Report Code: 12882 | Available Format: PDF | Pages: 290

Polymeric Adsorbents Market Size and Share Report by Type (Aromatic, Modified Aromatic, Methacrylic, Phenol Formaldehyde), End User (Pharmaceutical, Food & Beverages, Industrial), Application (Chlorinated Solvents Removal, Heterocyclic Amines Removal, Purification of Alkanolamines, Sugar Decolorization, Anthocyanin Removal) - Global Industry Growth Forecast to 2030

- Report Code: 12882

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Polymeric Adsorbents Market Overview

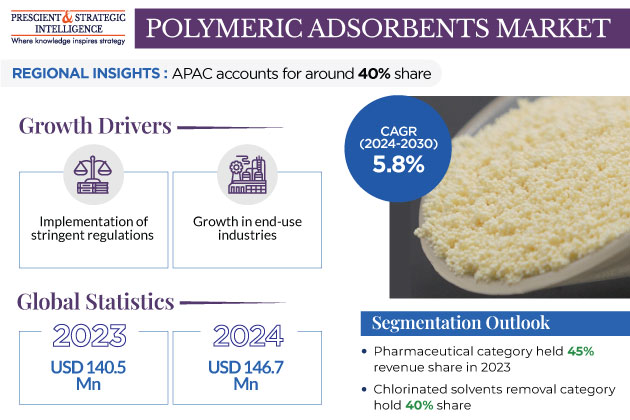

The polymeric adsorbents market generated revenue of USD 140.5 million in 2023, which is expected to witness a CAGR of 5.8% during 2024–2030, reaching USD 205.5 million by 2030. The usage of this material is rapidly increasing in the pharmaceutical, chemical, and food & beverage industries. Additionally, the implementation of stringent regulations by governments for water treatment drives the consumption of these chemicals. In these industries, these synthetic materials help adsorb a huge number of compounds.

- Their porous structure allows for enhanced efficiency in adsorbing alcohols, ketones, aldehydes, furans, acids, and phenols from aqueous solutions via Van der Waals interactions among molecules.

- Various polar and/or nonpolar functional groups are introduced in the polymeric matrix, thus modifying polymeric adsorbents to enhance adsorption and make them more selective toward derivatives of phenols.

- Changing the texture and porous structure, including the pore volume, specific surface, and dimensions, of the of the polymeric adsorbents can augment their capacity to adsorb compounds.

Increasing Water Pollution

One of the major concerns across the world is water pollution, which is related with the release of many pollutants. Almost all industries, such as textile, paper, metallurgy & mining, battery, fertilizer & pesticide, tanning, fossil fuel, and plastics, release effluents in waterbodies. This way such pollutant streams contaminate freshwater resources, harming both human health and the marine environment. Additionally, micropollutants are contained in the wastewater, released from the pharmaceutical, pesticides, and industrial chemical industries.

- Wastewater and sludge released from textile factories can contain dyes, sulfamethazine, phosphorus, and heavy metals.

- These industries generate a high volume of colored wastewater, the majority of which is released via waste dye.

- Over 700,000 tonnes of around 10,000 commercially available dyes are produced annually worldwide.

- Due to the rapid industrialization, an increasing volume of these contaminants are being released every year.

According to many researchers, 2% of the dye used in textile production is directly discharged into water. Among them, many pose a big threat to aquatic life due to their toxicity and carcinogenicity. Adsorption is one of the best methods for the decolorization of dyes, and it provides appreciable results during the removal of the entire dye molecule, leaving no fragments in the effluent. Additionally, adsorbents can be recovered for multiple purposes. How much of these chemicals are used strongly governs the performance of the initial dye concentration, solution pH, and temperature.

- Moreover, many polymer–polymer composites are synthesized to remove the colorant from wastewater.

- For example, cyclodextrin-based composites are gaining a lot of attention for dye removal from wastewater due to their extraordinary physicochemical properties and cavities.

- These compounds offer high design flexibility, physical stability, uniform pore size, porosity, chemical stability in acids and bases, large surface area, recovery feasibility, and thermal durability.

Furthermore, a clean water supply is essential for a robust economy, but it is not paid enough attention, especially in developing and under-developed countries. For instance, according to the United Nations International Children's Emergency Fund, in India, waterborne diseases have an economic burden of approximately USD 600 million a year.

Rising Demand from Pharmaceutical and Food & Beverage Sectors

The use of polymeric adsorbents plays vital role in the pharmaceutical and food & beverage industries.

- Polymeric adsorbents are synthetic spherical polymer with a defined pore structure, large surface area, and selectivity during the purification and removal of target molecules in aqueous applications.

- These chemicals interact with molecules in different ways, depending on the surrounding environment, such as solvents, heat, pH, and competing molecules.

- They can be used for the purification of pharmaceutical compounds, such as antibiotics and active pharmaceutical ingredients (APIs).

- They are also used in food & beverage items, such as vitamins and citric juices.

These sectors remove unwanted components in order to produce high-quality and purified products. This is where polymeric adsorbents are required as they are more effective and cause less contamination than other chemicals used for this purpose. A well-defined food safety protocol plays a crucial role in ensuring the quality of food. This is because foodborne illnesses are majorly caused by bacteria, viruses, and chemical substances that enter through body via contaminated food. Moreover, food contamination can lead to food poisoning and even long-lasting diseases, such as cancer.

Some of the most-common foodborne pathogens are Salmonella, Campylobacter, and enterohaemorrhagic Escherichia coli, affecting millions of people annually, sometimes with severe and fatal outcomes. Moreover, heavy metals, including lead, mercury, and cadmium, can cause kidney damage and neurological problems. Primarily, these metals enter food Via polluted soil and water.

- According to a report published by the World Health Organization (WHO), approximately half a million deaths occur every year across the globe due to unsafe food, with most of the affected people being children under the age of five.

- In India, households have an alarming 13.2% prevalence of hazardous food practices.

- In January 2023, two deaths occurred due to foodborne illness in Kerala in one week, with both victims dying due to complications.

| Report Attribute | Details |

Market Size in 2023 |

USD 140.5 Million |

Market Size in 2024 |

USD 146.7 Million |

Revenue Forecast in 2030 |

USD 205.5 Million |

Growth Rate |

5.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By End User; By Application By Region |

Explore more about this report - Request free sample

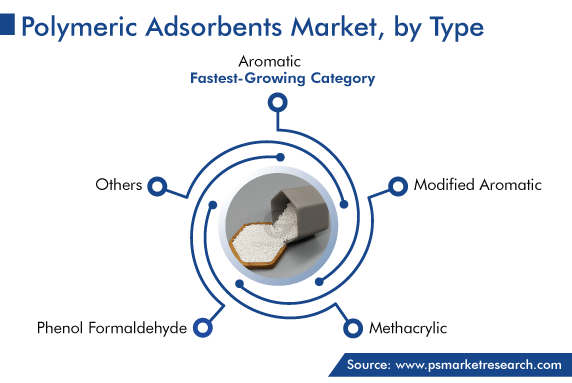

Aromatic Category Is Fastest-Growing

Based on the type, the aromatic category is expected to be the fastest-growing, with a CAGR of 7%, during the forecast period. These polymers are characterized by cross-linked polystyrene matrices and specially designed to adsorb ions, molecules, and other substances from liquids and gases. Additionally, they contain aromatic rings, which enhance their adsorption capability. They are used in various industries, such as environmental remediation, water treatment, gas purification, pharmaceutical, chemical, and petrochemical.

- Furthermore, modified aromatic adsorbents, especially those with brominated aromatic matrices, are widely used to remove certain pollutants. such as heavy metals.

- Methacrylic adsorbents, including methacrylic ester copolymers, are used in the biotechnology and pharmaceutical industries.

Chlorinated Solvent Removal Category Holds Largest Share

Based on application, the chlorinated solvent removal category held the largest share, of 40%, in 2023, and it is projected to grow at the highest CAGR in the years to come. Generally, polymer adsorbents are used as cleaning solutions for metals, pesticides, glues, paint thinners, pesticides, resins, and many more agents. Chlorinated solvents are a large family of chemical compounds that contain chlorine, such as trichloroethene (TCE), also known as trichloroethylene; tetrachloroethene (PCE), and vinyl chloride.

Amongst them, trichloroethylene and tetrachloroethene are widely used in dry cleaning. Moreover, TCE is used as an anesthetic gas in hospitals and for removing caffeine from coffee beans during the production of decaffeinated coffee. Furthermore, chemicals with a structure containing chlorine helps efficiently dissolve organic materials, such as fats and greases, and serve as raw materials or intermediates in a range of other chemicals.

Pharmaceutical Category Holds Largest Share

Based on end user, the pharmaceutical category held the largest share, of 45%, in 2023, and it is projected to grow at the highest CAGR.

- This is mainly due to the rising demand for polymeric adsorbents in the pharmaceutical industry for the purification of antibiotics, peptides, protein, enzymes, vaccines, and many more products.

- By controlling the pore structure of the resin matrix, the removal of the smaller molecules can be minimized, while retaining the larger ones.

- For example, Macronet resins are hemocompatible and size-selective, with a pore structure that can exclude molecules larger than 50 kDa.

- The pore system of Macronet resins, on the other hand, enables efficient adsorption and desorption of molecules smaller than 35 kDa.

Moreover, porous polymeric adsorbents are selective in extracting midsize proteins, such as ß2-microglobulin and cytokines, from bodily fluids, such as blood. On the other hand, cells, albumin, platelets, fibrinogen, hemoglobin, and other serum proteins that are important for human health remain untouched.

Asia-Pacific Holds Largest Share

Geographically, APAC held the largest share, of 40%, in 2023, and it is projected to grow at the highest CAGR.

- This is majorly ascribed to the increasing degree of industrialization and growing food & beverage sector.

- In this regard, the rapid urbanization and changing lifestyles are driving the growth of the market.

- In addition to this, the rising use of these polymers for the treatment of industrial effluents, which contain heavy metals, such as lead, arsenic, and cadmium, are likely to boost the market growth in this region.

These adsorbents are also used to remove impurities from gas streams, including carbon dioxide, sulfur dioxide, and nitrogen oxides. Therefore, the increasing focus on flue gas purification is likely to boost the demand for these materials in the region.

Among all the countries in the region, China is expected to hold the largest market share, attributed to the presence of major end-use industries. Additionally, India and China produce cost-effective polymeric adsorbent in large volumes, due to the availability of cheap labor and favorable government policies in terms of tax benefits.

India also held a significant market share in 2023.

- The use of these materials is extensive for the removal of harmful organic pollutants from industrial effluents, due to the stringent environmental norms in the nation.

- Moreover, their wide-ranging applications, such as sweetener decolorization, fragrance extraction, and limonin removal from citrus juices, are creating a surge in their consumption.

- The presence of major market players is also likely to contribute to the market growth.

North America is the second-largest region, followed by the APAC, with 30% share in 2023, mainly due to the growing pharmaceutical and industrial sectors. Moreover, the demand for polymeric adsorbents in the continent is increasing on account of the strong environmental concerns and stringent regulations necessitating effective effluent purification.

Key Players in Polymeric Adsorbents Market Are

- DuPont de Nemours Inc.

- Mitsubishi Chemical Corporation

- Thermax Limited

- Sunresin New Materials Co. Ltd.

- Purolite Corporation

- Merck KGaA

- CHEMRA GmbH

- Suzhou Nanomicro Technology Co. Ltd.

- Tianjin Nankai Hecheng Science & Technology Co. Ltd.

- Ajinomoto Fine-Techno Co. Inc.

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the polymeric adsorbents market from 2017 to 2030, based on all the relevant segments and geographies.

Segment Analysis, By Type

- Aromatic

- Modified Aromatic

- Methacrylic

- Phenol Formaldehyde

Segment Analysis, By End User

- Pharmaceutical

- Food & Beverages

- Industrial

Segment Analysis, By Application

- Chlorinated Solvents Removal

- Heterocyclic Amines Removal

- Purification of Alkanolamines

- Sugar Decolorization

- Anthocyanin Removal

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws