Market Statistics

| Study Period | 2019 - 2030 |

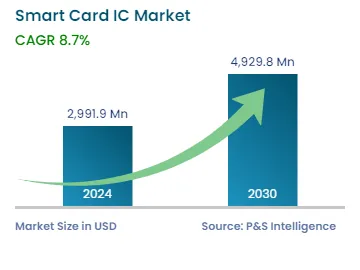

| 2024 Market Size | USD 2,991.9 Million |

| 2030 Forecast | USD 4,929.8 Million |

| Growth Rate(CAGR) | 8.7% |

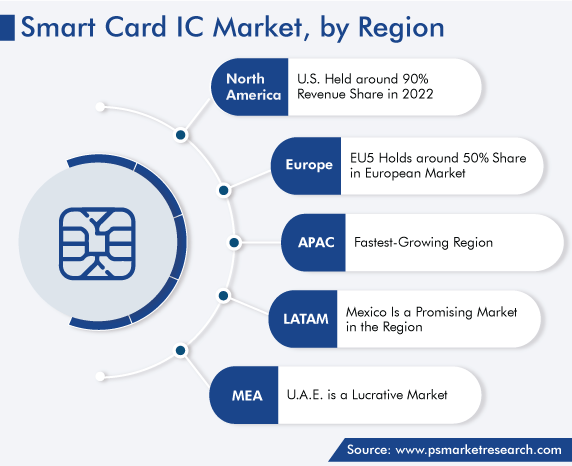

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12645

Get a Comprehensive Overview of the Smart Card IC Market Report Prepared by P&S Intelligence, Segmented by Type (Microcontroller, Memory), Architecture (16-bit, 32-bit), Interface (Contact, Contactless, Dual-Interface), Application (USIMs/eSIMs, ID Cards, Financial Cards, IoT Cards), End User (Telecommunications, BFSI, Transportation, Education, Retail, Healthcare, Government), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,991.9 Million |

| 2030 Forecast | USD 4,929.8 Million |

| Growth Rate(CAGR) | 8.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The smart card IC market size stood at USD 2,991.9 million in 2024, and it is expected to grow at a compound annual growth rate of 8.7% between 2024 and 2030, to reach USD 4,929.8 million by 2030. This will be due to the rising usage of financial cards and other secure payment solutions. Additionally, the adoption of smart IDs in educational institutions and e-governance projects is contributing to the growth.

Due to the rising usage of credit/debit cards globally, the demand for integrated circuits in these payment gateways is also growing at a high pace. Their usage has seen an instant growth since the outbreak of the COVID-19 pandemic, as they played a vital role as both a source of credit in emergencies and a payment method, with more transactions than ever occurring online. This was because people were not able to move out of their homes; hence, a lot more consumers applied for new financial cards in 2020 than the year prior for making smooth transactions from home.

Due to the pandemic, the demand for contactless cards also increased as a way to prevent COVID-19 spread. This move was also backed by various financial organizations, such as VISA and American Express. Consumers can pay for things with just a tap, by touching the card on any reader in a hygienic way, without any actual physical contact.

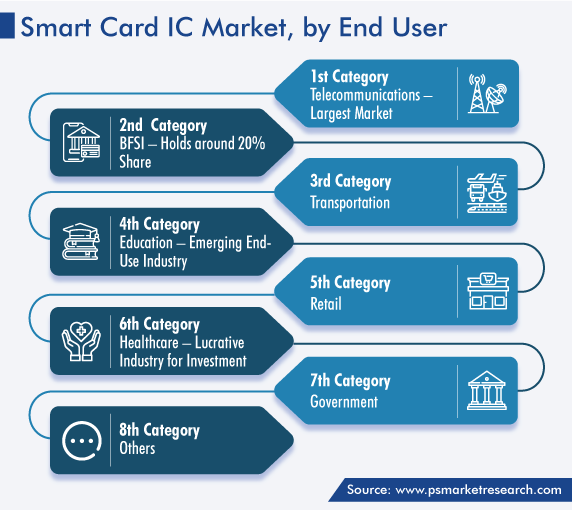

In the end user segment, the telecommunications category held the largest share in 2022. This is due to the use of integrated circuits in subscriber identity modules, driven by the rising smartphone adoption. Companies are not only providing prepaid and postpaid SIMs but also the pay-as-you-go variants with little paperwork, which makes it easier for consumers to access these cards. Further, various initiatives are being taken by the government of different countries to connect people in rural areas with the internet or mobile phones.

The government category in the end user segment is expected to grow at a significant rate in the forecast period. This is due to the increasing usage of smart cards in various documentation equipment, such as chip-embedded IDs, passports, and driver’s license. This is because they are more secure due to the usage of various encryption algorithms in their security systems. Various countries, such as the U.S., are identifying these cards as an appropriate technology for identity applications that must meet critical security requirements. The Federal Government is also specifying smart cards in new identity programs for citizens and transportation workers. Because of this successful implementation of smart cards in the U.S., other countries, including India, Singapore, Jamaica, Barbados, and The Bahamas, are also looking at them as an identity proof, health card, and other platforms.

In the interface segment, the contactless category is growing at a high rate. This is due to the increasing usage of these cards in various organizations and educational institutions as an access control device. They are used in biometric systems as they transmit data from only one direction and do not require the internet to process. Moreover, due to the COVID-19 pandemic, many organizations shifted to contactless smart cards, as they are a more-hygienic option compared to touch-based biometric technologies, such as palm geometry and fingerprint recognition.

These devices are also being used in financial applications as vendors are providing credit/debit cards with the one-touch payment facility, in which the user just has to tap the card on a screen or any other device to make the payment. Following the tap, the transaction and other information needed to complete the transaction are authenticated automatically.

The contact-based category held the largest share in the market in 2022. This is due to the burgeoning usage of ICs in smart SIMs, financial cards, and many more such instruments. These devices help in the identification and authentication of the user with the help of the contact-based technology, which reads the data encrypted in these cards. Contact-based debit and credit cards are already widely popular, with many large BFSI companies, such as Visa, Mastercard, American Express, and UnionPay, providing them for secure and fast transactions.

On the basis of type, the microcontroller category held the largest share in 2022, and it is expected to lead the market in the forecast period, as these chips offer greater memory storage and security to data compared to the traditional magnetic-stripe cards. Moreover, these chips allow for improved cryptographic security and extended usability. In this regard, the increasing use of financial and biometric ID cards globally is contributing to the dominant share of the microcontroller category in the market.

Drive strategic growth with comprehensive market analysis

APAC is expected to advance at a high rate in the forecast period, due to the rapid urbanization and industrialization in the region. Additionally, the rapid adoption of new technologies in the telecommunications, BFSI, and healthcare sectors is propelling the integration of integrated circuits in smart cards. In addition, the number of SIMs being used in the region is increasing at a high rate, which will contribute to the industry’s growth.

Moreover, since the COVID-19 pandemic, people in the region have understood the importance of online or cashless transactions, due to which the demand for smart financial cards is increasing. Essentially, due to the presence of many major players, the APAC region contributes the highest revenue to the global market.

The region will be dominated by China, followed by South Korea, Australia, Japan, and India. In developing countries, including India and Malaysia, governments are implementing many policies for increasing the usage of connected infrastructure, the internet, and online/cashless transactions. Due to such initiatives, the number of online transactions continues to surge, which impacts the smart card IC market in a positive way.

Based on Type

Based on Architecture

Based on Interface

Based on Application

Based on End User

Geographical Analysis

The market for smart card ICs valued USD 2,991.9 million in 2024.

Contactless payment solutions are a key opportunity in the smart card IC industry.

ID cards are growing as an application in the market for smart card ICs.

The interface segment of the smart card IC industry is dominated by the contact-based bifurcation.

The APAC market for smart card ICs is growing rapidly.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages