Report Code: 12859 | Available Format: PDF | Pages: 260

Process Analyzer Market Size and Share Analysis by Type (Liquid Analyzers, Gas Analyzers), End Use (Oil & Gas, Petrochemicals, Pharmaceuticals, Water & Wastewater, Power, Food & Beverages, Paper & Pulp, Metals & Mining, Cement & Glass) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12859

- Available Format: PDF

- Pages: 260

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Process Analyzer Market Size & Share

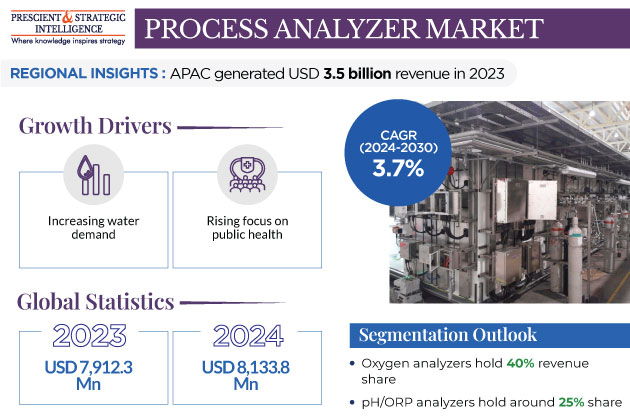

The global process analyzer market size is estimated to have stood at USD 7,912.3 million in 2023, and it is projected to reach USD 10,099.8 million by 2030, advancing at a CAGR of 3.7% during 2024 and 2030.

The growing focus on enhancing water quality and public heath, increasing water demand from industries and individuals, booming oil & gas industry and strict government guidelines on wastewater treatment are the major market drivers. The optimization of processes, protection of assets, and compliance are the biggest advantages of a process analyzer. The device is majorly used for the equipment-assisted precise periodic measurement of the physical and chemical characteristics of an industrial process. Furthermore, the adoption of artificial intelligence, automation, and smart technology in the manufacturing industry is serving as a major driving factor for the market.

The need for precision in process analyzers is increasing with the growing pharmaceutical and personalized medicine sectors, where the equipment is widely used in drug safety analysis and bioprocessing. These devices are used in industries revolving around the continuous flow of liquids and gases. They are used in process industries to detect and monitor the flow rate, composition, and pressure of liquids and gases.

Rising Demand for Wastewater Treatment Is Strong Market Driver

The need for wastewater treatment plants is growing as industrial waste is high in salts, toxic chemicals, and other harmful particles. Further, the shortage of water for human consumption is catalyzing the need for wastewater treatment, thus contributing to the market growth. The decreasing availability of freshwater is due to the disturbed weather patterns due to the pollution-induced climate change. Further, the rise in the awareness to conserve water, implement rainwater harvesting and wastewater treatment approaches, and increase the efficiency of water supply systems drives the market.

Wastewater plants use various types of process analyzers to monitor the chemicals present in the water. To provide safe drinking water to people worldwide, several companies have started investing in water & wastewater treatment plants. For instance, in 2020, Veolia acquired a 29.9% stake in SUEZ Group, which is a major player in the wastewater treatment solutions industry.

In this industry, process analyzers are used to monitor production and reduce waste. Manual inspection is being replaced by sensors and machines to lower the productivity and financial losses caused by human error. Likewise, the adoption of these instruments by the pharmaceutical industry due to the rapid industrial automation and the government policies to ensure a better quality of industrial products propels the growth of the market. The demand for liquid and gas analyzers in this regard is augmented by the high-volume demand for purified water in the pharmaceutical and food & beverage industries.

Growing Usage of MLSS Analyzers in Environmental Monitoring

On the basis of liquid analyzer, the mixed-liquid suspended-solid (MLSS) category is expected to witness the highest CAGR over the forecast period. These variants are primarily used in environmental monitoring and wastewater treatment. They contribute in process optimization & monitoring, microorganism concentration analysis, and efficient waste breakdown within activated sludge. The continuous monitoring by MLSS analyzers reduces the need for manual sampling and laboratory analysis, which saves time and resources for wastewater treatment plant operators.

Furthermore, the advancements in the sensor technology and automation have boosted the acceptance of MLSS analyzers. The new-generation variants are more accurate, offer real-time monitoring for efficient wastewater management, and enable regulatory adherence for utilities. These devices trigger an alarm when the suspended solids concentration rises above the set limit, thus resulting in the prompt addressal of potential issues in the treatment process.

pH/ORP Analyzers Dominate Market

pH/ORP variants dominated the liquid analyzers category, with a share of 25%, in 2023. This dominance can be attributed to the increasing adoption of these products in the oil & gas industry to measure the acidity, alkalinity, and oxidation reduction potential (ORP) of liquids. Moreover, the measurement of pH is important in the water treatment, chemical, pharmaceutical, and food & beverage industries. The pH must be controlled to prevent the release the alkaline or acidic effluents into waterbodies or the civic supply.

The total organic carbon (TOC) category also holds a significant share, as industries frequently utilize these variants to monitor the quality of process water and raw water feedstock, in order to prevent corrosion in critical systems. With the implementation of stringent regulations for wastewater treatment in various countries, the use of TOC analyzers is rising among utilities and industries, thus driving the market growth.

Wide Applications of Oxygen Analyzers

Based on gas analyzer, oxygen analyzers generated revenue of around USD 3 billion in 2023. The amount of oxygen available plays a chief role in deciding whether the combustion of a fuel is rich or lean. Therefore, these instruments are used to determine the quantity of this gas in boilers, furnaces, and incinerators. The major advantage of this device is rapid and accurate readings in high-temperature and corrosive atmospheres.

Moreover, in biotechnology processes and pharmaceutical production, oxygen analyzers help maintain the ideal O2 levels for product formation and cell growth, such as in bioreactors and fermenters. These analyzers are also used in laboratories by researchers to measure the oxygen concentration in experimental setups and studies. These devices are important in maintaining process efficiency, compliance with the guidelines, and safety in various industries.

| Report Attribute | Details |

Market Size in 2023 |

USD 7,912.3 Million |

Market Size in 2024 |

USD 8,133.8 Million |

Revenue Forecast in 2030 |

USD 10,099.8 Million |

Growth Rate |

3.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By End Use; By Region |

Explore more about this report - Request free sample

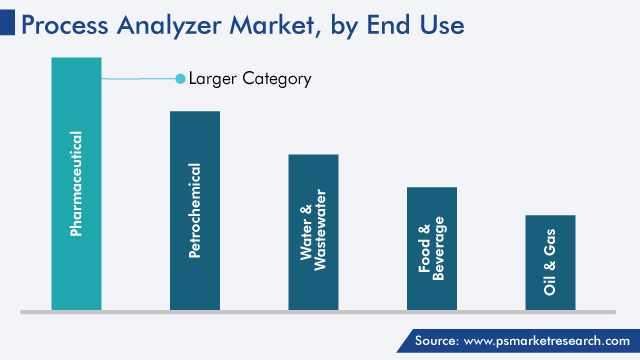

Pharmaceutical End Use Contributes Highest Revenue

The pharmaceuticals category holds the largest share, of 30%, in 2023, in the end use segment, attributed to the strict regulatory regulations for pharmaceutical products. To ensure product quality and the efficient production of pharmaceuticals, a range of gas and liquid analyzers have become indispensable in this sector. Here, they guarantee regulatory compliance and uphold the highest levels of product quality. In this regard, the COVID-19 pandemic was a major market driver as it propelled drug research & development activities.

In the pharmaceutical industry, these devices are primarily used to monitor the quality of raw materials and detect impurities, thus ensuring accurate concentrations of the active ingredients. Moreover, they provide real-time data on temperature, pH, pressure, and chemical composition, help maintain batch consistency, reduce the need for sampling, and ensure safety.

The pharmaceutical industry primarily uses dissolved oxygen analyzers to quantify the amount of O2 dissolved in the liquid samples used in the fermentation process. Similarly, turbidity analyzers detect and measure the cloudiness of the liquid sample, which is important while monitoring the clarity of pharmaceutical solutions. Moreover, TOC analyzers are mostly used in the pharmaceutical industry to ensure water quality control and comply with the Environmental Protection Agency (EPA) and other regulations.

Rapid Rise in Product Usage in Metals & Mining Industry

The metals & mining category is expected to witness a robust CAGR over this decade. Process analyzers play an important role in monitoring and managing different production processes, maintaining quality and safety, and ensuring overall operational efficiency. They are used in elemental analysis for the determination of the chemical composition of metals, alloys, and ores. In this industry, gas analyzers are used to monitor the emissions from the metal smelting and refining processes, to reduce environmental damage. These instruments also result in minimal waste, enhanced product quality, and regulatory compliance.

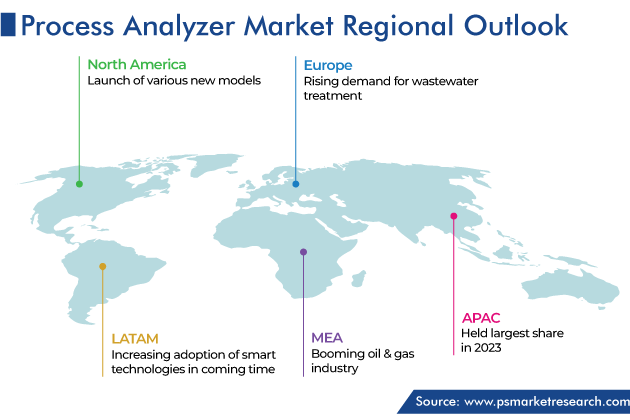

Asia-Pacific To Dominate Market

In 2023, the Asia-Pacific region dominated the global process analyzer market, with revenue of more than USD 3.5 billion. This can be attributed to the expansion of the manufacturing base due to the relocation of the production facilities of many global corporations across many sectors, encouraged by cost-effective labor and the easy access to a proficient workforce. The region has major industries such as petroleum refining, automotive, pharmaceuticals, consumer electronics, and mining. The increase in the demand for process analyzers in China and India is set to drive the market in the region over the forecast period. This will be due to the advancements in the quality and process control methods used in all these and many other industries.

Europe Held Significant Share

The European process analyzer market held significant share, because of the rising demand for wastewater treatment, itself due to the surge in the degree of urbanization. Water & wastewater treatment facilities are becoming increasingly necessary due to the rising attention being paid to water quality and public health, growing industrial base, and strict government rules on wastewater treatment. In the European region, Germany holds the largest market share, and the U.K. is the fastest-growing market.

Second Largest Market is North America

The North American process analyzer market is expected to grow at CAGR, of 3.8%, during the forecast period. This can be attributed to the advancing technologies and the launch of various new models. Further, pharmaceutical companies in the U.S. are mandated to use these instruments for quality control and regulatory compliance.

Canadian process analyzer market held the significant market share. In April 2023, Thermo Fisher Scientific Inc. launched two wet chemistry analyzers offering complete automated testing, in accordance with the U.S. EPA’s standards. These systems serve agricultural, environmental, and industrial testing laboratories with specific and streamlined analytical capabilities.

Key Players in Process Analyzer Market Are:

- ABB Ltd.

- AMETEK.Inc.

- Applied Analytics Inc.

- Endress+Hauser Group Services AG

- Emerson Electric Co.

- METTLER TOLEDO

- Siemens AG

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

Market Breakdown

This report offers deep insights into the process analyzer market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Type

- Liquid Analyzers

- pH/ORP analyzer

- Conductivity analyzer

- Turbidity analyzer

- Dissolved oxygen analyzer

- Liquid density analyzer

- Mixed-liquid, suspended-solid (MLSS) analyzer

- Total organic carbon (TOC) analyzer

- Gas Analyzers

- Oxygen analyzer

- Carbon dioxide analyzer

- Moisture analyzer

- Toxic gas analyzer

- Hydrogen sulfide analyzer

Segment Analysis, By Type End Use

- Oil & Gas

- Petrochemicals

- Pharmaceuticals

- Water & Wastewater

- Power

- Food & Beverages

- Paper & Pulp

- Metals & Mining

- Cement & Glass

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The value of the market for process analyzers was USD 7,912.3 million in 2023.

The process analyzer industry future CAGR will be 3.7%.

In the market for process analyzers, MLSS analyzers are the fastest-growing category within liquid analyzers, while pH/ORP analyzers hold the largest share.

The process analyzer industry is driven by the growing industrial production and strict regulations for product safety and quality.

The pharmaceutical category dominates the market for process analyzers, based on end use.

The replacement of human inspectors with machines is trending in the process analyzer industry.

APAC is the largest market for process analyzers.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws