Report Code: 12866 | Available Format: PDF | Pages: 210

Pipeline Monitoring System Market Size and Share Analysis by Type (Metallic, Non-Metallic), Solution (Leak Detection, Pipeline Break Detection, Operating Condition), Technology (Ultrasonic, PIGs, Smart Ball, Magnetic Flux Leakage, Fiber Optics), End Use (Crude and Refined Petroleum, Water and Wastewater) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12866

- Available Format: PDF

- Pages: 210

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Pipeline Monitoring System Market Outlook

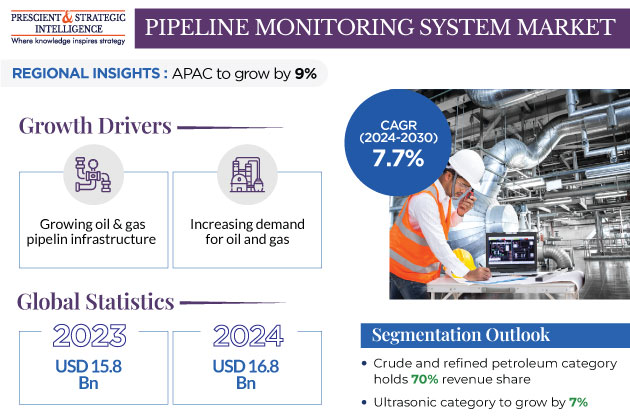

The pipeline monitoring system market generated revenue of USD 15.8 billion in 2023, which is expected to witness a CAGR of 7.7% during 2024–2030, reaching USD 26.2 billion by 2030. This is growth in the length of oil & gas pipelines around the world, technological advancements, adoption of monitoring systems, and increasing demand for metallic pipelines. Moreover, the aging pipeline infrastructure is causing leakage due to corrosion, structural weaknesses, and environmental hazards, which makes such systems necessary.

Growing Oil & Gas Pipeline Infrastructure Is Major Market Driver

- The demand for oil and gas is rapidly increasing globally, which leads to the expansion of pipeline systems.

- The construction of new pipelines and the maintenance of existing ones continuously require advanced monitoring technologies.

- Highly effective facilities are being developed by businesses to enhance the production of hydrocarbons and lower operational costs.

Furthermore, there is an increasing threat of terrorist and cyberattacks on the oil & gas industry, which is compelling E&P firms globally to enhance their spending on infrastructure and network monitoring. In the past, Europe and the Middle East have been victims of multiple attacks on gas facilities and plants.

Several information and communication technologies that are widely used in modern pipeline facilities, such as intelligent video surveillance (IVS), programmable logic controllers (PLC), supervisory control and data acquisition (SCADA) software, and human–machine interfaces (HMI).

- By using these technologies, a digital pipeline infrastructure is created, which helps oil & gas operators manage and operate their facilities remotely.

- Further, to prevent cyberattacks and lower the risk of other threats, businesses are increasing their investment in network monitoring and implementing monitoring solutions to protect the network and make the system powerful.

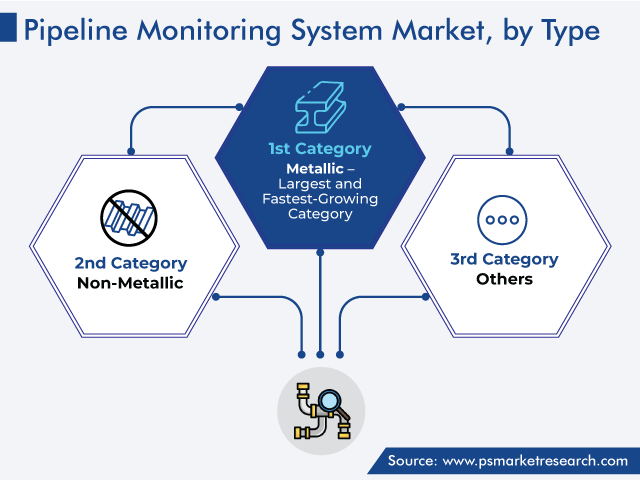

Metallic Pipeline Category Is Expected To Grow Rapidly

The metallic pipeline category is expected to grow with a CAGR of 10% from 2024 to 2030. Metallic pipes are in high demand for hydrocarbon transportation due to their corrosion resistance, durability, weldability, higher yield, and tensile strength. They are widely used in oil & gas fields, refineries, petrochemical plants, and even power plants. Metallic pipes include stainless steel, aluminum, ductile iron, carbon– steel, duplex stainless steel, alloy steel, corrugated, copper, and cast iron pipes.

- These pipes work well for underground transportation and underwater since they can handle high pressures and temperatures, which enable smooth functioning when integrated with monitoring systems.

- These pipes are also cost-effective and comparatively maintenance-free.

Ultrasonic Category Is Gaining Rapid Popularity

The ultrasonic category is growing with a CAGR of 7%. Ultrasound enables the detection of the location of flaws and leaks over a wide range of pipes through the use of high-frequency sound waves and noise patterns. It typically utilizes sound emission monitors to respond to modifications in background noise. Its ability to differentiate and identify leak disturbances from regular tap water is driving the growth of the market in this category.

- Ultrasonic monitoring systems use vibrations or sound waves to find any leaks, irregularities, and structural problems in pipelines.

- They work by examining variations in sound patterns or frequencies, which allows them to identify possible issues, such as leaks or flaws, in the pipe.

Additionally, advancements in signal processing techniques and sensor technologies have also enhanced the reliability and accuracy of ultrasonic monitoring systems, making them increasingly preferred for pipeline integrity assessment.

Crude and Refined Petroleum Category Holds Largest Share

The crude and refined petroleum category holds a share of 70% in the pipeline monitoring system market.

- Crude oil serves as the main energy source for the electricity and transportation sector and, to some extent, for the heating sector too.

- Upon undergoing treatment, crude oil is further processed into petroleum, diesel, gasoline, LPG/LNG/CNG, and petrochemicals.

- As pipelines are utilized for carrying all these products, there is a substantial market for solutions that can provide end-to-end security and monitoring capabilities.

The crude and refined petroleum industry has an urgent requirement for pipeline monitoring systems to enable a reliable, safe, cost-effective, and efficient means of hydrocarbon transportation across long distances. Integrating pipeline detection/monitoring systems can eliminate ruptures, internal leakage, and thefts, as well as minimizing the environmental footprint and decreasing wastage.

| Report Attribute | Details |

Market Size in 2023 |

USD 15.8 Billion |

Market Size in 2024 |

USD 16.8 Billion |

Revenue Forecast in 2030 |

USD 26.2 Billion |

Growth Rate |

7.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Segments Covered |

By Type; By Solution; By Technology; By End Use; By Region |

Explore more about this report - Request free sample

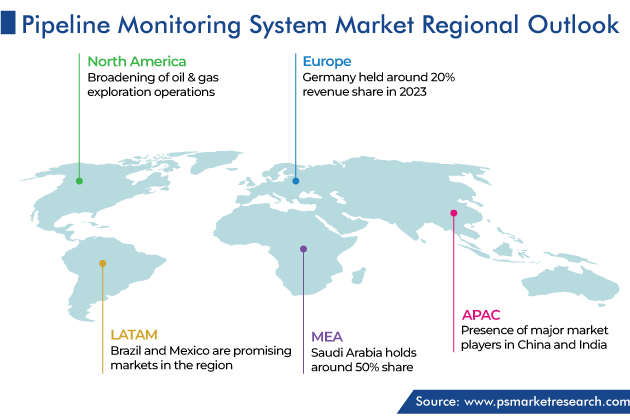

North America Has Largest Market Share

Geographically, the North American region is expected to lead the market, with a share of 40%, in 2030.

- The demand for pipeline monitoring systems is on the rise in the region due to the broadening of oil & gas exploration & production operations and advancements in technologies.

- An increasing number of pipelines are being constructed in the U.S. and Canada.

- Consequently, government agencies, oil & gas businesses, and environmental organizations are working to prevent accidents, such as gas leaks and oil spills.

In North America, several small and medium-sized players provide the associated services and components to giants such as Honeywell International Inc., Emerson Electric Co., and Rockwell Automation Inc. In the region, the U.S. pipeline monitoring system market holds the larger market share, and Canada is set to witness rapid growth in the years to come.

Due to the rise in the number of pipelines used for the transportation of crude oil, petroleum products, natural gas, and wastewater, as well as the increasing adoption of pipeline monitoring systems to stop spills, leaks, pipe bursts, and contamination, the U.S will maintain its position in the coming years.

- The safety standards associated with natural gas transportation, pipelines, and storage are implemented by the Federal Energy Regulatory Commission (FERC) and the U.S. Department of Transportation.

- The U.S. and Canada have been major oil producers for many years, which has given rise to substantial investments in the pipeline infrastructure.

Europe is the second largest shareholder in the market, after North America, owing to the rising investment in the oil & gas industry. In this region, Germany holds the largest market share, and the U.K. is the fastest-growing market.

APAC Is Fastest-Growing Market

Geographically, APAC is expected to grow at the highest CAGR, of 9%, from 2024 to 2030 because of the presence of major market players, such as ABB Ltd., Huawei Investment, and ORBCOMM Inc. India, China, and Southeast Asian countries are witnessing significant investments in pipeline networks to provide power for industrial expansion and urbanization.

Further, advanced pipeline monitoring systems integrated with leading-edge sensor technologies, remote surveillance capabilities, and data analytics are finding increasing acceptance in the region. Essentially, these systems are becoming more prevalent in the region as a consequence of the growing investments in the construction of hydrocarbon pipelines, which will boost the market growth in the coming years.

- China Oil and Gas Pipeline Network Corporation, or PipeChina, began construction of a natural gas trunk line in North China in April 2021 to establish a relationship with the Power of Siberia project, a gas transmission system.

- With an investment of USD 1.3 billion in the construction of the gas pipeline, PipeChina seeks to ensure an enhancement in air quality and encouraged growth in the economy.

The region’s governments are also taking the responsibility to establish strict regulations regarding environmental protection and pipeline safety, which has compelled businesses to set up efficient monitoring systems to ensure compliance.

Competitive Analysis

- The industry’s top players are investing significantly in research and development to broaden their product lines, which will boost the growth of the market.

- In addition, market players are involved in a wide variety of strategic activities to expand their reach in the market.

- Significant among them are the launch of new products, mergers & acquisitions, contractual agreements, and collaboration with other entities.

For instance, ABB Ltd. is focusing on pipeline automation and monitoring technologies. The company’s solutions optimize mobility, manufacturing, power, and operation with the help of software and engineering expertise.

Pipeline Monitoring System Companies News

In May 2021, a joint agreement between Huawei and SINO-PIPELINE International was signed in Shenzhen. Whereas Huawei will deliver ICT technology and employees, SINO-PIPELINE International will offer commercial capabilities and resources.

- Together, the organizations seek to employ a digital shift to encourage collaboration on intelligent pipeline networks, enabling SINO-PIPELINE International to Accelerate its growth.

In April 2021, ABB Ltd. introduced the Hover Guard, an easily transportable gas leak detection system, which utilizes unmanned aerial vehicles (UAVs) connected to the cloud.

- The UAV gas leak detection technology examines greenhouse gases, such as methane and carbon dioxide; and vapors of water, while offering precise data on diverse environmental processes that cause pollution.

- In March 2021, TC Energy Corporation and TC PipeLines LP accomplished their merger.

- With this, TC Energy became an indirect wholly owned subsidiary of TCP, with the latter acquiring all of the outstanding publicly owned units of TCP.

Pipeline Monitoring Systems Companies:

- Siemens AG

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- ABB Ltd.

- Emerson Electric Co.

- Schneider Electric SE

- General Electric Company

- ORBCOMM Inc.

- TransCanada PipeLines Limited

- PSI Software SE

- BAE Systems

- Xylem Inc.

Market Size Breakdown by Segment

The study uncovers the biggest trends and opportunities in the pipeline monitoring system market, along with offering segmentation analysis at the granular level for the period 2017 to 2030.

Based on Type

- Metallic

- Non-Metallic

Based on Solution

- Leak Detection

- Pipeline Break Detection

- Operating Condition

Based on Technology

- Ultrasonic

- PIGs

- Smart Ball

- Magnetic Flux Leakage

- Fiber Optics

Based on End Use

- Crude and Refined Petroleum

- Water and Wastewater

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws