Market Statistics

| Study Period | 2019 - 2030 |

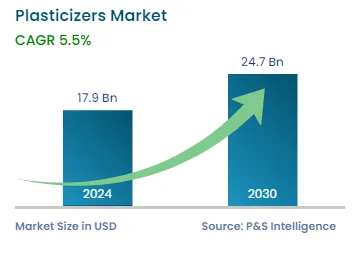

| 2024 Market Size | USD 17.9 Billion |

| 2030 Forecast | USD 24.7 Billion |

| Growth Rate(CAGR) | 5.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 11782

Get a Comprehensive Overview of the Plasticizers Market Report Prepared by P&S Intelligence, Segmented by Product (Phthalates, Non-Phthalates), End Use (Wires & Cables, Flooring, Roofing, & Cladding, Films & Sheets, Automotive Parts, Medical Equipment, Toys & Child Care Products), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 17.9 Billion |

| 2030 Forecast | USD 24.7 Billion |

| Growth Rate(CAGR) | 5.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global plasticizers market is estimated to have generated revenue of USD 17.9 billion in 2024, and it is expected to grow at a CAGR of 5.5% during the forecasted period, to reach USD 24.7 billion by 2030. This is because the foremost end user of such products, i.e., the construction industry is growing significantly across the world, wherein the demand for flexible polymers like PVC is high.

Moreover, the rise in the adoption of non-phthalates, an inflated molecular weight of phthalate plasticizers, increased growth of such materials in the packaging industry, and high need for polymers in the consumer goods sector are driving the market. Furthermore, the steady growth occurred globally in their demand, due to the rising requirement for plastic-based products in various industries, such as automotive, construction, packaging, and textiles; and ongoing investigations and growth attempts to make plasticizers safer and more sustained.

In addition, plasticizers help in offering viscosity, softness, flexibility, and other features to finished products. Thus, the demand for plasticizers is increasing for the manufacturing of automotive components, packaging products, medical equipment, toys, and others. This makes the plasticizers industry very volatile, as it is sensitive to changes in consumer demands, regional supply, and seasonality. Thus, manufacturers, traders, and sellers need to be able to respond rapidly to opportunities available in the market.

Globally, China is the leading market in terms of demand, production, and commercialization of plasticizers. This is due to rapid economic growth, the booming manufacturing industry, rapid urbanization, and the growing construction and automotive sectors in the country. The enlargement of the construction sector generated a high requirement for such substances, as this sector needs a remarkable quantity of building materials and tools. For example, PVC has been used in various materials and tools and has a wide range of applications in this sector.

Moreover, the production of PVC necessitates some chemicals for softness, such as dioctyl phthalate (DOP), diisononyll phthalate (DINP), dioctyl terephthalate (DOTP), and dibutyl phthalate (DBP). The growth of the plasticizers sector is forecasted to push the development of bio-based plasticizers and new applications of the plasticizers. Some of the popular types that are available and extremely used in the market include terephthalates, phthalates, epoxies, and aliphatics. Due to the increasing requirement for eco-friendly plasticizers to safeguard both the environment and human health, the demand for eco-friendly plasticizers is ballooning rapidly.

Moreover, these are widely used in generating films and cables and have good compatibility and less toxicity, propelling the expansion of the plasticizers market. Thus, it is expected that this outlook will drive revenue generation in the coming years. In addition, the substitution of wood and iron products, such as windows, floorings, doors, and pipes, with plastics is positively impacting the sales of plasticizers throughout the world.

Furthermore, major players in the plasticizer market are investing heavily in research and development to expand their product offerings, which will further drive market growth. In order to grow and survive in an increasingly competitive and growing market environment, plasticizer companies are focusing on providing cost-effective products. In addition, these players are pursuing a variety of strategic initiatives to grow their global footprint, such as entering into contractual agreements, launching new products, merging and acquiring other companies, and increasing investments.

Based on product, the phthalates category dominates the market and is projected to witness the same trend in the expected future as well. This is because phthalates have high presentation properties, such as low transition temperature, strong solvent, low volatility, stability, low diffusion, flame retardance, flexibility, durability, and improved processing characteristics; are the most frequently utilized type of plasticizer in different industries; and are available at an economic cost.

Moreover, it is the most commonly used by medium and small enterprises because it is the economical option for them. To have plasticity in plastic materials, phthalates add durability and transparency and are operated along with PVC materials. Also, these can enhance the performance of plastics by transmitting beneficial properties including softness, workability, and elasticity.

On the other hand, the non-phthalates category is projected to witness the fastest growth in the plasticizers market during the forecast period. This can be due to their prominent outcome features and are used as an alternative to phthalate plasticizers, due to their advantages like flexibility, durability, and environment-friendliness. In comparison with traditional plasticizers and compatibility with recycled plastics, non-phthalates are attractively considered due to their improved performance, are less toxic in nature, and are considered safer alternatives to use in materials.

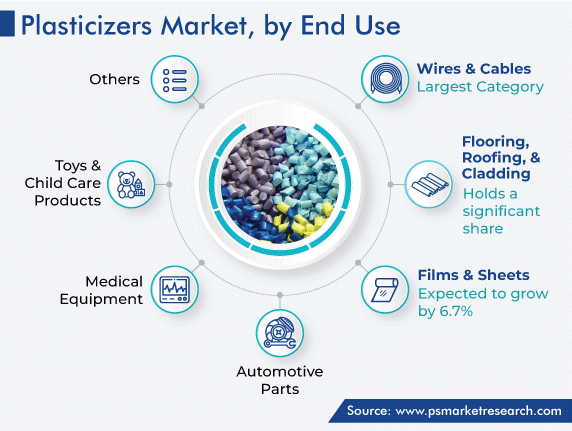

Based on end use, the wires and cables category accounts for the largest market share and is also forecasted to remain in the leading place during the expected time. This is due to the increasing demand for electrical devices in different countries and the surging usage of wires and cables in various industries such as automotive, construction, and electrical and electronics. The manufacturing of wires and cables necessitates the usage of a huge capacity of PVC to provide better protection and insulation.

Moreover, the flooring, roofing & cladding category holds a significant share of the market, as people are spending more on flooring, roofing, and cladding, which increases the construction and building business all over the world. Thus, the utilization of plasticizers is high in constructing new buildings and renovating and maintaining former buildings, which in turn, increases the demand for plasticizers. In addition, plasticizers have enhanced flexibility, weather resistance, and durability, which make them suitable for use in flooring, roofing, and cladding systems.

Whereas, the films & sheets category is forecasted to witness the highest CAGR during the predicted period. This can be ascribed to the rising demand for packed food and beverages, which are laminated by plasticizer-based films and sheets, and the increasing use of protective coatings for other products. Moreover, plasticizers enhance the flexibility and effects of films and sheets, which make them more usable for several end-use applications. To meet the evolving consumer needs and industry requirements, important aspects such as formability, appearance, and barrier properties of films and sheets are considered.

Drive strategic growth with comprehensive market analysis

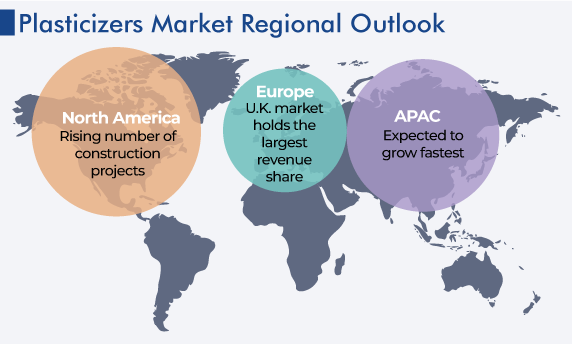

Geographically, Europe is one of the important and foremost zones in the market of plasticizers and is witnessing tremendous development in this field. The European region is witnessing significant growth in end-use industries, such as electronics, due to the rise in the investment in research and innovation by government and non-government organizations, thus generating demand for plasticizers and PVCs that are generally utilized for producing wires and cables. Thus, the European market is projected to witness the highest CAGR from 2024 to 2030, due to rapid industrialization and most importantly increasing polymer requirements from various end-use industries in the region.

In Europe, the U.K. market holds the largest revenue share. This is due to various factors, such as its well-established industrial base, diverse manufacturing sector, and extensive use of plasticizers in various applications, in the country. Moreover, the electronics industry is managed by the European region, which has raised investments in research and innovation, creating a high demand for PVCs. Whereas, Germany is the fastest-growing market in the region. This can be attributed to the presence of a well-developed automotive industry, a robust manufacturing sector, and a strong emphasis on research and development, in the nation.

The APAC plasticizers market is estimated to have accounted for the largest revenue of, USD 8.5 billion, in 2023, and it is looking forward to displaying a significant growth rate in the coming years. The presence of several growing end-use sectors, such as electrical and electronics, manufacturing, infrastructure, aerospace, building & construction, automotive, healthcare, and chemical, in countries like India, Indonesia, Japan, South Korea, China, Australia, and various other Southeast Asian nations, which are boosting the requirement for plasticizers for various applications.

Moreover, the APAC market is expected to witness high demand for plasticizers in the future, owing to the surging need for electrical and electronic components, the increasing adoption of mobile phones, and the rising consumption of such chemicals in the construction and packaging industries, in the region. In addition, industry contributors are also taking a range of strategic ambitions to extend their universal footprint, with main market developments such as new product launches, predetermined agreements, mergers and acquisitions, expanding investments, and alliances with other organizations. Thus, competitors in the plasticizer industry offer lucrative items to increase and get through in a progressively competitive and surging market environment.

In addition, North America accounts for the second-largest share of the market. This is due to the high usage of plasticizers in several applications, the surging use of corrugated cardboard, the rising number of development projects, the presence of key industry players, and the high disposable income of people in the region.

This fully customizable report gives a detailed analysis of the plasticizers industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Product

Based on End Use

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages