Report Code: 11760 | Available Format: PDF | Pages: 139

Polytetrafluoroethylene (PTFE) Market Research Report: By Type (Powder, Granules, Aqueous Dispersion), Application (Tubes, Films & Sheets, Fabrics, Coatings, Wires & Cables, Fuel Additives, Tapes), End User (Automotive, Construction, Electrical & Electronics, Industrial Processing, Medical), Geographical Outlook (U.S., Canada, Mexico, Germany, Italy, U.K., France, China, India, Japan, Brazil, South Africa, Iran, Australia) - Global Industry Trends and Forecast to 2024

- Report Code: 11760

- Available Format: PDF

- Pages: 139

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

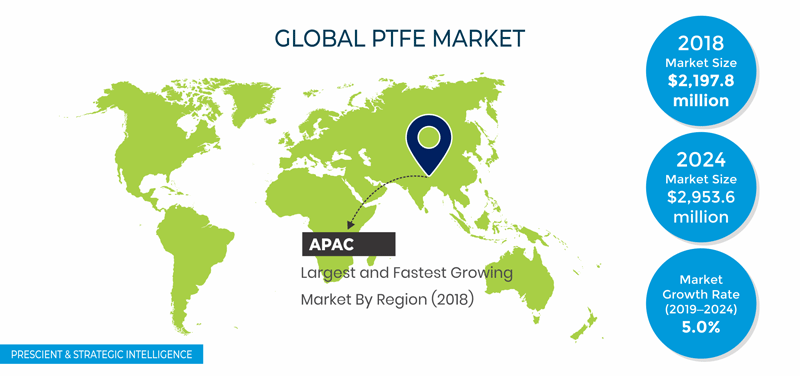

The polytetrafluoroethylene (PTFE) market revenue stood at $2,197.8 million in 2018, and it is expected to witness a CAGR of 5.0% during 2019–2024.

The APAC region will register the fastest growth in the market for PTFE, in terms of volume, at a CAGR of 5.9%, between 2019 and 2024. This can be attributed to the increasing production of electrical and electronic devices owing to the macroeconomic growth in the region. The surging adoption of polytetrafluoroethylene coatings for wires and cables, insulations, semiconductors, and electrical tapes will accelerate the demand for this material in the coming years.

Market Dynamics

The rising application of the material in the medical sector is a prominent trend in the PTFE industry. PTFE has replaced traditional plastics in multiple medical applications as it is a biocompatible material. In recent years, market players have heavily invested in research and development (R&D) and launched enhanced PTFE-based products. For example, Bal Seal Engineering Inc. achieved the USP Class VI compliance for its SP-23 (polymer with a PTFE base) and SP-191 (filled PTFE) seal materials in May 2019. These materials protect the components of catheters, pumps, powered surgical tools, and other medical equipment and prevent leakage.

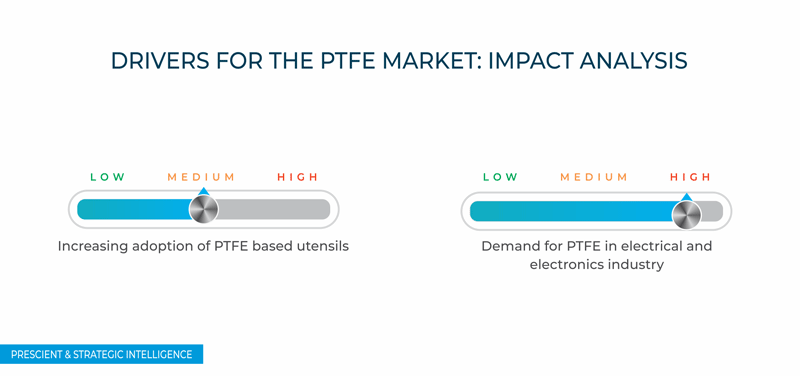

The PTFE market growth is thriving on the spurring demand for this plastic from the electrical and electronics industry. The material finds application in cable ties, barb insulators, battery binders, brush holders, connectors, circuit breakers, and fabrication of semiconductor devices. The Semiconductor Industry Association (SIA) states that over one trillion units of semiconductors were shipped in 2018. Additionally, the annual sales value of semiconductors in China increased by over 20.5% in 2018 from 2017.

The rising usage of PTFE in cosmetics is expected to create a huge growth opportunities for the market. In recent years, it has been noted that using the polymer of tetrafluoroethylene in beauty products, such as pressed powders, anti-aging creams, bronzers, and blushes, can provide a smooth texture to the skin. Thus, the growing demand for beauty products owing to the rapid surge in the consumer interest in novel and premium products and online expenditure on cosmetics will serve as an opportunity for the market in the foreseeable future.

Segmentation Analysis

In 2018, the granules category, under the type segment, held the largest share in the PTFE market, of approximately 55.0%, involume terms. The granular variant is preferred over the powdered variant as it is relatively difficult to mix solids with fine powders to form a uniform blend. Moreover, the cost-effectiveness of granules makes them a preferred option over powdered PTFE. The granular material is ideal for compression-molding for the production of sheets, tubes, and rods.

The coatings category, within the application segment, accounted for the largest volume share in 2018. By 2024, nearly 90.5 kilotons of PTFE will be demanded for coatings applications. The category is also expected to witness the highest CAGR in the coming years. The spurring demand for PTFE-coated rings, valves, and seals in the industrial processing sector has boosted the demand for the coatings of the plastic.

The industrial processing category held the largest share, in terms of volume, in 2018, under the end use segment. This can be ascribed to the high demand for PTFE-coated piping, gaskets, and linings in the chemical processing sector. Moreover, the ability of the material to increase the electrical load bearing capacity, enhance the heat and chemical resistance, and reduce friction and sticking of the material supported this category in generating the highest revenue in the PTFE market. In the coming years, the demand for PTFE from the electrical and electronics sector will grow at the fastest pace, at a CAGR of 6.4%.

Geographical Analysis

The APAC region emerged as the largest consumer of polytetrafluoroethylene during 2014–2018, and it is expected to maintain this trend during 2019–2024. This will primarily be on account of the high-volume consumption of the polymer in the automobile and electrical and electronics industries of the region. The Consumer Electronics Association (CEA), in January 2018, estimated that the consumer electronics retail revenue will be $351.0 billion in 2018, which would be an increase of 3.9% from 2017.

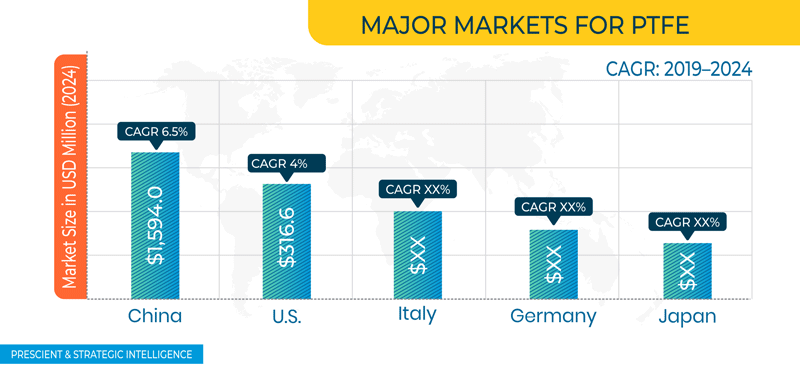

Among APAC nations, China will dominate the market in the coming years, generating revenue of $1,594.0 million in 2024. The APAC market for PTFE will also register the fastest growth in the foreseeable future due to the increasing industrial processing activities, surging production of vehicles, and mounting demand for consumer electronics. China is expected to display the fastest growth, at a CAGR of 6.6% by volume and 6.5% CAGR by revenue, in the coming years.

Competitive Landscape

The global market for the chemical compound is highly concentrated in nature and has a small number of players. The key players in the market are The Chemours Company, Gujarat Fluoropolymers Ltd., 3M Company, Daikin Industries Ltd., AGC Inc., Juhua Group Corporation, Solvay SA, Zhonghao Chenguang Research Institute of Chemical Industry, and Shandong Dongyue Polymer Material Co. Ltd. The production is also quite limited to the APAC region, primarily China. Several players are backward integrated and with their own raw material production facilities and even process PTFE to produce high-value-added products.

Shamrock, Jinhua Yonghe Fluorochemical Co. Ltd., DuPont (Changshu) Fluoro Technology Co. Ltd., and Liaocheng Fuer New Material Technology Co. Ltd. are other key players in the global PTFE market.

Recent Strategic Developments of Major PTFE Market Players

In recent years, the major players in the global polytetrafluoroethylene market have taken several strategic measures, such as mergers and acquisitions, in order to gain a larger share in the global market. For instance, in Aug 2017, Daikin Industries Ltd. acquired Heroflon S.p.A., an Italian manufacturer of fluoropolymer compounds. Heroflon’s product portfolio comprises fluoropolymer compounds and micro-powders centering on the chemical.

Key Questions Addressed

- What is the current scenario of the global market?

- What are the historical and present size of categories within the market segments and their future potential?

- What are the evolving opportunities for the players in the market?

- Which application is expected to dominate the global market during the forecast period?

- Which are the key regions from the investment perspective?

- Which region is expected to dominate the market during the forecast period?

- What are the gross profit margins of producing PTFE across different regions?

- What are the key strategies being adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws