Report Code: 11730 | Available Format: PDF | Pages: 330

Micro Battery Market Report: Latest Trends, Growth Prospects, and Competition Analysis, 2024-2030

- Report Code: 11730

- Available Format: PDF

- Pages: 330

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Micro Battery Market Statistics

| 2023 Market Size | 2024 Market Size | 2030 Market Size | 2024-2030 CAGR | Nature of Market |

| USD 489.3 Mn | USD 587.3 Mn | USD 2,060.2 Mn | 23.3% | Consolidated |

Key Information Available in this Report

|

|

|||

Major Players

Growth Outlook

The micro battery market was valued at USD 489.3 million in 2023, witnessing a compound annual growth rate (CAGR) of 23.3% between 2024 and 2030, to reach USD 2,060.2 million by 2030. This can be ascribed to the rising usage of wearable devices and advancements in technology such as the internet of things (IoT) and artificial intelligence along with automation and robotics.

- Moreover, the increasing demand for micro batteries in a variety of sectors, such as residential, automotive, and consumer electronics, is driving the growth of the market.

- The increasing availability and surging adoption of electronic devices such as wearable gadgets, smart cards, medical monitoring equipment, and wireless communication chips are boosting the demand.

- Additionally, this battery is more advantageous than other forms of batteries since it is a renewable and more refined source of energy, producing no carbon emissions to the atmosphere and ensuring a smooth and predictable power supply.

- In order to overcome the complexity originated by conventional battery technologies, masses are switching over to this advanced energy-saving solution, boosting the demand for micro batteries worldwide.

- Furthermore, the healthcare category is strongly influenced by the development in the micro battery industry. Medical applications that need consistent, uninterrupted power depend heavily on the predictability and reliability of these button batteries.

- Button batteries are most commonly used in medical devices such as glucometers, thermometers, pacemakers, smartwatches, and fitness bands.

High Demand for Smart Wearable Devices

The emergence and development of smart wearable devices have been major driving forces for the growth of the market. These devices, including smart wearables, fitness trackers, and health monitoring systems, require compact and energy-efficient power sources to function while still being aesthetically pleasing and lightweight in nature.

These include lithium-ion batteries, in particular, providing a win-win situation that combines high-energy density with extending lifecycle and a compact size. As the demand for wearable continues to expand, the micro battery market will also continue to grow.

CR (Lithium) Batteries Dominate the Market

- On the basis of type, the lithium category grasped largest market share, around 40%, in 2023. This is ascribed to its high-energy density among all battery types with comparatively small and lightweight packaging, making it ideal for the functioning of microelectronics.

- Additionally, this is due to its advantages such as operating within a wide range of temperatures, both high and low making it suitable for diverse atmospheres, low discharging rate, fast charging, high voltage, and recyclable in nature.

- Furthermore, lithium batteries have a wide range of landscape for usage in wearable technology, IoT sensors and devices, Bluetooth devices, medical devices, key fobs and remote controls, portable electronics, smart cards, RFID tags, wireless sensors, and Beacons.

- Moreover, these batteries will continue to advance, leading to their increasing adoption in a variety of industries and applications.

- Also, their versatility and environmental benefits make them a preferred choice for powering devices and systems.

Below listed types of micro battery are covered in this study:

- CR (Lithium) (Largest and Fastest-Growing Category Market)

- LR (Alkaline)

- SR (Silver Oxide)

- Others

10–100 mAh Category Holds the Largest Market Share

Micro batteries having a capacity of 10–100 mAh hold the largest share in the market. The increasing prevalence of such batteries in the microelectronic market is ascribed to their versatile range providing power to various applications, including small electronic devices, remote controls, IoT sensors, wearables, and key fobs; longer runtime; compact size; and balanced energy density.

On the other hand, <10 mAh batteries are usually preferred in ultra-compact and low-powered electronic devices, such as RFID tags and hearing aids. Also, these micro batteries cater to a relatively niche market, and thus, this category holds a significant market share, as a large volume of devices needs such batteries.

Additionally, >100 mAh batteries have specifically high power, which is taken into account only when there is a high requirement for electric current, generally used in portable electronic gadgets, wireless communication devices, and medical devices.

Three major capacities of micro battery are included in this report:

- <10 mAh

- 10–100 mAh (Largest and Fastest-Growing Category Market)

- >100 mAh

Demand for Rechargeable Batteries To Witness a Higher CAGR

- The rechargeable micro batteries category under the rechargeability segment is expected to witness a higher compound annual growth rate during the forecast period. This growth can be ascribed to some of the consequent benefits like reusability.

- Rechargeable batteries have the advantage of being reused multiple times, making them a more value-for-money perspective as compared to single-use batteries.

- Environment-friendly, sustainable, and low-self-discharging capabilities make them to be used for significantly longer intervals.

- Rechargeable batteries are often characterized as secondary batteries, due to their use in memory backup applications. These can simply be used by plugging them into power sockets or USB ports.

- On the other hand, non-rechargeable micro batteries are composed of alkaline, silver oxide, and zinc, which make them cost-effective and long-shelf-live batteries, with low maintenance.

- Additionally, these batteries are extensively used in a plethora of applications like remote controls, watches, clocks, and low-drain devices. These batteries are often known as primary batteries.

The rechargeability categorization of micro battery includes:

- Non-Rechargeable (Larger Category Market)

- Rechargeable (Faster-Growing Category Market)

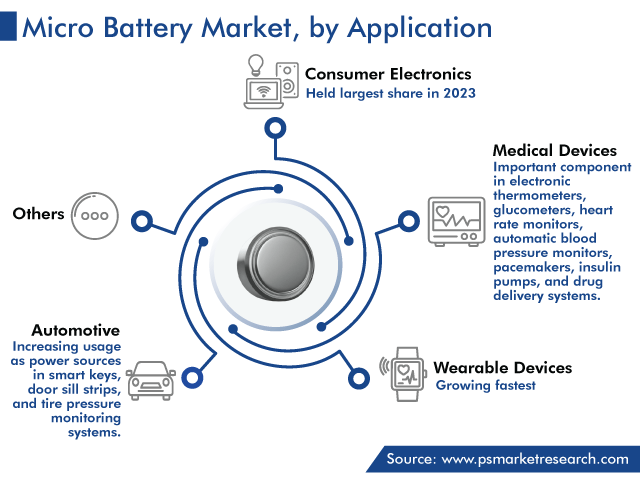

Consumer Electronics Grasp Highest Revenue

Micro batteries are key components of consumer electronics; thus, this category holds the largest market share. Moreover, the need for compact and dependable power solutions is rising across the world.

These batteries are widely used in the consumer electronics sector to provide the energy required to power a variety of devices, from smartphones to digital cameras and remote controls. Additionally, micro batteries are used to power wireless earbuds and other earbud-like devices. These are essential for the uninterrupted operations of electronic devices serving the masses for entertainment and convenience.

Moreover, micro batteries serve as the powerhouse of consumer electronics, as these are designed with high-energy density in mind as well as according to the long cycle life and compact form factor, which are essential for meeting the power requirement of contemporary consumer electronics. They also contribute to the portability of these devices, as well as their performance and user experience.

Applications of micro batteries found in:

- Medical Devices

- Consumer Electronics – Largest Category Market

- Wearable Devices – Fastest-Growing Category Market

- Automotive

- Others

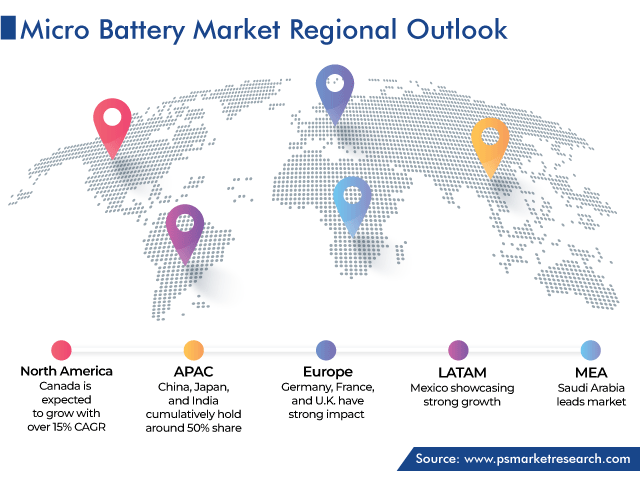

APAC Market To Record the Highest CAGR

Globally, the Asia-Pacific (APAC) market is expected to witness the fastest growth during the forecast period, advancing at a CAGR of 25%.

- This can be ascribed to the bourgeoning requirement for medical devices and the surging adoption of wearable devices, with their ability to sync with mobile or cloud and update information in apps or web browsers. Their convenience and ease of data access have also contributed to the growth of micro batteries in the region.

- Additionally, in Asian Markets like India and China, micro batteries are projected to experience a surge in demand, as a result of the increasing popularity of next-generation (NG) smart cards in these countries. This has led to an increase in the need for flexible batteries for smart cards.

- Furthermore, the demand for micro batteries is expected to further expand in Asia-Pacific, owing to the increasing demand for smart packaging, GPS devices, miniature devices, and robots in major countries of the region.

Moreover, in Europe, countries like Germany and U.K., the micro battery industry is booming at a high rate.

- This is due to the heavy use of electric equipment; smart packaging industries turn to flexible batteries; and people are more likely to use smart devices to access important information.

- The shift in lifestyle and the development of new technologies have led to a boom in smart labels and packaging that rely on micro batteries.

Below listed regions and countries are covered in this study:

- Asia-Pacific (APAC) (Largest and Fastest-Growing Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Australia

- Rest of APAC

- Europe

- U.K. (Fastest-Growing Country Market)

- France

- Spain

- Germany (Largest Country Market)

- Italy

- Rest of Europe

- North America

- U.S. (Larger and Faster-Growing Country Market)

- Canada

- Latin America (LATAM)

- Brazil (Largest Country Market)

- Mexico (Fastest-Growing Country Market)

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa

- U.A.E. (Fastest-Growing Country Market)

- Rest of MEA

Recent Developments

Major key players have been involved in product launches to gain a key position in the market. For instance, in September 2022, Maxell Ltd. launched PSB401515H, a solid-state battery packaged with ceramic ceasing providing increased durability and safety compared to traditional battery technologies. Maxell’s high-capacity solid-state batteries witnessed significant development with advanced electrolytes.

In November 2022, VARTA AG powered with the latest coin power series, the A% family at Electronica. These cutting-edge cells are specifically designed for applications such as TWS and wearables.

Micro Battery Market Companies:

- Panasonic Corporation

- VARTA AG

- Murata Manufacturing Co. Ltd.

- Ultralife Corporation

- Koch Industries Inc.

- Energizer Holdings Inc.

- Seiko Instruments Inc.

- The Swatch Group Ltd.

- Maxell Ltd.

- Berkshire Hathaway Inc.

- Toshiba Lifestyle Products & Services Corporation

- GP Batteries International Limited

- TDK Corporation

- Shenzhen Grepow Battery Co. Ltd.

- Duracell Inc.

- Enfucell

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws