioligand therapy market size is estimated to have stood at USD 9,205.9 million in 2024, and rising at a compound annual growth rate of 6.4% during 2024–2030, it will reach USD 9,741.1 million by 2030. The market for radioligand therapy is driven by the increasing number of FDA-approved drugs with low side-effects. The progress is augmented by the increasing research on cancer treatment and the rising demand for more-effective drugs. Nuclear medicine physicians are encouraging the establishment of centralized radio-pharmacies, as radiopharmaceuticals are the major area of interest for researchers, for targeted therapy. For instance, in the U.S., Cardinal Health and Jubilant Radio Pharma are the key players in the radio-pharmacies market.

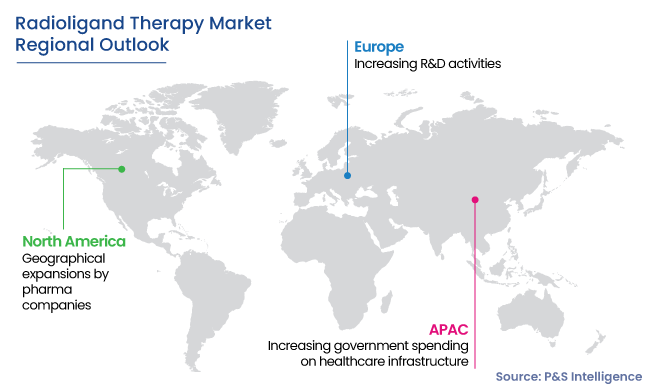

Moreover, governments are taking initiatives and raising funds to reduce the cancer burden. For instance, the European Commission launched Europe’s Beating Cancer Plan in February 2021. The plan aims to provide cancer services with an emphasis on disease prevention and early diagnosis. In 2022, the European government has planned to pour more than USD 4.2 billion into cancer research and care. Radiopharmaceuticals and radiotherapy are highly effective and are being, thus, demanded increasingly for malignancies, which augments growth.

For instance, the POINT Biopharma Global Inc. is preparing to enter the market for radioligand therapy with PNT2003 drug, which is currently in the final phases of clinical trials. Similarly, considering the increasing demand for radiotherapy and government funding in this field, market players are strengthening their focus on the development, approval, and launch of advanced products, especially drugs based on radioligands.