Report Code: 11670 | Available Format: PDF | Pages: 155

Metering Pump Market Research Report: By Type (Diaphragm, Piston), End User (Water Treatment, Petrochemicals, Oil and Gas, Chemical Processing, Pharmaceuticals, Food and Beverage, Pulp and Paper) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 11670

- Available Format: PDF

- Pages: 155

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Metering Pump Market Overview

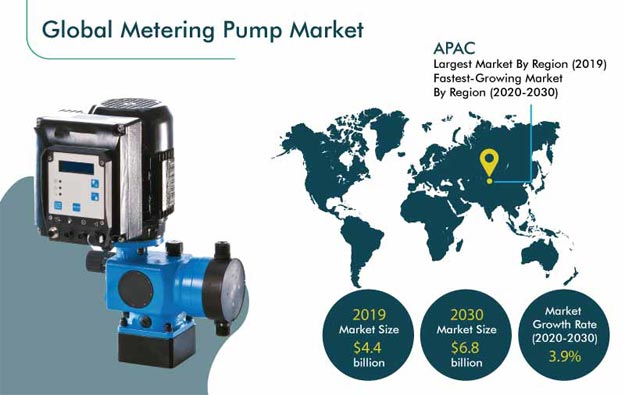

The global metering pump market size was $4.4 billion in 2019, and it is expected to register a CAGR of 3.9% over the forecast period (2020–2030). Strict government regulations for water treatment and rising demand for such devices from the oil & gas industry are some major growth factors propelling the metering pump industry. Additionally, in the Asia-Pacific (APAC) region, the increasing government regulations for water treatment, chemical sector, and foreign direct investments (FDIs) in manufacturing plants are some major factors influencing the demand for metering pumps.

The COVID-19 pandemic that started in late 2019 has severely impacted the metering pump market across the globe. The slow economic growth and stringent lockdown measures implemented by governments have led to the plummeting of the overall market, both on the supply and demand sides. The supply of raw materials, required for production, from China, Japan, and numerous Association of Southeast Asian Nations (ASEAN) member countries has been disrupted, which has put a major strain in the production of metering pumps. The shrunken labor availability over time, due to shutdowns, followed by the migration of workers to their home states, has also impacted the production of pumps.

Segmentation Analysis

Diaphragm Is Fastest-Growing Category in Industry due to Various Advantages Offered

The diaphragm category registered the fastest growth in the metering pump market till 2019, based on type, and it is expected to retain its pace over the forecast period. This is because of the various advantages offered by these pumps over other types. Other than their ability to handle abrasive, flammable, and corrosive liquids and pump liquids of much-higher viscosities, diaphragm pumps are more energy-efficient and cheaper to operate in the longer run. Diaphragm metering pumps are further classified into metallic and polytetrafluoroethylene (PTFE). Of them, the PTFE segment held larger metering pump market share in 2019, owing to the flexibility and robustness of the materials used for the diaphragm of the pump.

Water Treatment Is Largest End-User Category due to Tough Government Regulations for Safe Drinking Water

In the metering pump market outlook, the water treatment category, based on end user, held the largest market share in 2019. This can be attributed to the tough government regulations for safe drinking water around the world. For instance, the Safe Drinking Water and Fluoride Monitoring Protocol was made effective in February 2019 by the Ontario Ministry of Health and Long-Term Care, to provide direction to health boards on the components of the Safe Water Program, for the reduction and prevention of water-borne illness. This rise in such regulations has led to an increase in the number of water treatment projects, to make water suitable for reuse. Since a variety of chemicals are used for wastewater treatment, metering pumps are being used to measure the correct dosages of those chemicals. These applications of metering pumps in water treatment plants are boosting the metering pump market.

Geographical Outlook

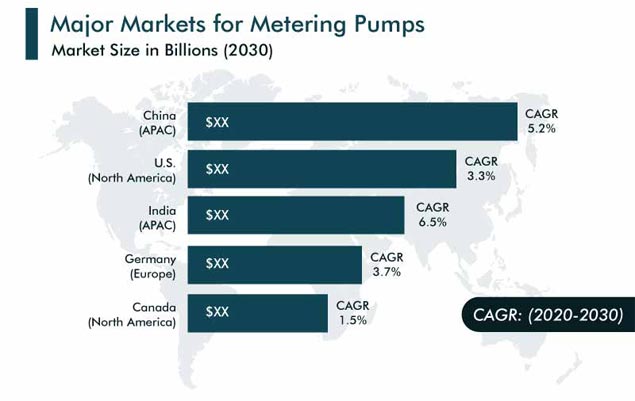

Asia-Pacific (APAC) – Largest Regional Market owing to Increasing Demand at Water Treatment Plants

The APAC region held the largest share in the metering pump industry during the historical period (2014–2019). China and India held the major share in the regional metering pump market, owing to the growing population and industrial expansion, which are fueling the demand for freshwater. Ample safe drinking water availability has become a top priority for governments in the region, especially in China, India, and Japan. This is fueling the setting up of water treatment plants in the region, which, in turn, is propelling the high-volume sale of metering pumps, due to their requirement for the water treatment process.

Asia-Pacific (APAC) – Fastest-Growing Regional Market due to Rise in Industrial Development Activities

APAC is also the fastest-growing region in the metering pump market currently, and it is expected to retain the pace throughout the forecast period. One of the major factors driving the market growth in the region is the rise in industrial development activities, visible in the setting up of new manufacturing facilities in every major industry, such as chemical processing, pharmaceuticals, and oil & gas. This rapid industrial expansion is opening up huge avenues in the region, and, coupled with the availability of low-cost raw materials for pump production, it will help the market pick up pace here.

Trends & Drivers

Increasing Demand for Energy-Efficient Metering Pumps Is Key Market Trend

A prominent trend being observed in the metering pump market is the growing popularity of energy-efficient metering pumps. Power consumption has become a major cost factor for metering pumps. With a longer functioning time in certain applications, energy-efficient pumps are being deployed to reduce energy wastage, without compromising the accuracy. The high energy efficiency of these systems allows for energy savings, and hence, reduces the cost burden. Cost advantages, coupled with enhanced energy efficiency, improved overall productivity, and low maintenance requirements, have led to a surge in the popularity of such models in the metering pump market.

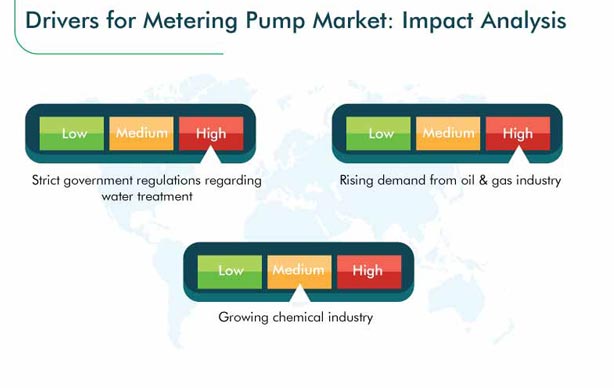

Strict Government Regulations Regarding Water Treatment Are Important Driver

The strict government regulations for water treatment across the globe are a key driver for the metering pump industry. These pumps are used in water treatment plants to feed chemical additives to the wastewater, to eliminate pollutants, slurry, and harmful microorganisms, thereby enhancing the water quality.

In 2018, the Water Infrastructure Act (AWIA) of the U.S. was amended, and the strengthened law focuses on all water that is currently or theoretically intended for drinking. This act authorizes the Environmental Protection Agency (EPA) to set minimum requirements to protect drinking water from pollution and requires all surface water system operators or owners to meet the health-related requirements. These toughening regulations are expected to boost the metering pump market during the forecast period.

Rising Demand for Metering Pumps in Midstream Oil & Gas Processes

The oil & gas industry is playing a major role in the growth of the global metering pump industry. This can be attributed to the rising usage of metering pumps in the dosing of corrosion inhibitors in midstream processes and the extraction of oil & natural gas. The rise in the production of crude oil in the U.S., Saudi Arabia, Russia, Iraq, and other countries is leading to an increase in the demand for metering pumps in the industry.

As per the U.S. Energy Information Administration (EIA), the country produced 10.96 million barrels of crude oil per day in 2018. The EIA projects that U.S. crude oil production will continue to grow, averaging 12.3 million barrels and 13.0 million barrels per day in 2019 and 2020, respectively. Hence, the increasing production of crude oil has boosted the demand for these pumps and is driving the overall metering pump market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$4.4 billion |

Forecast Period CAGR |

3.9% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, COVID-19 Impact, Company Share Analysis, Companies’ Strategical Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

By Type; By End-User; By Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Japan, China, India, Brazil, Mexico, Saudi Arabia, Turkey, U.A.E. |

Secondary Sources and References (Partial List) |

American Petroleum Institute (API), British Pump Manufacturers’ Association (BPMA), European Association for Pump Manufacturers, European Hygienic Engineering and Design Group, Food Processing Suppliers Association (FPSA), Hydraulic Institute, Indian Pump Manufacturers’ Association (IPMA), International Water Association, Iowa Rural Water Association, Mass Rural Water Association, Submersible Wastewater Pump Association (SWPA), Water Quality Association |

Explore more about this report - Request free sample

Growing Chemical Industry Augmenting Uptake of Metering Pumps Worldwide

Metering pumps offer various advantages to the chemical industry, such as pumping and handling corrosive chemicals. Other advantages, such as high energy-efficiency, low maintenance costs, and longer service life, have provided good results to the chemical industry, which, in turn, is leading to a wide adoption of such devices. The growing chemical industry in China, Europe, and the U.S. is favorable for the metering pump market. The increasing crude exploration & production activities in the U.S. have resulted in growing investments in the construction of chemical plants.

Market Players’ Purpose of Launching New Products Is to Increase Business Growth Rate

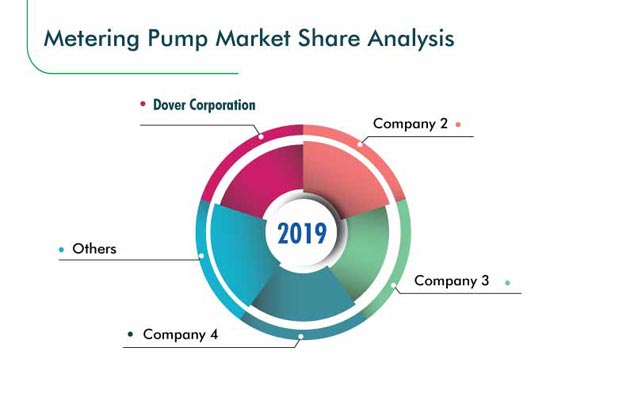

The metering pump industry is highly consolidated and competitive in nature, with the presence of a limited number of market players, such as SEKO S.p.A., Grundfos Pumps Corporation, LEWA GmbH, IDEX Corporation, and ProMinent GmbH.

In recent years, apart from engaging in extensive research and development (R&D), players in the industry have launched several new and advanced products to stay ahead of their competitors. For instance:

- In April 2020, Blue-White Industries Ltd. launched the FLEXFLO A1F peristaltic metering pump that offers high energy efficiency, requires minimal maintenance, and has an enhanced tube failure detection system, which works with all chemicals.

- In February 2020, Blue-White Industries Ltd. launched a new CHEM-PRO CD3 multi-diaphragm metering pump that offers smooth, pulse-less chemical feed.

- In July 2019, SEKO S.p.A launched a new metering pump that is integrated with the company’s diaphragm technology and offers better performance and reduced wear of materials such as PTFE and metals.

Some of the Key Players in the Metering Pump Market are:

-

Spirax-Sarco Engineering plc

-

Dover Corporation

-

Verder International B.V.

-

SEKO S.p.A.

-

Grundfos Pumps Corporation

-

LEWA GmbH

-

IDEX Corporation

-

ProMinent GmbH

-

Ingersoll Rand plc

-

Blue-White Industries Ltd.

-

SEEPEX GmbH

-

MCFARLAND PUMPS

-

Morrill-Industries Inc.

-

Cole-Parmer Instrument Company LLC

-

SPX FLOW Inc.

-

AxFlow Holding AB

-

Evoqua Water Technologies LLC

-

North Ridge Pumps Limited

-

Idex Corporation

-

Progressive Pumps Corp.

Metering Pump Market Size Breakdown by Segment

The metering pump market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- Diaphragm

- Metallic

- Polytetrafluoroethylene (PTFE)

- Piston

Based on End User

- Water Treatment

- Petrochemicals

- Oil and Gas

- Onshore

- Offshore

- Chemical Processing

- Pharmaceuticals

- Food and Beverage

- Pulp and Paper

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- APAC

- Japan

- China

- India

- LATAM

- Brazil

- Mexico

- MEA

- Saudi Arabia

- U.A.E.

- Turkey

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws