Report Code: 10392 | Available Format: PDF

Military Communications Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2023-2030

- Report Code: 10392

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

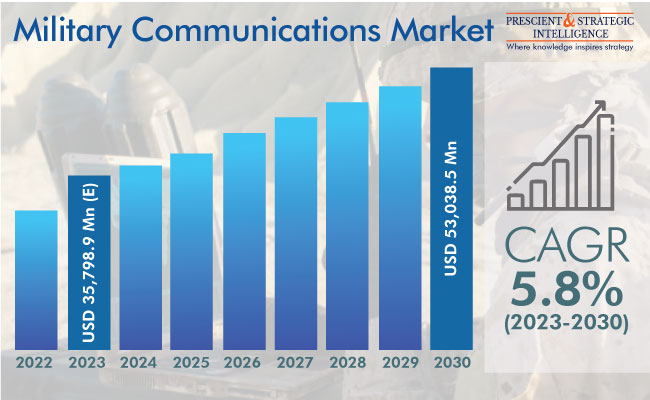

The global military communications market is expected to reach USD 53,038.5 million by 2030 from USD 35,798.9 million (E) in 2023, witnessing 5.8% CAGR during 2023–2030.

This is credited to the increasing security worries and rising disagreement among different nations across the globe. These factors continue to drive investments in defense capabilities to obtain progressive communication systems that offer private, precise, and safe voice and data transmission among different departments, establishments, and sections of the military.

The safety of the extremely critical defense-related data and the maintenance of reliable communication are two key demands of the defense industry. Furthermore, defense communication involves all characteristics associated with military forces' transfer of data and information, for efficient command, surveillance, and control operations. Additionally, communication usually depends on a multifaceted and massive network of hardware mechanisms and software to transport data to various units and across geographies.

Deployment of 5G Technology in Military Communications

The 5G wireless system, or 5G mobile network, is an enhanced telecommunication technology that allows for high-speed data transmission and better system spectral efficiency. This implies the transfer of a larger data volume with comparatively low battery usage. It also provides the ability of connecting many devices concurrently. 5G in defense would advance reconnaissance and intelligence systems and processing abilities and allow new approaches for command and control (C2).

The higher network speed and lower latency of these networks and the rising acceptance of autonomous and connected devices are helping in the development of 5G in military communications market.

Rising Security Concerns Boosting demand for More-Robust Military Communications

The confidentiality and security of military communications are key necessities of defense agencies. The growing size of IP-based information communicated over standard interfaces, including situational alertness video and remote sensor data, boosts the requirement for enhanced network security. Furthermore, strengthening the cybersecurity of military satellites has become progressively vital in these times of cyber warfare.

As defense data and network infrastructure are important assets, any breach in their security may put individuals, societies, and entire economies at risk. In order to avoid this, the defense industry is accepting secure communication solutions, including advanced radars, satellites, walkie-talkies, fiber optic cables, switchboards, and signaling towers.

For example, India’s Ministry of Defence (MoD), in July 2023, announced that it has signed an agreement worth INR 500 crore with ICOMM Tele for obtaining 1,035 units of 5/7.5-tonne radio relay communication equipment containers. The radio relay containers will fulfill a long overdue need of the Indian Army for mobile communication detachments.

Fast Acceptance of Enhanced Ka-Band Satellites for Military Communication

Ka-band satellites offer an advanced spectrum and allow for much better data speeds in comparison to satellites leveraging the Ku and X bands. Therefore, the launch of advanced Ka-band satellites allows armed forces to plan and carry out difficult operations better and with higher precision. Because of the increasing requirement for more satellite bandwidth at the best price, the utilization of Ka-band satellites for army communication is rising.

The Ka band essentially allows for faster data downloads and uploads. Moreover, its bandwidth prices are reducing because of the growing count of users of communication systems utilizing Ka-band satellites. Furthermore, the advanced Ka-band satellite systems are fortified with smaller, guided beams for better capacity density, which enhances network jam resistance for communication channels, while aiding substantial uplink data rates for intelligence, surveillance, and reconnaissance (ISR) and other data-associated applications.

Therefore, the Ka band is an ideal frequency for present mobile and military satellite communications as it offers supreme dependability, flexibility, capacity, and capability.

SATCOM Systems Category Is Projected To Dominate Component Segment

The military communications industry, on the basis of the system type, has been divided into radio systems, SATCOM systems, security systems, and communication management systems. Among these, the SATCOM systems division is projected to dominate the market over the forecast period. The majority of the technically enhanced nations depend on satellite communications because of the need for wider coverage, safety, and site independence.

Moreover, with the arrival of software-defined radio (SDR), the radio systems division is expected to advance at a considerable pace. For instance, in May 2023, the Ministry of Defence signed a contract worth INR 2,963 crore with NewSpace India Limited (NSIL) for the GSAT-7B satellite, which will be solely for the use of the the Indian Army. The satellite is capable of aiding the Indian Army in advancing surveillance in border areas.

Presently, the country has only two dedicated army satellites — the GSAT-7 (Rukmini) and GSAT-7A (Angry Bird) — defense by the Indian Navy and Indian Air Force, respectively.

| Report Attribute | Details |

Market Size in 2023 |

USD 35,798.9 Million (E) |

Revenue Forecast in 2030 |

USD 53,038.5 Million |

Growth Rate |

5.8% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

APAC Market Is Projected To Advance at Highest CAGR

The APAC military communications market is experiencing exponential development, primarily due to the rising border and security issue among neighbors. Moreover, the region is home to the three biggest defense spenders in the world—China, India, and Japan—which continue to invest in the enhancement of their military capabilities.

North America is expected to dominate the industry, because of the growing technical progressions in the continent. The U.S. is the biggest military spender, with investments reaching USD 877 billion in 2022, which is around three times more the amount spent by China and 39% of the total global military expenditure.

Hardware To Dominate Market owing to its Increasing Adoption Worldwide

Based on component, the industry is divided into software and hardware. The hardware category is leading the industry because of the growing need for progressive communication systems for numerous military applications, such as ISR, operations, and logistical and combat supply route monitoring. The hardware category is further subdivided into antennae, transceivers, receivers, transmitters, and others.

The increasing need for defense-grade communication devices, such as vehicle-mounted, handheld, and portable radios, inertial navigation ssytems, data links and tactical radios, transceivers, intercoms, and satellite communication systems, boosts the category growth.

The software category is projected to display substantial development over this decade. This is credited to the growing acceptance of SDR systems for enhanced communication. For instance, the U.S. Army signed a contract with several companies in September 2020 for software and maintenance services for around 15 item segments, which comprise NetOps, communications, development and programming, and modeling and simulation.

Ground Is Dominant Platform Because of Growing Use of Terrestrial Antennae for Situational Awareness

By platform, the industry is categorized into ground, airborne, space, and naval. The ground category holds the largest share of the industry because of the rising use of progressive data links, VHF/UHF/L-Band, and high-speed communication systems for ground forces. A wide range of terrestrial antennae are utilized to find threats and communicate with satellites, by enabling the transmission of airborne signals.

The airborne category will display extraordinary development in the coming years. This is because of the launch of the next generations of avionics for fighter airplanes, which will offer wideband video, voice, and data for armed forces. Moreover, reconnaissance aircraft depend on a robust communication network to send and receive data from control rooms and military commands.

Command & Control Category Is Dominant Application Credited to High Acceptance of Manpack Radios

Based on application, the industry is divided into ISR, command & control, routine operations, situational awareness, and others, among which the command & control category is leading the industry. This is because of the high acceptance of manpack radios for command & control applications, increasing political disagreement among neighboring nations, and rising count of battles, such as the ongoing Russia–Ukraine confrontation.

The ISR category is projected to advance at a substantial rate in the coming years, credited to the continuous increase in the initiation of ISR operations via the aerial, naval, and ground media. For instance, Parsons Corporation signed an agreement in March 2021 with the Naval Information Warfare Center (NIWC) to create field ISR systems that offer strong surveillance, communication, and security to the U.S. Navy.

Biggest Companies Offering Military Communications Solutions Are:

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- General Dynamics

- Thales Group

- BAE Systems

- L-3 Communications Holdings Inc.

- Harris Corporation

- Raytheon Anschütz

- Rockwell Collins

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws