Organic Fertilizers Market Analysis

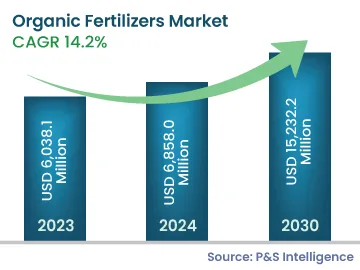

The global organic fertilizers market size generated $6,038.1 million revenue in 2023, and it is expected to advance at a compound annual growth rate of 14.2% during 2024–2030, to reach $15,232.2 million by 2030. The key factors driving the growth of the market are the growing number of organic farms, increasing acreage across the globe, rising demand for organic food products, and various health and fitness benefits.

Additionally, the surging availability of plant and animal waste and advances in the manufacturing procedure of organic fertilizers are increasing the opportunities for suppliers of these products.

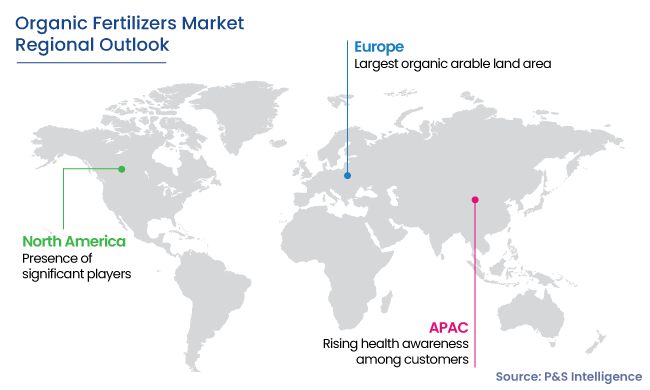

In recent years, the land under organic farming has compounded across several regions of the world, on account of several direct and indirect factors. The former includes increasing investments by public and private players in organic farming and the growing downstream demand for organic products due to their perceived health benefits and the low chemical leaching during their production. These factors have also resulted in their premium pricing and greater interest among farmers due to higher margins.

Besides, secondary/indirect factors such as equivalence agreements between countries for product certification, benchmarking, and labeling, wherein countries recognize and certify products of trading partners; supportive government initiatives and policies; and participatory guarantee systems (PGS) have pushed farmers from the conventional mode of farming to organic farming in recent years, thereby fueling the demand for organic fertilizers.