Report Code: 12819 | Available Format: PDF | Pages: 220

Molten Salt Batteries Market Size and Share Analysis by Type (Thermal Battery, Sodium-Sulphur Battery, Sodium-Nickel Chloride Battery, Liquid Metal Battery), Charging (Rechargeable, Non-Rechargeable), Application (Grid Storage, Electric Vehicles, Military), Battery Capacity (Low (less than 5 kWh), Medium (5 kWh to 100 kWh), High (over 100 kWh)) - Global Industry Demand Forecast to 2030

- Report Code: 12819

- Available Format: PDF

- Pages: 220

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Molten Salt Batteries Market Size & Share

The molten salt batteries market size is estimated at USD 2,461.1 million in 2023, and it is expected to grow at a CAGR of 24.9% during 2024–2030, to reach USD 11,543.2 million by 2030.

The growth can be primarily ascribed to the increasing demand for storing energy efficiently, especially that generated by renewable sources. These batteries offer a large number of benefits, which include enhanced safety, higher energy densities, and longer lives. The market is essentially booming because of the rising focus on reliable and sustainable power sources. For large-scale applications, batteries that have liquid components are used as they possess a higher current density and longer life. Therefore, grid storage and electric vehicles are a few potentials uses for the molten salt battery.

These devices use molten salts as the electrolyte and provide a high-power density. Furthermore, their storage capacity is large, and they can keep energy from renewable sources for a longer time, economically. Thus, with their ability to efficiently store excess energy, they offer a solution to the intermittent nature of renewable sources. The storage of the excess electricity generated by renewable sources during peak production times, such as on sunny or windy days (for solar and wind power, respectively, or when the demand is low), allows it to be discharged when the demand surges.

The energy can be stored in these systems for a longer time in an inactive state, because the molten salts inside them are solid at room temperature. The anode, cathode, and electrolyte layers separate on the basis of immiscibility and relative densities upon activation. The molten salt layer possesses high ionic conductivity, and it works like an electrolyte, allowing electrons to move from one side to another while the battery charges and discharges.

Further, the demand for these products is driven by their dwindling prices. Engineers from MIT have created a molten salt battery that is 90% cheaper than a lithium-ion battery, costing just USD 9 per kWh. In the last three decades, the prices of these ESSs have reduced by 97%, which continues to make them affordable and encourage people to buy them.

Liquid-Metal Batteries Holds Largest Share

Liquid-metal batteries hold the largest share, of 30%, as they are suitable for storing energy at the grid level and highly scalable. This means that they can be made bigger without negatively affecting their efficiency. They are also considered safer than other battery types as they minimize the risk of thermal explosions due to the chemical reactions that occur within. Moreover, the usage of cost-effective materials reduces their manufacturing and, ultimately, purchase cost. Other benefits are a low self-discharge rate and long cycle life.

| Report Attribute | Details |

Market Size in 2023 |

USD 2,461.1 Million |

Market Size in 2024 |

USD 3,042.9 Million |

Revenue Forecast in 2030 |

USD 11,543.2 Million |

Growth Rate |

24.9% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Chargeability; By Application; By Capacity; By End User; By Region |

Explore more about this report - Request free sample

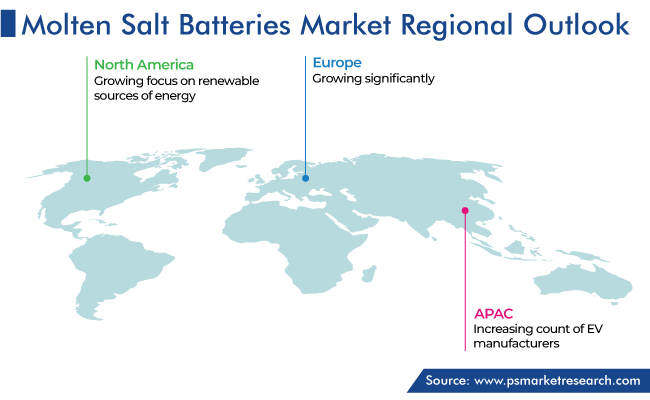

North America Makes Largest Contribution to Global Revenue Generation

North America has the leading position in the market, and it will hold the same position till 2030, with a value of around USD 5.2 billion. This is attributed to the growing demand for electric vehicles. In North America, the U.S. holds the leading position, and it will grow with a CAGR of 25.0%. This is attributed to the growing focus on renewable sources of energy and the increasing demand for these systems from the power and energy sector.

Furthermore, the market is growing significantly in Europe due to the booming renewable energy capacity. As per the International Renewable Energy Agency (IRENA), the installed concentrated solar power (CSP) capacity in the continent is projected to reach 2.3 GW by 2030. In addition, the EU now plans to have 42.5% of its total energy come from renewable sources by 2030, as against the previous target of 32%. Thus, with more clean power plants coming online, the demand for these batteries will rise to store the excess electricity and release it to the grid when demand rises.

By Chargeability, Rechargeable Category Generates Higher Revenue

Based on chargeability, the rechargeable category will generate the higher revenue, attributed to the fact that these variants are environment-friendly, as they contribute in minimizing e-waste. This lessens the rate of global warming, water pollution, air pollution, and air acidification. They provide a higher energy density owing to the use of high-conductivity molten-salt electrolytes, but the efficiency also depends on the reactant pairs. Because of such features, they are being increasingly used for powering electric vehicles.

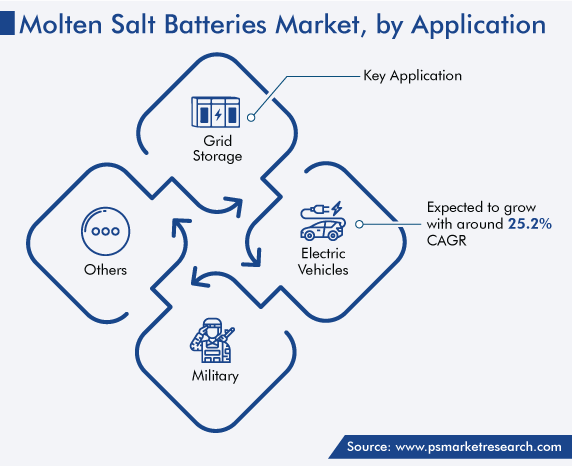

Grid Storage Is Key Application

Grid storage is a key application because these devices can store a large amount of energy, which can be used later, when required. Although the grid is vast, it is not always able to cater to the high demand for electricity in most places. The problem worsens when a large number of renewable electricity installations are connected to it, because their generation is not reliable. Thus, whenever excess energy is produced, it should be stored, so that it can be released when generation decreases or demand rises.

High-Capacity Batteries (over 100 kWh) Are in High Demand

High-capacity batteries (over 100 kWh) are in high demand, as they can supply power over varying durations. Moreover, they are rapid-charging variants, which makes them suitable for grids, heavy-duty EVs, and other large-scale applications.

Power Plants Are Major End Users

Power plants are the major end users, with a share of 40%, ascribed to the growing number of solar power plant projects, aided by the increasing funding for the energy sector. According to the International Energy Agency (IEA), the global renewable electricity capacity is forecast to rise by more than 60% from the 2020 levels, to over 4,800 GW by 2026. With the rise in renewable energy production, the demand for molten salt thermal energy storage for concentrating solar power (CSP) plants, heat transfer fluid systems, and other applications is projected to rise.

Growing Interest in EVs also Drives Market

The growing demand for electric vehicles is a strong driver for the market as these automobiles have a battery as their primary or secondary (in the case of HEVs and PHEVs) power source. Moreover, since driving range and speed are a few major restraints in their adoption, the higher energy density of molten salt batteries could provide a solution.

Mostly, gasoline/diesel is used to fuel automobiles, but their burning leads to an increase in GHG emissions and, thus, to higher pollution levels. Hence, to reduce the carbon footprint and attain carbon-neutrality goals, governments are introducing favorable policies for promoting the manufacturing and sale of EVs. Governments across various countries have also announced plans to have a significant portion of their new vehicle sales be of electric models in the coming years.

Additionally, numerous ASEAN countries have taken the decision to standardize EV regulations and specifications and implement training and certification programs. For instance, Indonesia has set a goal of having about 2.5 million EV users by 2025. Similarly, Brunei’s National Climate Change Policy has set the EV sales target to 65% of the total automotive sales by 2035.

Another example is Malaysia, where the Low Carbon Mobility Blueprint 2021–2030 aims to increase the share of electric cars and motorcycles in their total sales by 15% and those of electric buses to about 10,000 by 2030. The country also has plans to install 1,000 DC and 9,000 AC EV charging stations by 2025. Further, import and excise duty exemptions were set for the sales of a maximum of 10,000 completely built BEVs and 90,000 completely built PHEVs in 2021–2022. For 2023–2025, the exemption for 50% and 75% of these categories of vehicles, respectively. Additionally, funds for PHEV charging infrastructure installation would be MYR3,000 per vehicle during 2026–2030.

Key Players in Molten Salt Batteries Market Are:

- NGK Insulators Ltd.

- Ambri Inc.

- Sumitomo Electric Industries Ltd.

Market Size Breakdown by Segment

The study uncovers the biggest trends and opportunities in the molten salt batteries market, along with offering segmentation analysis at the granular level for the period 2017 to 2030.

Based on Type

- Thermal Battery

- Sodium–Sulphur Battery

- Sodium–Nickel Chloride Battery

- Liquid Metal Battery

Based on Charging

- Rechargeable

- Non-Rechargeable

Based on Application

- Grid Storage

- Electric Vehicles

- Military

Based on Battery Capacity

- Low (less than 5 kWh)

- Medium (5 kWh to 100 kWh)

- High (over 100 kWh)

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for molten salt batteries is witnessing a CAGR of 24.9%.

In 2030, the molten salt batteries industry size will be USD 11,543.2 million.

The market for molten salt batteries is driven by their numerous advantages and widening application area.

Liquid-metal variants dominate the molten salt batteries industry.

Eco-friendly electrolyte and electrode materials are trending in the market for molten salt batteries.

Power plants hold the largest molten salt batteries industry share.

North America is the largest market for molten salt batteries.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws