Report Code: 12172 | Available Format: PDF | Pages: 250

Psoriasis Drugs Market Research Report: By Type (Biologic Drugs, Small-Molecule Systemic Drugs, Topical Therapies), Mechanism of Action (Tumor Necrosis Factor-Alpha Inhibitors, Phosphodiesterase Type 4 Inhibitors, Interleukin Inhibitors), Route of Administration (Oral, Parenteral, Topical) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 12172

- Available Format: PDF

- Pages: 250

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

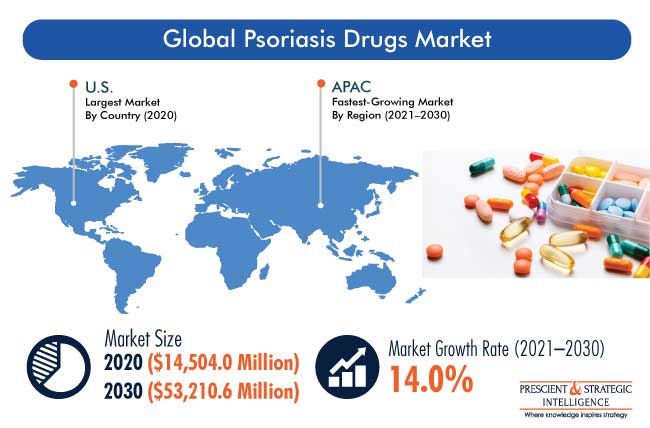

The global psoriasis drugs market was valued at $14,504.0 million in 2020, which is projected to progress at a CAGR of 14.0% during the forecast period (2021–2030). The major factors responsible for the growth of the market include the rapidly aging population, increasing number of patients with psoriasis, rising per capita income, escalating healthcare expenditure, and surging number of research programs.

With the COVID-19 pandemic’s outbreak, the burden of both morbidity and mortality increased exponentially, leading to major disruptions in the economic, social, and other aspects of life. In addition, the major burden fell on the healthcare sector and related infrastructure, even in the most-developed countries with advanced healthcare systems. However, the COVID-19 pandemic has not affected the market for psoriasis drugs much due to the recent launch of some major drugs and their increased sales.

Due to Increasing Number of Psoriasis Patients, Biologic Drugs Category Led Market

Based on type, the biologic drugs category held the largest share in the psoriasis drugs market during the historical period (2015–2020), and it is expected to retain its position in the upcoming years. This will majorly be due to the rising number of psoriasis patients across the globe. Moreover, the increasing number of research programs to decode the genetics of psoriasis has led to the development of highly targeted and effective drugs. Thus, the availability of an improved treatment to clear psoriasis and reduce the risk of its comorbidities, including psoriatic arthritis (PsA), inflammatory bowel disease (IBD), and certain cancers, has allowed biologic drugs to gain a large customer base.

Higher Prevalence of Autoimmune Diseases Supports Growth of Interleukin Inhibitors Category

On the basis of mechanism of action (MoA), interleukin inhibitors are expected to be the fastest-growing category in the psoriasis drugs market during the forecast period. This is majorly attributed to the increasing adoption of these drugs for the treatment of psoriasis and growing prevalence of autoimmune conditions.

Due to Availability of large Number of Brands, Parenteral Category Led Market

On the basis of route of administration (RoA), the parenteral category held the largest share in the psoriasis drugs industry during the historical period. This was due to the rising adoption of biologic drugs to be delivered intravenously. Furthermore, the rise in the preference for parenteral administration is due to the large number of brands available for injection and overall rise in the rate of psoriasis.

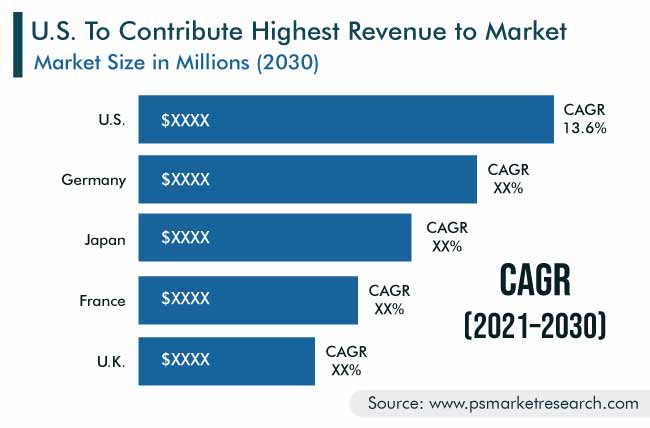

Rising Awareness on Newly Developed Drugs Led to Largest Market Share of North America

The North American region accounted for the largest share in the psoriasis drugs market during the historical period in the psoriasis drugs industry. This was majorly due to the increasing awareness on newly developed drugs and high per capita income in the region. However, Asia-Pacific (APAC) is expected to be the fastest-growing region in the forecast period. This is attributed to the increase in the disposable income, which is leading to the high adoption of skincare products, such as psoriasis drugs, surge in the healthcare spending, and growth in the number of product launches in the region.

Increasing Number of Product Approvals Is Key Market Trend

The increasing number of drug approvals is a notable trend being observed in the market for psoriasis drugs. The expansion of the drug portfolio for the disease is expected to attract more patients and healthcare professionals. For instance, in January 2021, AbbVie Inc. announced that the European Commission (EC) has approved RINVOQ (upadacitinib - 15 mg), an oral, once-daily selective and reversible Janus kinase (JAK) inhibitor developed for the treatment of active PsA in adult patients.

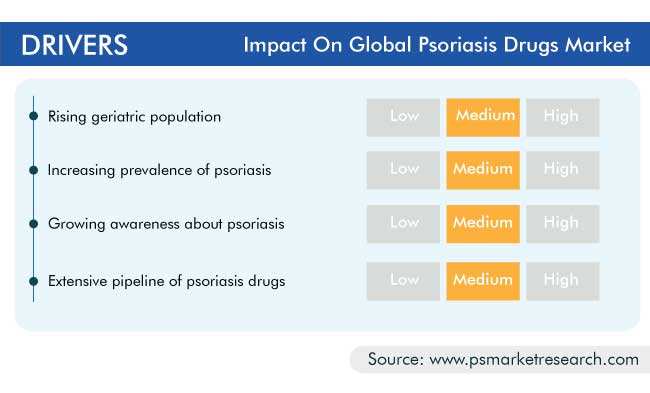

Rising Geriatric Population Leading to Rising Psoriasis Prevalence

The functionality of the human skin decreases with age, bringing with it various problems, such as slow healing of wounds, loss of subcutaneous fat, increased sensitivity to ultraviolet (UV) radiation, and greater susceptibility to skin infections and diseases, such as psoriasis. According to the World Population Ageing 2019 report by the United Nations (UN), there were 703 million people aged 65 or above in 2019, and their number is set to increase to 1.5 billion by 2050. Thus, the rising geriatric population is one of the key factors driving the market for psoriasis drugs, by resulting in the increasing number of cases and, in turn, the demand for the associated medication.

Increasing Prevalence of Psoriasis Propelling Demand for Novel Drugs

According to the National Psoriasis Foundation, 125 million people across the world were reported to have psoriasis, as of 2020, which is significantly higher compared to the disease prevalence reported in the year 2016, which was approximately 100 million. Thus, the increasing prevalence of psoriasis is resulting in the high demand for the related treatments and drugs, which, in turn, is driving the psoriasis drugs industry growth.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$14,504.0 Million |

Forecast Period CAGR |

14.0% |

Report Coverage |

Market Trends; Revenue Estimation and Forecast; Segmentation Analysis; Regional Breakdown; Companies’ Strategic Developments; Product Benchmarking; Company Profiling |

Market Size by Segments |

By Type; By MoA; By RoA; By Region |

Market Size of Geographies |

China; India; Japan; South Korea; Australia; U.S.; Canada; Mexico; Brazil; Germany; U.K.; France; Spain; Italy; Saudi Arabia; South Africa |

Secondary Sources and References (Partial List) |

African Society of Dermatology and Venerology; American Dermatological Association; British Association of Dermatologists; Centers for Disease Control and Prevention; Dermatological Society of Singapore; European Societies of Dermatology; International Society of Dermatology; National Psoriasis Foundation; Psoriasis Association of Singapore; Psoriasis Association of India |

Explore more about this report - Request free sample

Market Players Are Focusing on Product Launches to Gain Competitive Edge

The global psoriasis drugs market has various key players, such as Novartis AG, Pfizer Inc., Bristol-Myers Squibb Company, Johnson & Johnson, Merck & Co. Inc., AbbVie Inc., Eli Lilly and Company, GlaxoSmithKline plc, Mylan N.V., and Bausch Health Companies Inc.

In recent years, players in the psoriasis drugs industry have engaged in product launches to offer a better portfolio than their competitors.

- In January 2021, AbbVie Inc. announced that RINVOQ (upadacitinib - 15 mg), an oral, once-daily selective and reversible JAK inhibitor, has been approved by the EC for the treatment of active PsA in adults.

- In August 2020, Novartis AG received the EC’s approval for Cosentyx (secukinumab) for the treatment of plaque psoriasis in patients aged 6–18 years.

Key Players in Psoriasis Drugs Industry Include:

-

Novartis AG

-

Pfizer Inc.

-

Bristol-Myers Squibb Company

-

Johnson & Johnson

-

Merck & Co. Inc.

-

AbbVie Inc.

-

Eli Lilly and Company

-

GlaxoSmithKline plc

-

Mylan N.V.

-

Bausch Health Companies Inc.

-

Amgen Inc.

Market Size Breakdown by Segment

The global psoriasis drugs market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2030.

Based on Type

- Biologic Drugs

- Small-Molecule Systemic Drugs

- Topical Therapies

Based on Mechanism of Action (MoA)

- Tumor Necrosis Factor (TNF)-Alpha Inhibitors

- Phosphodiesterase Type 4 (PDE4) Inhibitors

- Interleukin Inhibitors

Based on Route of Administration (RoA)

- Oral

- Parenteral

- Topical

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

In 2030, the market for psoriasis drugs will value $53,210.6 million.

Under the type segment of the psoriasis drugs industry, the biologic drugs category holds the largest share.

The demand for interleukin inhibitors is rising among the end users in the psoriasis drugs market because of the increasing incidence of autoimmune diseases.

APAC is set to offer the best opportunities for investments in the psoriasis drugs industry.

Companies in the market for psoriasis drugs are launching new medications and seeking the approval of regulatory agencies for the same.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws