Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4,598.9 Million |

| 2030 Forecast | USD 6,966 Million |

| Growth Rate(CAGR) | 7.2% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12549

Get a Comprehensive Overview of the Mining Automation Market Report Prepared by P&S Intelligence, Segmented by Offering (Equipment, Software, Communication System), Technique (Surface Mining, Underground Mining), Workflow (Mine Development, Mining Process, Mine Maintenance), Application (Metal Mining, Mineral Mining, Coal Mining), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4,598.9 Million |

| 2030 Forecast | USD 6,966 Million |

| Growth Rate(CAGR) | 7.2% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

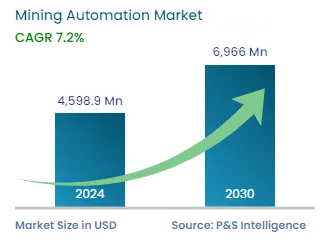

The global mining automation market was valued at USD 4,598.9 million in 2024, and the market size will reach USD 6,966 million by 2030, advancing at a CAGR of 7.2% during 2024–2030. This is due to the increasing need for improving work safety, the rising demand for fleet management systems, and the surging focus on reducing operating costs.

The sector has a long history of utilizing technology to confront and resolve obstacles like workplace productivity and environmental concerns. In fact, productivity has increased as a result of the development and application of new mining technologies, and these improvements have also coincided with an overall enhancement of the working conditions in the mining industry. Along with these, other issues are being addressed by the industry’s continued development of new technologies. For instance, the introduction of digitalization promises to keep mines competitive while also providing operators with comfortable positions in control rooms.

Globally, all industries are being impacted by the new technology generation 4.0, which will lead to several advancements in terms of productivity, flexibility, and efficiency growth. The competitive nature of the mining business has made it more important than ever to always strive to improve tools, automated procedures, and modes of transportation. The digital twins will soon become the most important piece of technology that will increase the productivity of the equipment. Thus, mining enterprises and ore extraction organizations must adopt the newest technology trend in order to remain competitive and maintain prospering in business.

When arranging plans and operations, virtual simulations will show to be of great use. By modeling the workplace, miners will be able to make long- and short-term schedules and precise estimations for when the drilling, crushing, and extraction operations will be finished and what the results of the end product will be. Additionally, by simulating the machinery, equipment, and entire work process, on-site workers will be able to test new methodologies on their most important work processes very affordably since no capital will be needed to precisely find out what works, every test will be carried out in a digital simulation, using the same machinery and equipment.

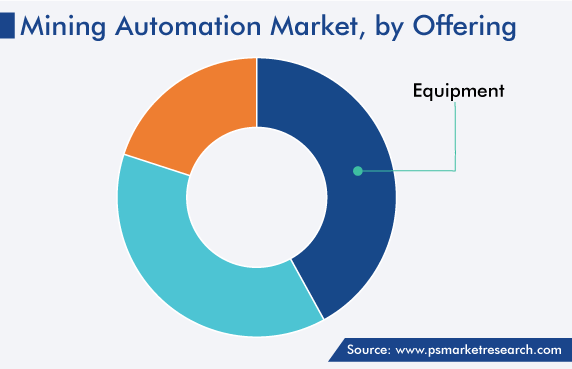

The equipment category held the largest revenue share, of more than 42%, in 2022. This is because various equipment is used for mining processes, including autonomous hauling systems, autonomous drilling rigs, underground LHD loaders, tunneling equipment, smart ventilation systems, pumping systems, and others. Of these, autonomous drilling rigs are mostly used in mining. These operate around the clock and eliminate many of the safety issues associated with manually controlled drill rigs while being more precise and predictable.

There are numerous ways to implement this robotic drill equipment. It may be completely autonomous and not need a rig driver, or a rig driver may control it remotely. The package can additionally include additional GPS and GNSS-based semi-autonomous operations. Moreover, it reduces maintenance and supply costs, as well as offers faster and more accurate drill rig modeling to evaluate choices.

Moreover, mining businesses can contribute to improving safety and overall production at mine sites by using autonomous technologies. By requiring personnel in fewer numbers around mining equipment, the technology automates haulage processes and lowers the danger of casualties at mine sites. Greater equipment availability is made possible by AHS's capacity to reduce the need for breaks or shift changes that come along with using manned machinery for mining operations. Additionally, it enables miners to cut back on pollutants and fuel use.

The underground mining category held a larger revenue share in 2022. Technology and AI have taken over the world and are operating at the core of many businesses. Innovative underground mining technology has enhanced a variety of working circumstances, including underground communication, better metal and mineral transportation, quick emergency responses, and many more. The incorporation of AI that is active around the clock would be the ultimate illustration of this. AI integration incorporates real-time, round-the-clock monitoring of metals and minerals as well as plant processing.

Moreover, underground mining technology can help businesses reduce working hazards. Undoubtedly, poor visibility can result in accidents. The technology used in underground mining makes it possible to ensure secure mining evacuations. In the meantime, worker safety can guarantee the lowering of potential injury risks as well as the prevention of fatalities.

Also, in most cases, machines, haulers, and loaders are used to load, move, and transport items. Technology allows for the integration of a seamless, continuous system for loading and hauling while also allowing for the simultaneous handling of the support function for underground mining. It makes sense that, while increasing productivity, larger loaders and haulers for material handling also increase the danger of injuries from safety issues. Firms in this sector can gain a lot from sensors that deal with obstacle detection, location detection, effective communication, automated controls, and others for the protection and safety of personnel by focusing on the integration of new technology.

The communication system category is expected to grow at the highest CAGR, of 7.6%, during the forecast period. Huge-speed digital networks are necessary for greater efficiency and cost optimization, due to the high volume of data generated in mining operations, including video and audio communications, and vehicle telemetry. Open-pit mining operations can make use of wireless communication, optical fiber networks, and cable networks. In order to overcome difficulties caused by the complexity and geographical limitations of underground operations, wireless communication is essential.

Reduced operating expenses and optimization are made possible by an efficient communication system linking the whole mine operations at a mine site from pit to port. The demanding needs of the future mine are fulfilled in part by high-performance connectivity like 4G and 5G in combination with cutting-edge technology like automation and data analytics. The environmental impact is lessened by keeping track of materials used and precisely measuring the mining waste. To protect the workforce in the event of an incident like a mine collapse, underground miners are tracked using tracking devices and two-way communication systems.

Mine operators can keep a watch for machine faults to minimize downtime and production concerns thanks to sensors and gadgets that remotely monitor and manage mining equipment. Also, collision accidents are decreased by using mobile Wi-Fi technology on mining equipment.

A fleet management system (FMS) is a technological approach to managing the fleet's vehicles in terms of automation and business process optimization, as well as connecting all business sectors, such as dispatching, purchasing, communications, navigation, accounting, and finance, in a single system. No matter the size, fleet management is crucial to the efficient operation of a fleet of vehicles. Monitoring the locations and conditions of vehicles, scheduled maintenance, and fuel consumption aid in cost control and extends the life of the equipment.

The FMS's main objective in the mining industry is to maximize mine productivity and efficiency based on real-time data. More particularly, the FMS attempts to meet quality mixing limits, reduce stock handling, feed the processing plant at the intended pace, and increase mining production.

Drive strategic growth with comprehensive market analysis

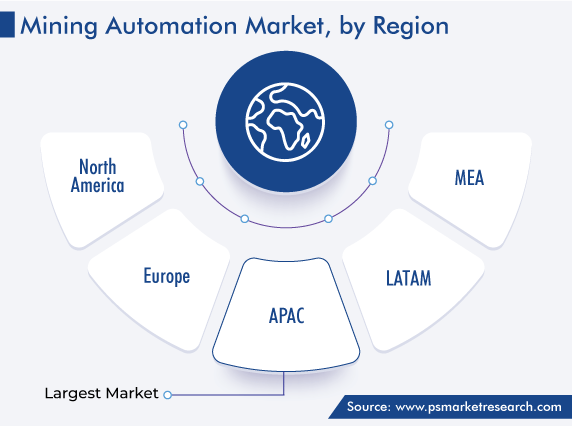

APAC leads the mining automation market, accounting for a revenue share of over 41% in 2022. This is due to the surging adoption of technologies for mining automation by various countries in the region. For instance, Australia is acknowledged as a global pioneer in mining automation technologies that allow resource firms to work more securely and effectively in difficult environments. In addition, the rising cost pressures that the mining industry is currently experiencing can be relieved owing to automation advancements.

Moreover, the mining equipment, technology, and services industry in Australia has created cutting-edge technologies that automate several processes and jobs throughout mining operations. Millions of dollars are also being invested in automation technology by a large number of Australian research institutions, academic divisions, and business collaborations. These technologies have aided mining firms all over the world in lowering costs, increasing production, maximizing the utilization of plant and equipment, and enhancing worker safety.

Also, the construction industry is increasing at a good pace in the region. Following the COVID-19 downturn, the construction industry needs government infrastructure investment more than ever. Over the short-to-medium term, significant investments have been planned in China, India, Japan, and other regional countries, which are expected to propel the industry's growth in the region.

Furthermore, APAC is renowned for its entrepreneurial spirit, ongoing technical innovation, and rapid expansion. The previous 10 years have seen a boom in digitalization across all industries in the area. Due to the strong infrastructure that was put in place before the pandemic started, India, for instance, is developing quickly in the area of digital transformation.

This report offers deep insights into the mining automation industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Offering

Based on Technique

Based on Workflow

Based on Application

Geographical Analysis

The mining automation market size stood at USD 4,598.9 million in 2024.

During 2024–2030, the growth rate of the mining automation market will be around 7.2%.

Equipment is the largest offering in the mining automation market.

The major drivers of the mining automation market include the rising need for improving work safety, the surging focus on reducing operating costs, and the increasing demand for fleet management systems.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages