Report Code: 12787 | Available Format: PDF | Pages: 280

Medical Exoskeleton Market Size and Share Analysis by Component (Hardware, Software), Type (Powered, Passive), Extremity (Upper Extremities, Lower Extremities, Full Body) - Global Industry Demand Forecast to 2030

- Report Code: 12787

- Available Format: PDF

- Pages: 280

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Medical Exoskeleton Market Overview

The global medical exoskeleton market valued USD 485.8 million in 2023, and it is projected to register a CAGR of 44.8% during 2024–2030, reaching USD 6,336.8 million by 2030. This is due to the increasing number of people with physical disabilities, rising geriatric population, and growing count of orthopedic surgeries. For instance, according to the WHO, an estimated 1.3 billion people, or 1 in 6 people worldwide, experience significant disability.

Moreover, the rising number of road accidents, severe injuries, and strokes is contributing in the growth of this market. Approximately, 1.3 million people die each year as a result of road traffic crashes, says the WHO. Thus, the increasing adoption of medical exoskeletons for the healing of injuries is driving the market growth.

Another important factor for the growing demand for such products is neurological diseases, such as acute spinal cord injury, ataxia, cerebral palsy, Alzheimer’s disease, Parkinson’s disease, and amyotrophic lateral sclerosis. They cause the human body to lose the control and coordination of physical movement, which is why their rising prevalence is expected to propel the demand for medical exoskeletons.

Hardware Component Accounted for Larger Share

Hardware accounted for the larger market share, of 60%, in 2023, and it is expected to grow at a CAGR of 45.0% during 2024–2030. This is because exoskeletons are made up of several pieces of hardware, including sensors, powered systems, actuators, and control systems.

Thus, in April 2022, Blackrock Neurotech announced that it will partner for research and development with Phantom Neuro for its patent-pending Phantom X system. The system allows patients to accurately control the existing and futuristic assistive devices, such as exoskeletons and prosthetics, in real time.

In addition, in June 2022, Ekso Bionics Holdings Inc. received the FDA clearance for EksoNR for rehabilitative use for MS patients. It was earlier approved for stroke and spinal cord injury in 2016 and then, for acquired brain injuries in 2022. The EksoNR provides support for the postural trunk, hip, knee, and ankle, encouraging lower body movements through sensors that detect patients’ instability movements and provide feedback to support them while standing.

Software is expected to be the faster-growing category, with a CAGR of 45.2%, during 2024–2030. This is because technological advancements will lead to an increase in the complexities in exoskeleton connectivity, which will create the requirement to integrate artificial intelligence (AI). The value of software in the overall exoskeleton market will increase with time as it enables such complex functionalities and results in quick and accurate physical movements.

Powered Exoskeletons Held Larger Share

Powered exoskeletons account for the larger share, because of the recent advancements in them. For instance, with funding from the NIH, Stanford University has developed an exoskeleton that adapts rapidly to users’ movement while they walk normally.

Moreover, the key players in the market are focusing on integrating advanced technologies, such as AI, to enhance the performance of their products. AI boosts the human potential, as well as the productivity of the devices. For instance, in December 2021, German Bionic launched the fifth generation of Cray X. The major advancements in the new model are active walking assistance, a 40-Volt battery, a more-powerful, and a new energy management system.

Passive exoskeletons also hold a significant share in the market, because of their lower price than powered exoskeletons. Moreover, passive exoskeletons are majorly used in developing and low-income countries, especially by those who cannot afford the powered ones.

| Report Attribute | Details |

Market Size in 2023 |

USD 485.8 Million |

Market Size in 2024 |

USD 688.2 Million |

Revenue Forecast in 2030 |

USD 6,336.8 Million |

Growth Rate |

44.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Component; By Type; By Extremity; By Mobility; By Region |

Explore more about this report - Request free sample

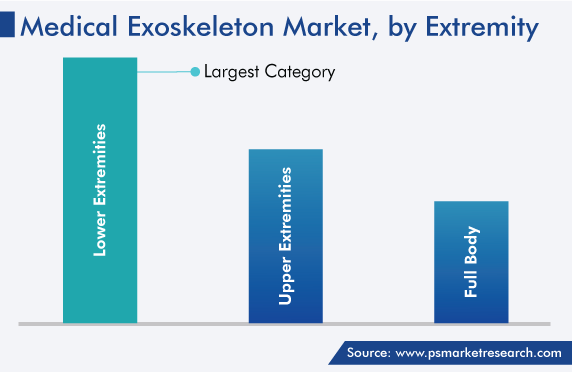

Medical Exoskeletons for Lower Extremities Held Largest Share

Lower-extremity exoskeletons accounted for the largest market share in 2023. This is because of the rising incidence of disability of lower body parts, such as the feet, ankles, and knee and hip joints. The rise in the number of people engaging in outdoor sports activities is a key factor contributing in this regard because outdoor activities, such as high jump, gymnastics, and other track & field events, soccer, hockey, and cricket, involve lower body parts, thus raising the risk of injury.

In addition, medical technology companies are more focused on lower-extremity-exoskeletons, for which they are widening their portfolio by acquiring other similar companies. For instance, in December 2022, Ekso Bionics acquired the human motion and control unit of Parker Hannifin Corporation. This move added to Ekso Bionics portfolio Indego line of lower-limb exoskeletons, and it will now allow Ekso Bionics to move ahead on the development of robot-assisted prostheses and orthotics. Parker’s FDA-approved lower-limb exoskeletons allow patients with paralysis in the lower parts of their body to receive task-specific, overground gait training.

Moreover, in April 2022, ReWalk Robotics Ltd. became a member of the Human Robot Interaction Consortium, which is a part of the MAGNET incentive program of the Israel Innovation Authority. This incentive program provides grants for R&D, as part of a consortium comprised of private businesses and academic centers.

Upper-extremity medical exoskeletons will register the fastest growth during the forecast period. This will be because of their advantages in the case of neurological diseases, neuromuscular disorders, arm disability, and musculoskeletal impairments. Furthermore, extensive research is being conducted on upper-body exoskeletons. For instance, in July 2022, Harmonic Bionics announced that the University of Houston (UH) has purchased its Harmony SHR exoskeleton for usage in research.

Also in July 2022, Harmonic Bionics announced that it has begun scheduling appointments for the in-person demonstrations of the Harmony SHR. The Harmonic Bionics team will travel across the U.S. to showcase the robotic system at various rehabilitation centers, hospitals, and clinics that have shown interest in the technology.

Further, in May 2021, the company announced the closure of its USD 7-million Series A financing round, with Big Basin Capital and KNet Investment Partners as the lead investors. DSC Investment, Bass Investment, Smilegate Investment, JCurve Investment, and H Robotics also participated in the investments, to support the clinical research efforts of Harmonic Bionics and allow it to advance its rehabilitation technology for the upper extremities.

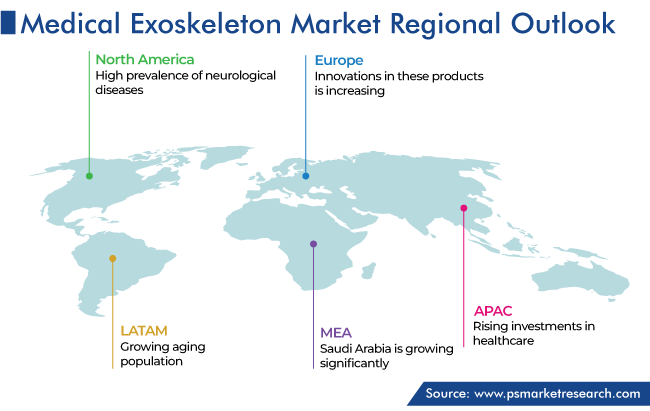

North America Accounted for Largest Share

North America held the largest share of global medical exoskeleton market, of 55%, in 2023, and it is expected to grow at a significant CAGR during 2024–2030. This is attributed to the rise in the geriatric population, high prevalence of neurological diseases, and increase in the government support for exoskeletons.

For instance, in September 2022, Human in Motion Robotics Inc. (HMR) announced a CAD 663,000 contract from Innovative Solutions Canada for the Department of National Defence Canada (DND). The agreement is for the Canadian government to purchase HMR's next-generation lower-extremity exoskeleton, XoMotion, which is designed to eliminate people’s dependence on wheelchairs and allow them complete mobility.

Moreover, in October 2021, the University of Michigan received USD 1.7 million from the NIH to develop new powered exoskeletons for the lower extremities. One in eight Americans faces a mobility disability, with serious difficulty in climbing stairs or walking. The University of Michigan team plans to develop a modular, powered exoskeleton system that can be used on one or multiple joints of the legs.

Asia-Pacific is the fastest-growing market for medical exoskeletons because of the rising investments in healthcare, expanding patient pool needing rehabilitation and mobility support, and recent product approvals. For instance, in October 2022, CYBERDYNE INC., a manufacturer of human enhancements, announced that its lower-body medical exoskeleton, Medical HAL, is now approved for two new treatments: hereditary spastic paraplegia and HTLV-1-related myelopathy (HAM). The system, which is majorly approved in Japan, is used primarily in clinics and other medical centers.

Similarly, in August 2022, Harmonic Bionics announced that Healthlink Holdings Ltd. will have exclusive distribution rights for the Harmony SHR in Macau and Hong Kong. Healthlink is to begin purchasing systems following the FDA registration of Harmony SHR and start the full commercial launch in 2023.

Some Key Players Operating in Market Are:

- Ekso Bionics Holdings Inc.

- ReWalk Robotics Ltd.

- Parker-Hannifin Corporation

- BIONIK Laboratories Corp.

- Rex Bionics Ltd.

- B-Temia Inc.

- Bioventus LLC

- Hocoma AG

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the medical exoskeleton market, to offer accurate market estimations for 2017-2030.

Based on Component

- Hardware

- Software

Based on Type

- Powered

- Passive

Based on Extremity

- Upper Extremities

- Lower Extremities

- Full Body

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for medical exoskeletons valued USD 485.8 million in 2023.

AI integration is trending in the medical exoskeleton industry.

Powered ones are more popular in the market for medical exoskeletons.

Lower-extremity variants dominate the medical exoskeleton industry.

North America is the largest and APAC the fastest-growing market for medical exoskeletons.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws