Market Statistics

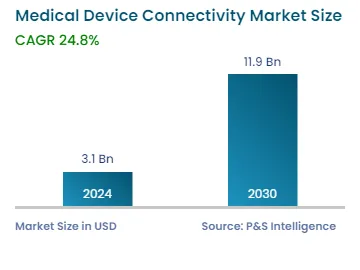

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3.1 Billion |

| 2030 Forecast | USD 11.9 Billion |

| Growth Rate(CAGR) | 24.8% |

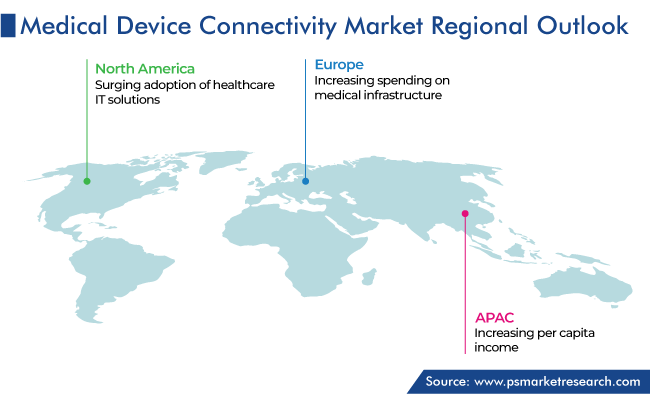

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 10787

Get a Comprehensive Overview of the Medical Device Connectivity Market Report Prepared by P&S Intelligence, Segmented by Offering (Solutions, Services), Technology (Wired, Wireless, Hybrid), Application (Vital Signs & Patient Monitors, Anesthesia Machines & Ventilators, Infusion Pumps), End User (Hospitals, Homecare Settings), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3.1 Billion |

| 2030 Forecast | USD 11.9 Billion |

| Growth Rate(CAGR) | 24.8% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global medical device connectivity market was valued at USD 3.1 billion in 2024, which is expected to reach USD 11.9 billion by 2030, growing at a CAGR of 24.8% during 2024–2030. This is primarily driven by the growth in the telehealth and remote patient monitoring segments. Also, the increasing preference for home healthcare is expected to present considerable potential prospects for companies in the medical device connection industry.

Moreover, the growing adoption of health information exchange (HIE) systems and electronic health records (EHRs) in healthcare organizations, the surging demand for data analytics in healthcare, the rising healthcare expenditure, the high prevalence of numerous communicable and non-communicable diseases, and the increasing emphasis on patient safety and quality of treatment are contributing to the surging need for medical device connectivity solutions.

Furthermore, the increasing number of government activities and support is another element influencing the growth of the market. For instance, according to a deal signed by the Japanese Prime Minister and the Indian Prime Minister in March 2022, a five-year USD 42 billion investment and finance plan, India intends to create medical equipment with the help of Japan. Dialysis, cardiac catheters, glucometers, patient monitoring systems, thermometers, specialty needles, and individual weighing scales are a few examples of such equipment.

The use of 5G technology for remote patient monitoring is a current trend in the market. For example, 5G networks speed up real-time data transfer, which is essential for accurate and prompt diagnosis. The diagnosis of infected individuals in remote regions from great distances is done instantly by hospitals with the help of this technology. On the other hand, medical imaging data from and is too big to transfer for remote analysis. These conditions have encouraged healthcare organizations to install 5G in remote hospitals' CT scanners.

Moreover, most hospitals lack experienced surgeons for every discipline, with the exception of large multispecialty hospitals in major cities. In this circumstance, doctors on the scene consult with specialists via video and audio. 5G connectivity can go one step further by providing professionals with real-time updates from operations, as they counsel the surgical team in progress. For instance, in addition to live-streaming the entire procedure with audio, surgical microscopes with 4K monitors can send consulting physicians high-quality pictures. These facts enable consulting experts to supervise and direct clients more effectively. Thus, these factors drive the market growth.

The usage of EHR devices by medical organizations has significantly increased during the past ten years. This is mainly due to the promotion of such systems by governments and their increasing usage by medical and insurance companies to raise the standard of healthcare.

Medical organizations are producing a lot of electronic data as a result of the rapid expansion in the usage of EHRs. To ensure that this data is used to its fullest potential for raising the standard of patient care, it must be appropriately managed. Thus, medical device connectivity solutions, which are effective, are being used more frequently by a number of healthcare companies to enhance clinical results and lower total healthcare costs. Additionally, by lowering medical errors, removing manual entry, and improving process efficiency, these solutions also make it simple to retrieve data, transfer patient information to EHR systems, and support meaningful usage of EHRs.

Moreover, funding is allotted for rewarding hospitals and doctors who significantly use EHRs under the American Recovery and Reinvestment Act (ARRA). Hence, the demand for automation and interoperable solutions is rising in tandem with the surging regulatory requirements and the increasing use of EHRs. Also, the demand in the industry is rising, as a result of the widespread use of EMR solutions and the growing focus of governments in both developed and developing nations on creating national HIE systems. Thus, these factors boost the demand for medical device connectivity solutions.

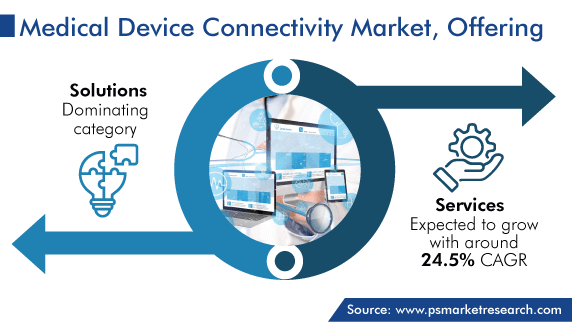

The solutions category held a larger revenue share, of 70%, in 2023. This is credited to the increasing adoption of HIE and EHR devices, the surging need for integrated healthcare systems, the expanding regulatory standards and healthcare reforms, and the migration of point-of-care diagnostics from hospitals to home care settings.

Additionally, the services category is projected to hold a sizable revenue share in the coming years, due to the rising initiatives implemented by major market participants. For instance, in January 2020, Korean telecommunications company, KT Corporation, and Samsung Medical Center announced a partnership to develop a cutting-edge, 5G medical service to support the expansion of smart hospitals. According to the agreement, KT built an enterprise-specific 5G network at Samsung Medical Center. It performed a pilot project test activity and created service settings in proton therapy and operating rooms.

The wireless technologies category held the largest revenue share, of 45%, in 2023, in the medical device connectivity market. This is because these technologies provide high-quality patient care, and patients' health can be continuously monitored by doctors and caregivers, who can also get real-time updates, allowing for quicker treatment. Additionally, these help in shorter stay times in healthcare facilities and remote patient monitoring to assure patient care and safety.

Moreover, the wireless local area network (WLAN) technology is now available to hospitals. WLAN is mostly utilized in hospitals for patient monitoring, communication, and the transmission of health data. For instance, if the appropriate patient information is supplied by a phone or personal digital assistant, doctors and nurses can make better clinical decisions. These WLAN applications are beneficial in advancing patient care and healthcare administration. Also, the market for wireless technology is being driven by the rising prevalence of chronic diseases like cancer and the resulting desire for more advanced solutions.

The vital signs & patient monitors category accounted for the largest revenue share, of 35%, in 2023. This is linked to the widespread usage of these monitors for ongoing patient monitoring because of the rise in cases of chronic diseases among older populations and their surging needs in emergency settings and operating rooms. Additionally, the high use of these monitors for remote monitoring of novel coronavirus significantly contributed to the market expansion.

Drive strategic growth with comprehensive market analysis

Globally, North America held the largest market share, of 50%, in 2023. This is due to the growing prevalence of chronic diseases, the surging adoption of healthcare IT solutions, the development of cutting-edge technologies, the increasing public awareness of health issues, and the rising healthcare expenditure in the region.

In an effort to simplify patient treatment, wireless tools are widely used across the region. For instance, HealthIT.gov reports that the U.S. Department of Health and Human Services looks forward to developing an interoperable health IT infrastructure. Thus, the demand for medical device connectivity solutions is being directly fueled by the rising focus on health IT infrastructure. Additionally, the improvement of the healthcare IT industry thanks to the efforts of government organizations like CMS is assisting in the expansion of the market.

Furthermore, the rising number of individuals infected with the coronavirus, the increasing consolidation among healthcare providers, the presence of key industry players, and strict regulations and guidelines established by various government and non-government authorities, including the Health Insurance Portability and Accountability Act and the Federal Communications Commission, are major contributors to the regional market growth.

In addition, Europe accounts for a significant market share. This is attributed to the rising prevalence of chronic diseases, the growing aging population, the increasing spending on medical infrastructure, the improving healthcare facilities, and the high disposable income of people in the region. These factors have led to a rise in the demand for better healthcare services and enhanced patient care quality.

This fully customizable report gives a detailed analysis of the medical device connectivity industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Offering

Based on Technology

Based on Application

Based on End User

Geographical Analysis

The medical device connectivity market size stood at USD 3.1 billion in 2024.

During 2024–2030, the growth rate of the medical device connectivity market will be around 24.8%.

Hospitals is the largest end user in the medical device connectivity market.

The major drivers of the medical device connectivity market include the increasing funding for medical infrastructure, the mounting automated workflow, the rising number of strategic collaborations and partnerships, the surging prevalence of chronic diseases, and the growing elderly population.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages