Report Code: 12190 | Available Format: PDF | Pages: 454

Active Pharmaceutical Ingredient Market Research Report: By Type of Manufacturer (Captive, Merchant), Type (Generic APIs, Innovative APIs), Type of Synthesis (Biotech, Synthetic), Type of Drug (Prescription Drugs, OTC Drugs), Therapeutic Application (Communicable Diseases, Oncology, Diabetes, Cardiovascular Diseases, Pain Management, Respiratory Diseases), Distribution Channel (Offline, Online) - Global Industry Revenue Estimation to 2030

- Report Code: 12190

- Available Format: PDF

- Pages: 454

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

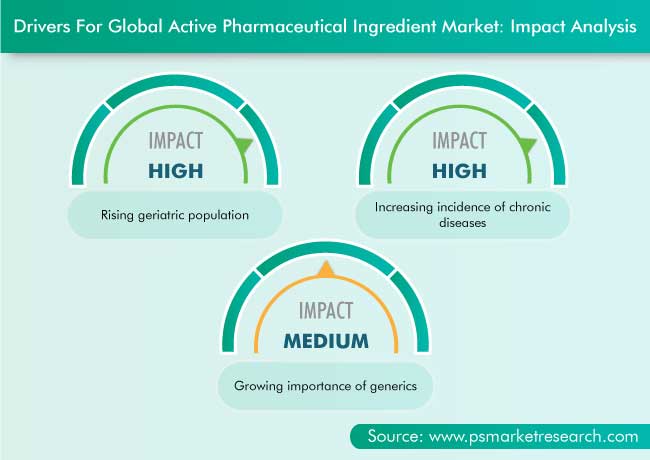

The global active pharmaceutical ingredient (API) market generated $184,311.2 million revenue in 2020, and it is expected to grow at a CAGR of 6.9% during the forecast period (2021–2030). The key factors responsible for the growth of the market include the rising geriatric population, increasing incidence of chronic diseases, and surging importance of generics.

The COVID-19 outbreak has spread to almost every country, due to which the number of infected patients is rising, which is straining the countries’ healthcare ecosystem and resources. This is mainly on account of the intensifying demand for healthcare facilities, workers, and most importantly, medical equipment, devices, drugs, and research studies. Moreover, the pandemic resulted in an immense increase in the cost of drugs. In India, according to the Pharmaceutical Export Promotion Council (PHARMEXCIL), which functions under the Ministry of Commerce and Industry, the cost of the API penicillin increased to $8.69 per unit in February 2020 from $6.16 per unit in January 2020. Further, the data collected by manufacturers operating in the API market indicated a 13–18% rise in the prices of APIs for many other antibiotics, such as azithromycin, doxycycline, amikacin, ornidazole, and dexamethasone sodium, most of which India imports from China.

Prescription Drugs Category Held Larger Share, due to Increasing Demand for these Drugs

The prescription drug category held larger share in 2020 in the active pharmaceutical ingredient market, based on type of drug. This is majorly attributed to the increasing demand for prescription drugs for the management of chronic diseases, across the world.

Oncology Category Held Largest Share, due to High Prevalence of Cancer

The oncology category accounted for the largest share in the active pharmaceutical ingredient market in 2020, based on therapeutic application. This is primarily due to the high prevalence of cancer and increase in demand for highly potent APIs (HPAPIs) for the treatment of cancer. According to the American Cancer Society, around 1.9 million new cancer cases and 608,570 cancer-related deaths are expected to be reported by the end of 2021. Similarly, according to a report by the World Health Organization (WHO), 2,003,789 cases of different types of cancer were reported in Southeast Asia and 1,336,026 people lost their lives due to them in 2018.

Offline Category To Witness Faster Growth in the Forecast Period

The offline category is expected to witness faster growth in the active pharmaceutical ingredient market during the forecast period, based on distribution channel. This will primarily be due to the high sales of APIs via this channel, owing to the increasing number of contracts with API providers and drug manufacturing companies, and established offline distribution channels of the providers.

North America To Generate Largest Market Share, due to Surging Incidence of Chronic Diseases

North America is expected to hold the largest share in the active pharmaceutical ingredient market in coming years, owing to the surging incidence of chronic diseases, increasing government focus on generic drugs, rising demand for biologics and specialty drugs, mounting number of pharmaceutical R&D activities, and increasing technological advancements. Additionally, people are becoming aware about various lifestyle-associated diseases, which is further driving the market progress in the region. According to the Centers for Disease Control and Prevention (CDC), chronic diseases cost $3.5 trillion in 2018 to the U.S. healthcare system. Additionally, according to an article published by the Partnership to Fight Chronic Disease (PFCD), around 45% of the U.S. population has at least one chronic ailment, and by 2025, around 165 million Americans will be suffering from more than one chronic diseases.

The major players operating in the market for active pharmaceutical ingredient are focusing on partnerships and mergers & acquisitions in order to expand their business in new and developing markets and earn a competitive advantage. For instance, in August 2020, Pfizer Inc. announced a multi-year agreement with Gilead Sciences Inc. to manufacture and supply Gilead’s investigational antiviral remdesivir, to support efforts to scale up the supply of the investigational treatment for COVID-19. Remdesivir, which is used to relieve symptoms in people experiencing COVID-19, also helps in stopping the virus from spreading inside the body.

Rising Geriatric Population

The increasing life expectancy and falling death rates are the major contributors to the growth of the geriatric population. According to a report by the WHO, people are living longer as the average life expectancy has increased. This has led to a huge growth in the world’s aged population. According to the World Population Ageing Report published in 2019, the number of people aged 65 years and above stood at around 703 million, and this population is expected to reach 1.5 billion by 2050. The elderly people require extensive care, as they are highly prone to illnesses, owing to their low immunity level and longer recovery time. Owing to the intensive care required for geriatric population, healthcare settings are increasingly adopting technologically advanced API products, which, in turn, is boosting the growth of the market for active pharmaceutical ingredient, globally.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$184,311.2 Million |

Market Size Forecast in 2030 |

$357,005.7 Million |

Forecast Period CAGR |

6.9% |

Report Coverage |

Market Trends, Drivers, and Restraints, Revenue Estimation and Forecast, Segmentation Analysis, Country Breakdown, Impact of COVID-19, Companies’ Strategic Developments, Company Profiling |

Market Size by Segments |

By Type of Manufacturer, By Type, By Type of Synthesis, By Type of Drug, By Therapeutic Application, By Distribution Channel |

Market Size of Geographies |

U.S., Canada, Germany, France, U.K., Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Mexico, Saudi Arabia, U.A.E. |

Secondary Sources and References (Partial List) |

American Pharmacists Association, American Society for Quality, Association of Official Analytical Chemists International, Bulk Drug Manufacturers Association, Center for Biologics Evaluation and Research, Center for Drug Evaluation and Research, Central Drugs Standard Control Organization, Chinese Pharmaceutical Association, European Medicines Agency, Food and Drug Administration, International Generic and Biosimilar Medicines Association, Japan Pharmaceutical Association , Parenteral Drug Association, Pharmaceutical Research and Manufacturers of America |

Explore more about this report - Request free sample

Market Players Involved in Business Expansion to Gain Significant Position

In recent years, the players in the API market have been involved in product launches, in order to attain a significant position in the market. For instance:

- In May 2021, Sandoz, a Novartis AG division, announced plans to expand its production capabilities in Kundl, Austria; and Palafolls, Spain, to further strengthen its European antibiotic manufacturing network. Sandoz will invest $175.3 million (EUR 150 million) in new antibiotic manufacturing technologies in Europe over the next three-to-five years. Sandoz confirmed that it will invest more than $116.9 million (EUR 100 million) in the first step to implement the new manufacturing technology, to produce oral amoxicillin, an API for one of its penicillin products.

- In January 2021, Sanofi unveiled EUROAPI, a new company dedicated to the development, production, and marketing of APIs in Europe. EUROAPI will contribute to the securing of significant API manufacturing and supply capacities, which are critical for patients in Europe and outside. EUROAPI will represent the “made in Europe” API capabilities and technologies, with around $1.17 billion (EUR 1.0 billion) in expected sales by 2022.

Key Players in Global Active Pharmaceutical Ingredient Market Include:

-

Cipla Ltd.

-

Dr. Reddy’s Laboratories Ltd.

-

Teva Pharmaceutical Industries Limited

-

Aurobindo Pharma Limited

-

Novartis AG

-

Pfizer Inc.

-

Bristol-Myers Squibb Company

-

Glenmark Life Sciences Limited

-

Johnson & Johnson

-

Merck & Co. Inc.

-

AbbVie Inc.

-

Eli Lilly and Company

-

GlaxoSmithKline plc

-

Sanofi

-

Takeda Pharmaceutical Company Limited

-

Amneal Pharmaceuticals Inc.

-

AstraZeneca plc

-

Sun Pharmaceutical Industries Ltd.

-

Alkem Laboratories Limited

-

Mylan N.V.

-

Lupin Limited

-

STADA Arzneimittel AG

-

Mallinckrodt plc

-

MSN Laboratories Pvt. Ltd.

Market Size Breakdown by Segment

The global active pharmaceutical ingredient market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2030.

Based on Type of Manufacturer

- Captive

- Merchant

Based on Type

- Generic APIs

- Innovative APIs

Based on Type of Synthesis

- Biotech

- Synthetic

Based on Type of Drug

- Prescription Drugs

- Over-The-Counter (OTC) Drugs

Based on Therapeutic Application

- Communicable Diseases

- Oncology

- Diabetes

- Cardiovascular Diseases (CVDs)

- Pain Management

- Respiratory Diseases

Based on Distribution Channel

- Offline

- Online

Geographical Analysis

- North America API Market

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- Indi

- Australia

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

In 2030, the value of the API market will be $357,005.7 million.

Prescription drug is the larger category under the type of drug segment of the API industry.

The major API market drivers are rising geriatric population, increasing incidence of chronic diseases, and growing importance of generics.

North America is the largest API market.

Most API market players are adopting collaborations and partnerships strategy to sustain their business growth.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws