What was the size of the pharmaceutical analytical testing outsourcing market in 2024?+

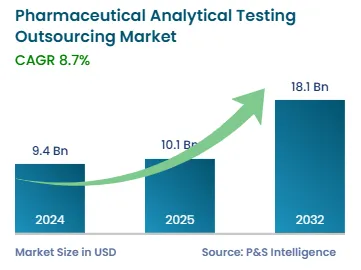

The pharmaceutical analytical testing outsourcing market size stands at USD 9.4 billion in 2024.

What will be the growth rate of the pharmaceutical analytical testing outsourcing market during the forecast period?+

During 2025–2032, the growth rate of the pharmaceutical analytical testing outsourcing market will be around 8.7%.

Which is the largest end user in the pharmaceutical analytical testing outsourcing market?+

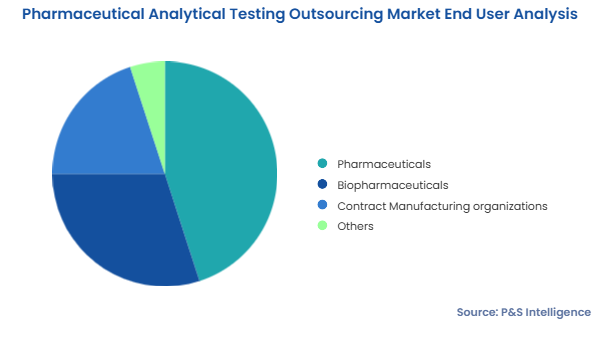

Pharmaceuticals is the largest end user in the pharmaceutical analytical testing outsourcing market.

What are the major drivers for the pharmaceutical analytical testing outsourcing market?+

The major drivers of the pharmaceutical analytical testing outsourcing market include extensive research & development activities, improved accessibility, an increase in consumption of drugs, and government initiatives and funding.

The pharmaceutical analytical testing outsourcing market is fragmented in nature.