Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 17.4 Billion |

| 2030 Forecast | 23.9 Billion |

| Growth Rate(CAGR) | 5.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12594

Get a Comprehensive Overview of the Professional Hygiene Market Report Prepared by P&S Intelligence, Segmented by Product (Tissues and Napkins, Wiping and Cleaning, Soaps and Sanitizers), Application (Hospitality, Commercial, Public Interest, Healthcare, Industrial, Education), Distribution Channel (Offline, Online), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 17.4 Billion |

| 2030 Forecast | 23.9 Billion |

| Growth Rate(CAGR) | 5.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

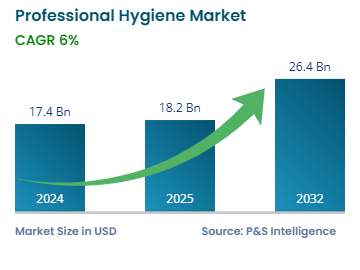

The professional hygiene market size stood at USD 17.4 billion in 2024, and it is expected to grow at a CAGR of 5.5% during 2024–2030, to reach USD 23.9 billion by 2030.

A lot of products can be used to ensure complete hygiene in commercial and industrial spaces. Thus, companies in the professional hygiene sector offer complete solutions for the sanitation and sterility of workplaces and public places, including paper hand towels, hand sanitizers, toilet paper, dispensers, hand soap, and cleaning and wiping products.

The growth of the market is primarily triggered by the rising health concerns because of the infections caused due to microbial growth within commercial spaces. Moreover, due to the increasing staff at workplaces, the use of washrooms by more people within the same amount of time raises the risk of infection. Additionally, with the increasing demand for cleanliness and hygiene at hotels, the market is booming.

Essentially, product demand is growing because of the rising need for the work environment to be clean and hygienic for both employees and visitors, especially in the hospitality sector, restaurants, and commercial spaces. As a result, market players are focusing on the advancement of the products as per their application in a variety of spaces. The players are also utilizing e-commerce platforms to have a wider reach for their products and spread awareness among end users about their benefits.

In the last few years, the use of liquid handwash and sanitizers has grown widely due to the rising focus on protection from viruses and other foreign particles. At many workplaces and public spaces, it has become mandatory to use sanitizers to restrict the onset of any infection. However, due to the irrational use of such products, people experience skin problems, such as dryness and irritation, which are often symptoms of contact dermatitis. This condition is mostly observed in people who regularly use handwashes and sanitizers, such as in hospitals and commercial kitchens.

Therefore, due to the rising concerns of the public for health, companies are launching products that are more natural and contain less-harmful chemicals. As a result, sustainable tissues, napkins, and other toiletries formulated with organic and natural material are becoming increasingly common. Additionally, organic sanitizers and soaps are gaining popularity among consumers over chemical- and alcohol-based hand sanitizers, as the former are skin-safe and eco-friendly.

At healthcare settings, industrial spaces, offices, and labs, microbial contamination is usual and responsible for the direct transmission of pathogens to people. Specifically, exposed surfaces and corners are rich breeding grounds for microbes.

Moreover, due to the ability of microorganisms to persist and survive for long periods on surfaces, the usage of hygiene maintenance products is necessary, as is the regular disinfection of areas prone to microbial colonization.

The situation at healthcare settings is even direr, as bacterial spores and viruses are easily transmitted from infected patients or even the staff and visitors to surfaces and vice versa. This is because areas adjacent to patients are frequently touched and, thus, must be sanitized on a regular basis. For instance, 1 in every 31 in-patients gets at least one HAI in the U.S. every day, including urinary tract infections, bloodstream infections, and pneumonia.

Due to the rise in population, shift of people from rural to urban areas, and increase in tourism activities, the demand for hygiene maintenance products is growing in the hospitality sector, which held around 40% share in the global market in 2022.

The category includes hotels, motels, food service providers, spas, beauty salons, and other spaces where guests’ accommodation and other personal requirements are catered to. One of the basic things that visitors expect at these places is proper sanitization and hygiene.

Thus, the fast-growing hospitality sector with the increasing tourism activities and inauguration of new resorts and luxurious hotels drives the market. For instance, the estimated number of international arrivals in the U.S. was more than 22 million in 2021, which was 15% more than the number in 2020. Around 42% of these tourists came from countries other than Canada and Mexico. Similarly, in Europe, the total number of tourists who took accommodation in 2022 was close to the number before the pandemic, i.e., more than 2.7 billion in 2022, compared with around 2.8 billion in 2019.

Moreover, since the pandemic, there has been a vast increase in people’s focus on health and hygiene. Due to this, the hospitality sector has grown its standards of hygiene, by providing sanitizers and tissues and regularly disinfecting the spaces. Additionally, there are now certain strict regulations for staff members in the hotel industry to practice good hygiene, which include sanitizing hands and using face masks, gloves, and clean and disinfected clothes.

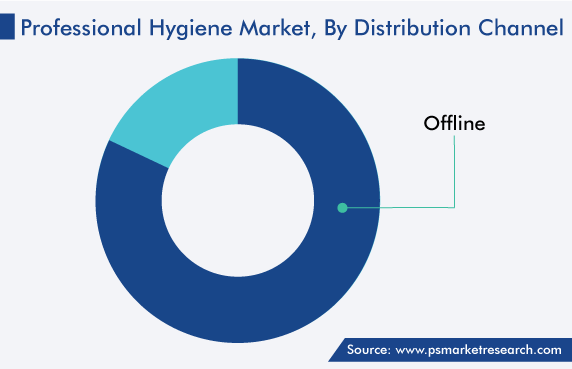

Owing to the availability of a wide variety of products of various brands with big discounts and offers at supermarkets and hypermarkets, the offline mode held 84% share of the professional hygiene products sales revenue in 2022. Moreover, in brick-and-mortar stores, the customer can physically view the product, as well as ask for assistance from actual humans, rather than talking to a virtual agent (chatbot). Additionally, the desire to see, touch, and feel items ranks the highest among the reasons consumers want to shop in-store over online. In case of hygiene products, the quality matters, and therefore, consumers mostly prefer to completely review the article in consideration of its cost, before they buy it.

Online retail stores, such as eBay, Amazon, and Alibaba, provide an online repository of such articles as well as vendors, and enable purchases to be made directly. Thus, the online mode is expected to witness the faster growth during the forecast period, majorly due to the increasing penetration of the internet, which has been boosting e-commerce sales across the world.

The primary driver for the growth of the tissues and napkins category is the increasing awareness of hand hygiene in workplaces and rising prevalence of healthcare-associated infections (HAIs). At hospitals, hotels, and offices, tissue and napkins are the most-frequently used products for the purpose for hand drying; therefore, they held a more than 81% share of the global revenue in 2022.

Furthermore, the advancements in the technology of manufacturing tissues, emergence of organic tissue paper and advanced ways of dispensing, rising disposable incomes, and government initiatives to support public health are propelling the market growth.

The usage of tissues in washrooms due to necessity, general Westernization of the washroom culture, increasing awareness of hygiene and cleanliness, and rising standard of living have increased the demand for more-premium sanitary products, for added convenience.

This report offers deep insights into the professional hygiene industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

Based on Application

Based on Distribution Channel

Geographical Analysis

Drive strategic growth with comprehensive market analysis

The market for professional hygiene products valued USD 17.4 billion in 2024.

The professional hygiene industry is driven by people’s growing awareness on infection control.

Tissues and napkins are sold the most in the market for professional hygiene products.

Offline channels are preferred in the professional hygiene industry, while online channels with grow faster.

North America dominates the market for professional hygiene products.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages