Report Code: 10243 | Available Format: PDF

Nuclear Medicine Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2023-2030

- Report Code: 10243

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

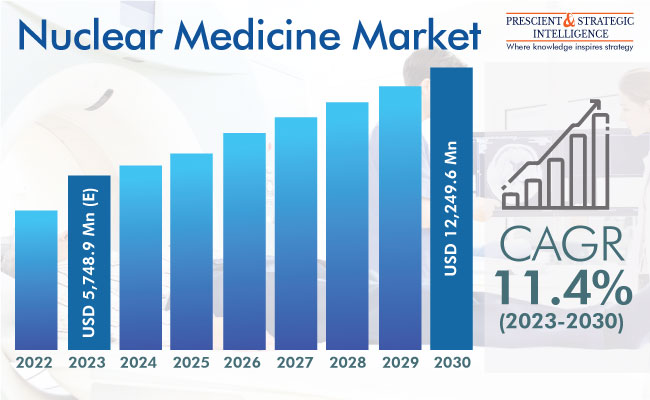

The global nuclear medicine market worth was USD 5,748.9 million (E) in 2023, and it will advance at a CAGR of 11.4% during 2023–2023, to reach USD 12,249.6 million by 2030.

The market's growth is attributed to government initiatives aimed at enhancing access to effective diagnoses, an extensive product pipeline, increasing prevalence of cancer, easy availability of medical insurance in advanced economies, rising awareness of early disease diagnosis, technological advancements in imaging systems and radiopharmaceuticals, and burgeoning geriatric population.

Several radioactive pharmaceutical products, including betalutin, yttrium-90 microspheres, omburtamab, 177Lu‑PNT2002, and PNT2003, are currently undergoing clinical trials. Moreover, the ANSTO reported that its production plants remained operational throughout the pandemic, to ensure the provision of critical radiopharmaceuticals.

Further, the approval of Novartis’ Pluvicto (177Lu-PSMA-617) by the U.S. FDA in March 2022 for treating metastatic prostate cancer is expected to propel the growth of the market, considering the high incidence of this condition in the U.S. Moreover, in April 2023, the FDA permitted the company’s Milburn, NJ, facility to commercially manufacture it. The company targets to supply 250,000 doses of this radiopharmaceutical in 2024.

The growth of the market is further encouraged by a supportive repayment scenario for nuclear imaging and treatments in the U.S., with the Center for Medical Services (CMS) providing additional payments for specific procedures. This has improved patient access to crucial diagnostic nuclear medicine approaches for illnesses that carry a high mortality risk.

Moreover, the emergence of advanced diagnostic and therapeutic technologies, along with the approval of new PET and SPECT devices, have addressed the unmet needs of patients for quality treatments. For instance, GE Healthcare showcased its MyoSPECT, a next-generation heart imager with automated workflows and a larger field of view, at the ACC.23/WCC conference in March 2023.

Growing Occurrence of Target Conditions

The growing occurrence of cardiovascular illnesses and cancer is the main factor fueling the industry's development. As per the American Heart Association, around 19.1 million demises were attributed to cardiovascular illness worldwide in 2020. The age-associated demise rate per 100,000 populace was 239.8, and the age-associated occurrence rate was 7,354.1 per 100,000. Similarly, cancer kills over 10 million a year, thus accounting for a significant health burden on the global society.

The incidence can be lowered via fast recognition and treatment, where radiopharmaceuticals and SPECT and PET scans plays a vital role. These imaging modalities offer detailed views of the muscles, tissues, bones, and blood vessels, helping doctors arrive at concrete diagnoses faster. Nuclear imaging can not only help identify issues in the structure of organs but also help ascertain if the organs are working properly or not. This makes SPECT and PET imaging advantageous over conventional radiological techniques, such as X-ray, CT, and MRI.

Utilization of Radiopharmaceuticals in Neurological Applications

Nuclear medicine is widely utilized to identify neurological illnesses, such as Parkinson's disease, Alzheimer’s disease, stroke, depression, and dementia. The growing illness load has encouraged businesses and stakeholders in this field to concentrate on exploring new applications for radiopharmaceuticals. For instance, in 2022, Curium announced the FDA approval for its generic variant of DaTscan (Ioflupane I 123 injection) to help in the assessment of adult patients with suspected Parkinsonian syndromes.

Similarly, Fluorodeoxyglucose PET scans are used as a biomarker to detect clinical dementia. Further, functional nuclear imaging of the brain can also help differentiate benign radionecrosis from recurring primary brain cancer. Other common radiotracers utilized for neurological imaging are iodine-123 and technetium-99m (99Tc).

Oncology Category Is Dominating the Market

Based on application, the oncology category holds the largest industry share, primarily because of cancer being a substantial reason of death globally. Poor lifestyle choices, such as smoking, unhealthy diet, and lack of physical activity, along with a few infections and genetic predisposition, contribute to its growing occurrence. Additionally, PET and SPECT and even hybrid PET/MRI and PET/CT are widely used for cancer diagnosis, staging, and therapy monitoring.

Furthermore, the rising expenditure in R&D of advanced nuclear drugs for cancer treatment is projected to boost the category growth. For example, in 2022, ITM Isotope Technologies Munich SE started the COMPOSE phase 3 trial of 177lu-edotreotide to ascertain its efficiency in the treatment of neuroendocrine tumors.

The cardiology category is projected to witness significant development during the projection period, mainly because of the rising need for cardiovascular illness diagnosis. Bracco Diagnostics Inc. collaborated with CardioNavix LLC in March 2021 to improve patient access to new cardiac PET imaging systems. This collaboration targets to make it easier for patients to get cardiac PET scans at hospitals, doctors, and diagnostic centers, thus decreasing upfront prices for patients.

Diagnostic Type Is Expected To Dominate Market

On the basis of type, the industry is bifurcated into therapeutic and diagnostic. Of these, the diagnostic category is predicted to dominate the worldwide industry over this decade because of the growing utilization of SPECT and PET imagers and advances in radiotracers. The World Nuclear Association estimates the annual count of nuclear imaging procedures globally at 40 million, credited to their high effectiveness, precision, non-invasiveness, and safety.

Nuclear Medicine Usage at Hospitals To Grow at Highest CAGR

In the next seven years, the hospitals category of the market is expected to experience the highest compound annual growth rate among all the end users. In addition, in 2023, this category has the dominant position due to an increase in the count of diagnostic imaging procedures performed in hospitals with the rising demand for early disease diagnosis. Moreover, hospitals provide comprehensive, long-term services, including diagnosis, surgery, and post-operative care, which is why they are preferred by patients.

| Report Attribute | Details |

Market Size in 2023 |

USD 5,748.9 million (E) |

Revenue Forecast in 2030 |

USD 12,249.6 Million |

Growth Rate |

11.4% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America To Continue Holding Greatest Market Share

The North American continent holds the largest share in the nuclear medicine market in 2023. This is owing to the advancements in radioisotopes, government investments in healthcare, growing research and development expenditure, and initiatives by companies in the region to offer more-effective diagnostic and treatment approaches. For instance, in January 2023, NorthStar Medical Radioisotopes attained a key milestone in the production of a critical medical radioisotope, molybdenum-99 (Mo99), without the usage of uranium.

In the same way, in 2021, Advanced Accelerator Applications inked an exclusive supply contract for lutetium-177 with the University of Missouri Research Reactor (MURR), to obtain GMP-quality lutetium-177 chloride, from which Lutathera and other Lu-177-based therapeutics are derived.

APAC is projected to witness the highest CAG rein the market during the forecast period, credited to augmenting knowledge regarding nuclear medicine’s benefits and increasing expenditure in this space. For example, Penang Adventist Hospital inaugurated a private nuclear drug center in northern Thailand in March 2022. The conditions diagnosed and treated at this medical center include hyperthyroidism, lymphomas, thyroid cancer, and bone pain caused by different cancer types.

Some Major Companies in Nuclear Medicine Market:

- GE Healthcare

- Jubilant Life Sciences Ltd.

- Nordion (Canada) Inc.

- Bracco Imaging S.P.A.

- Institute for Radioelements

- NTP Radioisotopes SOC Ltd.

- Australian Nuclear Science and Technology Organization

- Eczacıbaşı-Monroe

- Lantheus Medical Imaging Inc.

- Eckert & Ziegler

- Mallinckrodt plc

- Cardinal Health Inc.

- Siemens AG

- Bayer AG

- Novartis AG

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws