Report Code: 10348 | Available Format: PDF

Peptide Therapeutics Market: Size, Share, Strategic Developments, and Growth Potential Estimation, 2023-2030

- Report Code: 10348

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

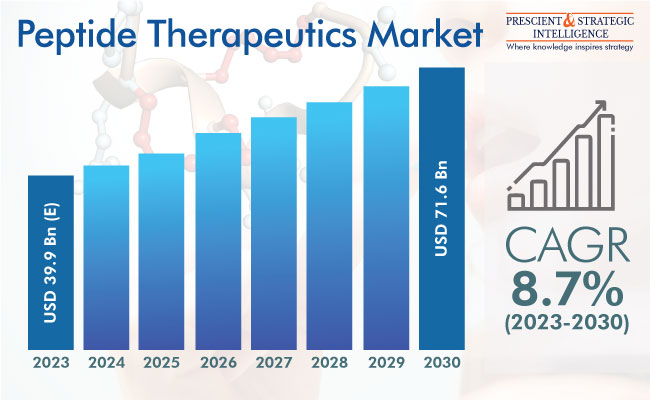

The total size of the peptide therapeutics market is USD 39.9 billion (E) in 2023, and it will grow at a rate of 8.7% from 2023 to 2030, to reach USD 71.6 billion by 2030.

The growing occurrence of cancer, osteoporosis, obesity, and metabolic syndromes, such as diabetes, boosts the acceptance of such drugs. Because of the rising count of impacted children and the high incidence of target illnesses in low-income nations, there is a heavy requirement for effective and low-priced medications. Further, peptide drugs are being evaluated as a treatment for COVID-19, with researchers looking for biologic molecules that either inactivate the mechanisms that lead to the infection or treat it.

Moreover, the FDA’s updated definition of biopharmaceuticals covers synthetic peptides with 40 or fewer amino acids and chemically synthesized polypeptides containing between 40 and 99 amino acids. This amendment would have an optimistic impact on the industry because peptide medications are now considered a potential COVID-19 treatment, thus leading to an augmenting expenditure on drug discovery.

Further, the industry progress is directly linked to the rising concentration on peptide therapeutics R&D, mainly for cancer, infectious illnesses, metabolic syndromes, and diabetes. The robust product pipeline is, thus, projected to contribute to industry development, along with the improvements in peptide manufacturing procedures.

The industry is essentially driven by the initiatives taken by numerous businesses for examining new medication candidates. As a result, the clinical trials of such medications have significantly augmented in the past few years. For example, in January 2022, Generate and Amgen Biomedicines announced a research agreement to discover protein-based drug for five clinical purposes in several therapeutic areas and methods of delivery.

Rising Burden of Diseases Is Major Driver for Market

The strongest driver for the market is the growing burden of chronic diseases, including diabetes, CVDs, cancer, neurodegenerative disorders, and respiratory disorders. The initial line of treatment for many of them is usually drugs, which are also prescribed for long-term therapy. A key reason for the increasing prevalence of such long-term diseases is the burgeoning geriatric population, which drives the demand for effective treatments.

Almost all kinds of diseases, including diabetes and CVDs, increase in incidence with age. As per the UNDESA, the population in the age group of 65 and above will be 1.5 billion by 2050, almost doubling from 727 million in 2020. This propels the usage of peptide therapeutics as hormones, neurotransmitters, growth factors, and ion-channel ligands. Moreover, a few of them serve as anti-infective agents, which is why their usage has been widely studied for COVID-19.

Metabolic Diseases Category Is Dominating Market

The metabolic diseases category is leading the industry, on the basis of application, owing to the quickly rising occurrence of these conditions. Poor eating habits, sedentism, and extreme alcoholism all contribute to the occurrence of such syndromes. Additionally, the rising elderly populace vulnerable to metabolic syndromes offers a lucrative development potential for the industry. The most-common among these diseases is diabetes, which affects over 530 million people globally, as per the International Diabetes Federation.

Cancer is another important category, as the disease accounts for the second-highest death count among all chronic diseases, of 10 million annually. Thus, the augmenting demand for effective and fast-responding peptide therapeutics is projected to boost the growth of this category. Such drugs either show cytotoxicity—the ability to destroy cancer cells—or can be used to ferry another cytotoxic agent to the tumor site.

Innovative Category Is Higher Revenue Contributor

The innovative category is leading the industry, credited to the augmenting research and development expenditure by big pharmaceutical businesses for new medications. Additionally, these drugs are more expensive than their generic counterparts and widely prescribed, which leads to the higher revenue generation from their sales.

The generic category is projected to advance at a fast pace during 2024–2030. The increasing healthcare expenditure and rising government healthcare investments propel generic medication acceptance. Moreover, the expiry of drug patents is enabling smaller pharma companies to come up with their generic variants, which are equally potent, but reasonably priced.

Drugs Manufactured Generate Higher Revenue

The in-house manufacturing category holds the larger revenue share. The majority of the large companies develop peptide-based medications themselves to adhere to the strict regulatory guidelines and because of the high expenses on outsourcing. Moreover, as huge pharmaceutical businesses have the suitable infrastructure and technology for mass production, they favor in-house manufacturing.

LPPS Category Propelled by Increasing Demand for Pure Peptides

The LPPS category is leading the industry, under the synthesis type segment, credited to the increasing need for pure peptides for a number of conditions. Using the liquid phase synthesis technology for peptides with fewer than 15 amino acids in the chain offers cost-effectiveness, larger yields, and less wastage.

Injectable Peptide Drugs Are Most Popular

The parenteral category is the largest within the route of administration segment of the market, because of the fast medication delivery, high bioavailability, quicker effect, and ease of usage of injectable drugs.

| Report Attribute | Details |

Market Size in 2023 |

USD 39.9 Billion (E) |

Revenue Forecast in 2030 |

USD 71.6 Billion |

Growth Rate |

8.7% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Is Highest Revenue Contributor

The North American region continues to hold the largest revenue share. The market growth in the region is propelled by the rising knowledge regarding peptide therapeutics, increasing burden of cancer and other chronic diseases, and flourishing biotechnology sector. The American Cancer Society has forecast 1,958,310 new cancer cases and 609,820 deaths in the U.S. for 2023. The high government expenditure on biopharmaceutical R&D also makes the region the largest consumer of peptide therapeutics.

The APAC region is projected to see a considerable rise in the demand for peptide therapeutics during 2024–2030. This would be a result of a vast unmet need for effective medication, low raw material prices, prospering biotechnology domain, and augmenting research and development funding. Moreover, the expiration of drug patents will fuel the generics industry’s future development potential. As per the IBEF, India already accounts for 20% of the global generics exports and 40% of all the generics sold in the U.S.

Key Companies in Peptide Therapeutics Market

- Eli Lilly and Company

- Pfizer Inc.

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

- AstraZeneca plc

- Teva Pharmaceutical Industries Ltd.

- Sanofi SA

- F. Hoffmann-La Roche Ltd.

- Novartis AG

- Novo Nordisk A/S

- GlaxoSmithKline plc

- Ironwood Pharmaceuticals Inc.

- Radius Health Inc.

- Ipsen

- Merck & Co. Inc.

- Lonza Group AG

- Bristol-Myers-Squibb Company

- AbbVie Inc.

- Bachem Holding AG

- Bausch Health Companies Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws