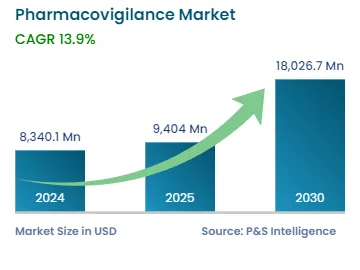

By 2030, the market for pharmacovigilance will value USD 18,026.7 million.

The demand for pharmacovigilance is primarily driven by the rising burden of cancer.

The data generated during phase IV trials necessitates pharmacovigilance as its analysis can shed light on possible common and rare ADRs.

Pharmacovigilance market includes the revenue generated from the provision of case data management, signal detection, and risk management services.

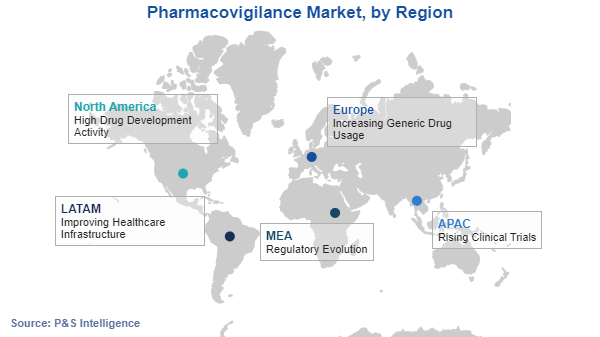

APAC is the most-lucrative region in the market for pharmacovigilance.