Report Code: 12837 | Available Format: PDF | Pages: 250

Medical Packaging Films Market Size and Share Analysis by Material (PE, PP, PVC, Polyamide, Metal), Type (Thermoformable, High-Barrier, Metallized), Application (Bags & Pouches, Tubes), End User (Pharmaceutical Companies, Medical Devices Companies) - Global Industry Demand Forecast to 2030

- Report Code: 12837

- Available Format: PDF

- Pages: 250

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Medical Packaging Films Market Size & Share

The medical packaging films market size stood at USD 7,904.2 million in 2023, and it is expected to grow at a compound annual growth rate of 6.1% during 2024–2030, to reach USD 11,752.8 million by 2030. The demand for medical packaging films is extensively driven by the high need for medical products and equipment in response to the rising number of patients and the growing aging population globally, and the advent of enhanced packaging solutions to provide protection to concerned products.

Moreover, the surging use of packaging films in the medical industry is attributed to their high-performance properties such as high transparency, unreactive to chemicals, and lightweight. Also, it can be stored, handled, opened, and resealed at ease, which makes it useful for pharma use. These films are mostly manufactured from metals and various plastic forms and are used for making blister packs (unit dose packaging), medical bags, sachets, wraps, pouches, and labels. Also, these are used for various applications in the industry such as individual wrap packaging including syringes, water-soluble packaging such as bags & pouches and sachets, and multi-compartmental trays.

Rising Incidence of Chronic Diseases

The patient population across regions has been increasing, owing to the rise in the incidence of chronic diseases such as diabetes, cancer, and other chronic conditions. In response to these diseases, the demand for medical products and services is increasing rapidly, which, in turn, bolsters the demand for medical packaging films.

For instance, in the U.S., in 2022, more than one million new cancer cases were diagnosed in the country. Further, the prevalence of cardiovascular disorders (CVD), rheumatoid arthritis, and others is on the rise, due to the growing geriatric population. CVD accounted for more than 900,000 deaths in 2020 in the country. Therefore, the growing prevalence and awareness of chronic disorders among the population worldwide are driving the requirement for drugs, vaccines, and therapies, which, in turn, is expanding the need for packaging films.

Increasing Investment in the Healthcare Sector

A rise in healthcare expenditure is the prime growth driver for the medical and pharmaceuticals industry and hence gives a boost to the demand for various protective packaging materials for proper handling of required products from their transit to end-use. The high investment is due to the high inclination of governments to invest in medical infrastructure to provide required and advanced healthcare facilities to the masses, the rising living standards, the growing aging population, and the increasing R&D activities by companies.

For instance, healthcare spending in the U.S. reached USD 4.3 trillion in 2021, growing by 2.7% as compared to the previous year. Similarly, the retail spending for non-durable medical products, such as medical instruments, surgical dressings, and over-the-counter medicines reached around USD 95 billion in 2021 in the country.

Furthermore, the heavy investment in the healthcare sector in emerging countries such as China, India, Brazil, Argentina, and South Korea is led by their rising GDP, which is expected to fuel the market for pharmaceutical packaging films. As per government sources, the pharmaceutical industry in APAC attracted the highest amount of FDI of USD 32 billion till 2021, which includes an investment of around USD 20 billion in medical devices and the rest in biotechnology and other healthcare sub-sectors.

Surging Demand for Bioplastics

Bioplastics have witnessed a dynamic shift and demonstrated substantial growth in demand, due to the commercial acceptance, manufacturing, investments, and R&D in the plastics sector. Being derived from renewable feedstocks such as sugarcane, corn, and cellulose, bioplastics are increasingly gaining attention across the globe, owing to their wide applications across several industries such as automotive, packaging, consumer goods, and textiles. Therefore, with their eco-friendly properties, promising government policies for manufacturing sustainable solutions, and accessibility of renewable stocks, the use of bioplastics is rising. Also, the improvement in the scope of bioplastics across end-use industries and the upsurge in the acceptance of biodegradable products in the medical and pharma sectors are expected to boost the demand for pharmaceutical packaging films.

| Report Attribute | Details |

Market Size in 2023 |

USD 7,904.2 Million |

Market Size in 2024 |

USD 8,252.0 Million |

Revenue Forecast in 2030 |

USD 11,752.8 Million |

Growth Rate |

6.1% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Material; By Type; By Application; By End User; By Region |

Explore more about this report - Request free sample

High Use of Polyethylene for Pharmaceutical Packaging

In 2023, the polyethylene category constituted a considerable revenue share, of around 35%, in the medical packaging films market, and it is further expected to witness a remarkable growth rate in the coming years. This is ascribed to its excellent chemical resistance and high flexibility. Also, it acts as a leak-proof barrier against moisture to avoid product contamination and further protects medical products against germs, moisture, and tampering due to its improved sterilization.

Among the types of PE, high-density polyethylene (HDPE) and low-density polyethylene (LDPE) are the most common materials that are used for pharmaceutical products. HDPE is mostly used for making drug containers, as it is less likely to be affected by acids and alkalis; and LDPE has wide usage in manufacturing plastic bags, as it has low density.

Furthermore, the sales of polypropylene (PP) materials is also growing. This is because PP is suitable for applications requiring sterilization at high temperatures, as it has a higher melting point than PE. Also, it is used for making strapping tape, gusseted bags, poly strapping, and polypropylene boxes.

In addition, consistent novelties in these materials are expected to propel market growth in the future. For instance, in April 2022, Amcor, a packaging solution manufacturing company, announced a low-carbon, recycle-ready packaging option under its pharmaceutical packaging product portfolio. The new high-shield pharma laminates portfolio delivers high barrier and safety requirements for pharma products while supporting companies’ recyclability programs.

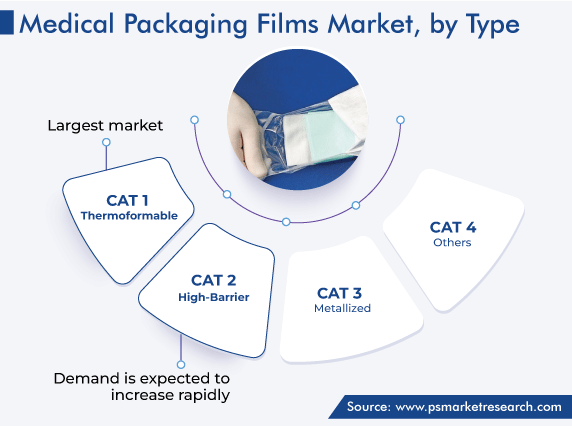

Thermoformable Films Hold a Substantial Revenue Share

Within the current available raw materials, thermoformable films are highly considered as an ideal packaging material for pharmaceutical consumables and non-consumables, due to the benefits associated with it such as soft, high-puncture resistance, quick transformation time, and low cost. Hence, the category captured the largest revenue share in the market in 2023. Moreover, it is a recyclable, financially efficient option and ensures product protection and sustainability. It also creates a sterilized barrier for single-use medical devices that come in different shapes and sizes.

Further, consistent innovations in these films are expected to foster sustainability and market growth in this category in the future. For instance, in April 2021, Amcor plc announced customer trials of the world’s initial recyclable polyethylene-based thermoform blister packaging – AmSky. It is created to meet the strict and specific requirements of highly regulated pharma product packaging. AmSky incorporates lidding film and polyethylene thermoform blister instead of PVC, and thus, reducing around 70% of its carbon footprint when compared to other packaging alternatives available in the market.

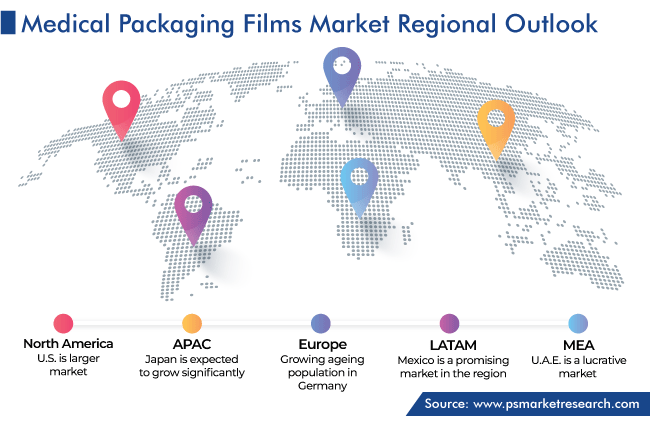

APAC Holds a Considerable Market Share

In 2023, the APAC market generated a significant value, and it is also projected to grow with a remarkable CAGR of 6.5% during the forecast period. This is attributed to the surging demand for pharmaceuticals, owing to the increased healthcare expenditure, enhanced availability of pharmaceuticals and medical devices especially for chronic disorder treatment, the growing aging population, the rising incidence of chronic diseases, and the provision of government support and incentives in the region.

Moreover, the mounting disposable income in the region leads to higher expenditure on healthcare and the surging sustainable flexible packaging due to the increasing consumption of plastics in the medical sector are driving the regional market.

Top Medical Packaging Film Manufacturers:

- 3M

- Amcor Plc

- Covestro AG

- DuPont de Nemours Inc.

- Glenroy Inc.

- Honeywell International Inc.

- Klöckner Pentaplast

- POLYCINE GmbH

- Toray Industries Inc.

- RENOLIT SE

Market Size Breakdown

This report unveils significant trends and opportunities in the medical packaging films market, providing in-depth segmentation analysis from 2017 to 2030. The breakdown by materials, film types, applications, end users, and geographical regions offers a comprehensive understanding of the market landscape.

Materials Covered in This Study

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyamide

- Metal

Types of Films Covered in This Study

- Thermoformable

- High-Barrier

- Metallized

Applications of Films Covered in This Study

- Bags & Pouches

- Tubes

End Users of Medical Packaging Films

- Pharmaceutical Companies

- Medical Devices Companies

Regions/Countries Considered in the Study

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The medical packaging films market size stood at USD 7,904.2 million in 2023.

During 2024–2030, the growth rate of the medical packaging films market will be around 6.1%.

Bags & pouches is the largest application area in the medical packaging films market.

The major drivers of the medical packaging films market include the high demand for pharmaceuticals and medical devices as a consequence of the rising incidence of chronic diseases and the growing aging population, and the surging demand for sustainable pharmaceutical packaging solutions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws