From 132.6 billion in 2024, the revenue of the market for wastewater treatment plants is set to reach 188.6 billion by 2030.

Which type of facilities generate the highest wastewater treatment plants industry revenue?+

Effluent treatment plants generate the highest revenue in the wastewater treatment plants industry.

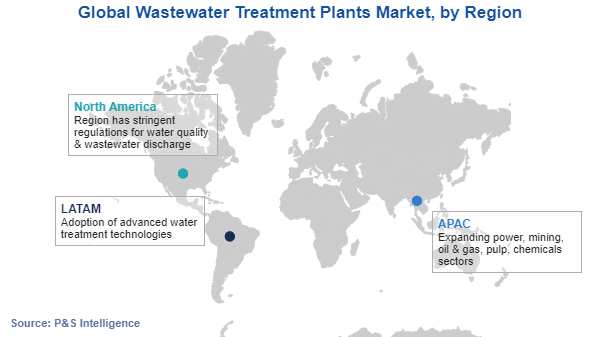

APAC leads the market for wastewater treatment plants because of its large population, expanding manufacturing base, and growing scarcity of freshwater.

Which emerging trends can offer opportunities to the wastewater treatment plants industry?+

The most-opportune wastewater treatment plants industry trends are technological advancements.

What measures are being adopted by wastewater treatment plants market players for business growth?+

Companies in the market for wastewater treatment plants are offering government and private agencies technical expertise for setting up effluent treatment centers.