Off-Highway Electric Vehicles Market Future Prospects

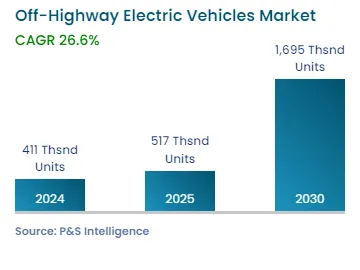

The global off-highway electric vehicles market size is estimated at 411 thousand units in 2024, and it will advance at a CAGR of 26.6% during 2024–2030, reaching 1,695 thousand units by 2030.

This is primarily due to the rising demand for low-noise and emission-free machines. The adoption of EVs is growing at a fast pace all over the world, and traditional automobiles are being phased out in an increasing number of countries. EVs are quiet, thus ideal for operation in densely populated regions, particularly in projects requiring midnight operations or operating in residential areas. Hence, digging or moving material from a house, school zone, or hospital becomes easier.

For instance, where it used to take multiple laborers with smaller electric tools, an electric compact excavator or an electric loader can now dig or carry material indoors without polluting confined environments or causing substantial interruptions.

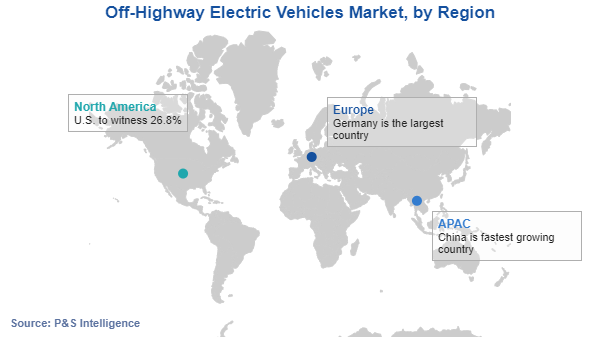

China, the European Union, and the U.S. collectively account for over 90% of the global EV sales; while Costa Rica and Colombia have lately established much-more-robust EV sales objectives. General Motors, BMW Group, Volkswagen AG, AB Volvo, Nissan, and Audi, among others, have vowed to invest a total of USD 150 billion in EV manufacturing and announced intentions to debut new EV models in the 2020s.

The electrification rate has been increasing in off-highway vehicles, including those used in the infrastructure sector. This is due to the necessary technologies becoming more mature and affordable, aided by their development and use in on-road vehicles. Several major OEMs are already producing a variety of electric vehicles for construction, mining, and agriculture.

For instance, AB Volvo offers a selection of electric compact equipment, including the ECR25 electric compact excavator and L25 electric compact wheel loader. In the ECR25, the batteries are paired with an electric motor, which powers the hydraulics and enables a full 8-hour workday on a single charge.

Moreover, Wacker Neuson has an existing lineup of zero-emission machines, including two electric wheel loaders, two battery-powered rammers, and a dual-power excavator.