Report Code: 12428 | Available Format: PDF

- Home

- Semiconductor and Electronics

- Photonic IC Market

Photonic Integrated Circuit (IC) Market Size and Share Analysis by Raw Material (III–V Material, Lithium Niobate, Silica-on-Silicon), Integration Process (Hybrid, Monolithic), Application (Telecommunications, Biomedical, Data Centers) - Global Industry Growth Forecast to 2030

- Report Code: 12428

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

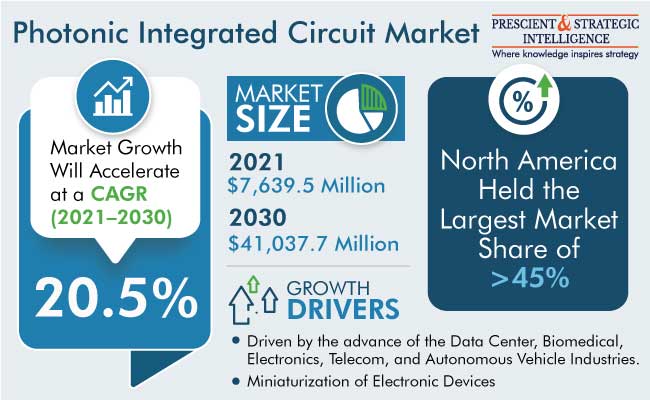

The global photonic integrated circuit market revenue stood at $7,639.5 million in 2021, and it is set to increase to $41,037.7 million by 2030, advancing at a CAGR of 20.5% during 2021–2030. The extensive demand for these components from the telecommunications, biomedical, and data center facilities, rising inclination toward autonomous vehicles, swift automation across various sectors, and miniaturization of electronic devices are driving the market.

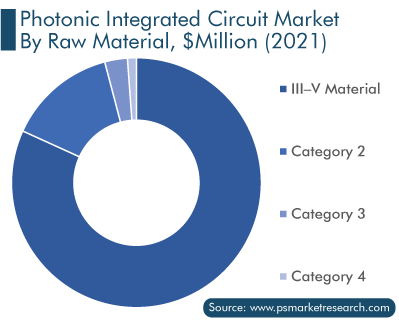

III–V Material Captured Major Industry Share

The III–V material category captured a more than 81.8% market share, based on raw material, in 2021. This is attributed to the advancing technology of 3D depth sensing in consumer electronics, automotive lighting, LiDAR, IR LED, and horticultural lighting applications.

Moreover, the silica-on-silicon category has the second-largest photonic integrated circuit market size. This is due to the low cost of setting up and operating photonic integrated circuits made from this material. Moreover, such components can be easily integrated into electronic devices, which has created an enormous opportunity for the market players supplying the silica-on-silicon platform.

Additionally, the rapidly increasing traffic on telecommunications networks, rising demand for data centers, and burgeoning adoption of high-performance computers necessitate that the data flows with a high speed, wide bandwidth, low cost, and high energy efficiency. Therefore, the integration of photonics into electronics for ultra-fast data transfer boosts the demand for this raw material in the market.

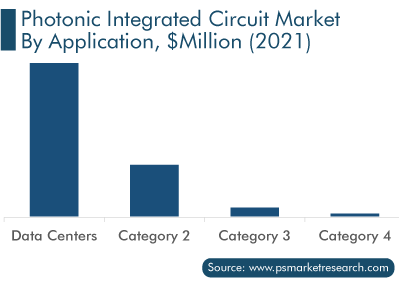

Data Center Application Growing at Highest Pace

The data centers category is expected to witness the fastest growth within the application segment, at a CAGR of 20.9%, during 2021–2030. This will be due to the emergence of cloud interconnection services, 5G mobile networks, and video streaming, which have been driving the construction of data centers on a massive scale across the globe.

Monolithic Process Captured Major Market Share

Based on integration process, monolithic held the larger photonic integrated circuit market share in 2021. This is because photonic ICs are integrated via the monolithic process in a variety of active and passive optical devices made from a single material, which eliminates the adaptation issues between multiple materials.

Moreover, the deployment of several monolithic photonics platforms in advanced CMOS technologies for next-generation integrated systems and the commercialization of this process are expected to broaden the scope for monolithic integration.

Furthermore, the rampant advancements in the photonics IC technology and the various integration methods are a major driver for the market. For instance, in October 2021, researchers at the Hong Kong University of Science and Technology created a monolithic InP on a silicon-on-insulator (SOI) platform that could show the way for fully integrated Si-based photonic ICs. The monolithic InP/SOI platform represents a synergy of the conventional InP and Si photonic platforms and supports the shift toward fully integrated PICs.

| Report Attribute | Details |

Historical Years |

2017-2021 |

Forecast Years |

2022-2030 |

Market Size in 2021 |

$7,639.5 Million |

Revenue Forecast in 2030 |

$41,037.7 Million |

Growth Rate |

20.5% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Raw Material; By Integration Process; By Application; By Region |

Explore more about this report - Request free sample

Regional Insights

North America had the largest market revenue share, of around 45.0%, in 2021, because of the widespread usage of WAN applications for fiber-optic communications and data centers. Additionally, the rising demand for high-speed data transmission increases the load on cloud computing networks, which, combined with the rapid rollout of IoT, has created a potentially booming photogenic integrated circuit market in the region.

Moreover, with the increasing data generation and consumption and bandwidth requirements, companies have started to shift toward integrated circuits. These components use light and photons, instead of electricity and electrons, to offer greater bandwidth and efficiency; thus, they could be a key enabler of many future applications. PICs are being used to support many new technologies, such as quantum computing.

For instance, in November 2021, researchers at the Purdue University introduced a new technique for optical isolation that removes the need for magnets. Purdue's magnet-free optical isolator was designed to advance photonic ICs, as higher bandwidths and greater efficiency are expected to be required in the future for data-driven communications.

Furthermore, Europe held the second-largest photonic integrated circuit market share in 2021, majorly due to the rising number of date centers in the region. As per a reliable source, in 2021, around 450 data centers were located in Germany, followed by around 420 in the U.K. and around 250 in the Netherlands.

Moreover, the rising demand for cardiac diagnostic sensors, high-speed fiber-optic communications, and self-driving cars, which require photonic ICs, enhances the market growth potential in the region. For instance, in July 2022, Level 3 autonomous driving will be authorized in Europe, which would boost the revenue generation opportunity for industry players in the coming years.

APAC captured the third-largest market share in 2021, and its industry will grow with a healthy CAGR during 2021–2030. This will be because of the rising adoption of electric and self-driving automobiles in China, Japan, South Korea, and India. Further, the increasing usage of the internet, availability of 5G connectivity, and advancement of technology will propel the market in the future. For instance, India, as per a government source, consumed around 300 Petabytes (PB) of data daily on average from the week beginning March 22, 2020.

China held the largest market share in the region in 2021 because of its advancing electronics and telecom industries. Moreover, Made in China 2025 initiatives empower advanced semiconductor manufacturing, thus boosting PIC consumption in the country. In addition, the Chinese government has emphasized the importance of deploying modern telecommunication networks, such as fiber-to-the-home (FTTH) and 5G wireless. Hence, the burgeoning demand for better broadband coverage in rural areas and the establishment of 5G networks in the coming years will provide opportunities to the market.

Market Players’ Recent Strategic Activities

Key players in the photonic integrated circuit industry have been active in collaborations and partnerships, in order to enhance their portfolios and achieve a larger market share. For instance:

In May 2022, EV Group, a provider of wafer bonding and lithography equipment for semiconductor, MEMS, and nanotechnology, and Teramount LTD., a provider of a scalable solution for connecting optical fibers to silicon chips, announced a collaboration for innovative packaging technologies for photonic ICs.

Similarly, in September 2021, LIGENTEC and X-FAB Silicon Foundries SE announced a strategic partnership to achieve a large-scale supply of integrated photonic devices in Europe.

Top Players in Photonic Integrated Circuit Market Are:

- Teramount LTD.

- X-FAB Silicon Foundries SE

- Broadcom Inc.

- Enablence Technologies Inc.

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Cisco Systems Inc.

- VLC Photonics S.L.

- Lumentum Operations LLC

Market Size Breakdown by Segment

The study offers a comprehensive market segmentation analysis along with market estimation for the period 2017-2030.

Based on Raw Material

- III–V Material

- Lithium Niobate

- Silica-on-Silicon

Based on Integration Process

- Hybrid

- Monolithic

Based on Application

- Telecommunications

- Biomedical

- Data Centers

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

APAC is set to witness the fastest growth in the market for photonic ICs.

The size of the photonic IC industry was $ 7,639.5 million in 2021.

The market for photonic ICs is driven by the advance of the data center, biomedical, electronics, telecom, and autonomous vehicle industries.

Monolithic integration is majorly used in the photonic IC industry.

The market for photonic ICs is dominated by the III–V materials.

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws