Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 15.6 Billion |

| 2030 Forecast | 31.4 Billion |

| Growth Rate(CAGR) | 12.3% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12734

Get a Comprehensive Overview of the Medical Billing Outsourcing Market Report Prepared by P&S Intelligence, Segmented by Service Type (Front-End, Middle-End, Back-End), Bill Type (In-Patient Bills, Out-Patient Bills), Billing System (Closed, Open, Isolated), End User (Hospitals, Physician Offices, Ambulatory Surgery Centers), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 15.6 Billion |

| 2030 Forecast | 31.4 Billion |

| Growth Rate(CAGR) | 12.3% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

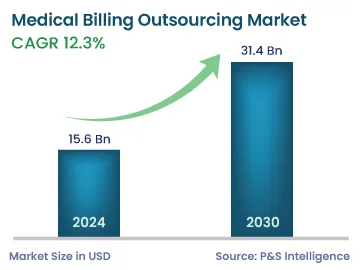

The medical billing outsourcing market size stood at USD 15.6 billion in 2024, and it is expected to grow at a CAGR of 12.3% during 2024–2030, to reach USD 31.4 billion by 2030. The growth can be primarily attributed to the increasing usage of IT resources in the medical business, the rising funding as well as schemes from governments, and the surging use of medical billing outsourcing services by hospitals, physicians, and other healthcare facilities, owing to their benefits.

Moreover, new trends in the usage of telehealth and the rising prevalence of infectious disorders are promoting the growth of the market. With the use of these outsourcing services, the cash flow is improved by the reduction in expenses of equipment, software, and employees.

The increasing number of medical prescriptions is one of the prime factors that is driving the growth of the market, owing to the rising incidences of chronic and infectious disorders and the surging number of hospital admissions around the world. Moreover, the sudden hit by the COVID-19 pandemic positively impacted the market for medical billing outsourcing, due to a spike in the hospitalization rate. This led to digital development and a high need for scalable, robust, collaborative, and agile infrastructure.

Due to the adoption of digitalization and outsourcing, the demand for advanced technology software for medical billing and maintaining databases of patients for future records is increasing. In addition, there is an increased adoption of for seeking and billing patients.

The surging need for or telehealth is one of the key trends witnessed in the market for medical billing outsourcing. Telehealth allows healthcare professionals to assess, diagnose, and provide treatment to patients at a distance with the help of telecommunication equipment, such as audio and video devices. Nowadays, technological advancements are enabling doctors to consult patients with the use of Health Insurance Portability and Accountability Act (HIPAA)-compliant video-conferencing tools. This has generated an increased number of medical prescriptions, leading to the need for medical billing outsourcing.

This trend emerged during the COVID-19 pandemic and is continued to exhibit in the forecast period. According to the guidelines given by the WHO, for the implementation of telemedicine services, telemedicine and telehealth are interchangeable terms in the healthcare sector. Also, telemedicine is a very accessible and cost-effective tool for the healthcare industry to increase patient engagement. Moreover, the rise in government funding and grants for telemedicine all over the globe is supporting the industry. Numerous government-based organizations are providing funding support and initiatives for raising awareness regarding telehealth, and in turn, are fostering the growth of the medical billing outsourcing market.

For instance, in February 2022, Health Resources and Services Administration (HRSA), the U.S. Department of Health and Human Services (HHS), awarded around $55 million to 29 HRSA-funded healthcare facilities to boost quality healthcare access to underserved people through virtual care, including , telehealth, digital patient tools, and health information technology platforms. In addition to that, this funding increased to over USD 7.3 billion in American Rescue Plan funding in 2022, invested in community healthcare facilities during the past year, to lessen the impact of COVID-19.

The front-end services category holds a significant revenue share in the market. This is primarily ascribed to a large number of front-end services required in the processes of preregistration, registration, scheduling, verification for insurance, eligibility criteria check, and pre-authorization. These services are handling the foremost functions of medical billing outsourcing and improving the functions by decreasing repetitive work, thereby providing faster serving and enhancing patient satisfaction. Additionally, front-end services are responsible to improve patient experience and handle back-end services, involving the processing of claims and reimbursement.

On the other side, the middle-end services category is estimated to exhibit lucrative growth in the coming years, due to new entrants offering such services and the growing awareness of middle-end services among healthcare practitioners.

The out-patient bills category is expected to grow at the highest growth rate, of 12.6%, in the market for medical billing outsourcing, during the forecast period, based on the bill type segment. This growth can be ascribed to the rising number of patients visiting OPDs for minor injuries and a large number of out-patient surgeries that do not require the need for overnight stays at hospitals. Also, the emergence of advancements in the medical field, including minimally invasive surgeries, and the availability of the latest medical equipment are contributing to the market growth in this category.

The large hospitals category is expected to hold the largest share, of around 50%, in 2030. This will be due to the increasing number of large hospitals, the rising hospital spending, the presence of robust technologies, and the adoption of electronic health records in hospitals. For instance, over 90% of hospitals in the U.S. are in the process of ratifying EHRs. Also, medical billing outsourcing is required for the proper functioning of large hospitals, to eradicate the occurrence of errors.

Moreover, large hospitals provide higher patient satisfaction, the latest technology & hi-tech laboratory facilities, proficient doctors, better insurance schemes, great amenities, and good infrastructure. In addition to that, best-in-class medical treatments and wellness benefits such as personal assistance and health assessments are given by large hospitals.

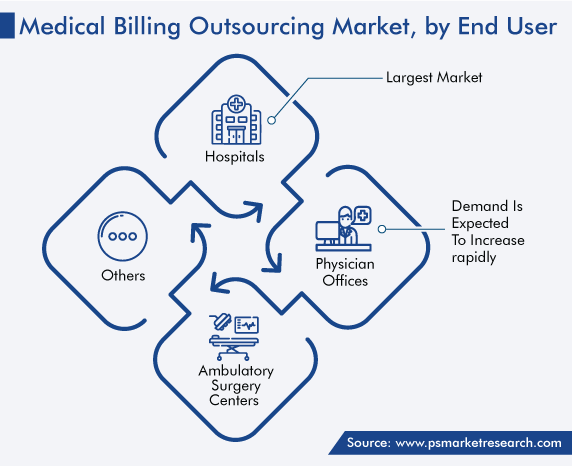

The hospitals category accounts for the largest revenue share, based on end user, and it is projected to maintain its dominance across the forecast period as well. This is due to the surging need for medical billing outsourcing solutions across hospitals, with the aim of handling the growing burden of managing patient records; and the rising demand for financial services in hospitals along with the great usage of these services, owing to a high volume of reimbursement claims.

Moreover, the hospital consolidation rises the reimbursement and billing complexities, further triggering the need for medical billing outsourcing services. Additionally, the introduction of the newly revised International Classification of Diseases-10th revision (ICD-11) has made the business of medical billing more difficult in nature. Because of this, the revenue cycle management (RCM) demand has significantly increased. Further, healthcare providers are preferring to choose companies providing the right association of RCM together with EMRs for enhanced patient outcomes.

Whereas, the physician offices category is expected to grow at the highest growth rate during the forecast period. This can be attributed to the increasing expenditure on the healthcare department by small and medium-sized medical providers, owing to the growing focus on risk management, regulatory compliance, complex technology, and staffing requirements. Also, these offices are adopting outsourcing services in several fields, due to changes in government regulations and for reducing operational costs. For instance, it is projected that around 15% of physician earnings are spent on health billing errors and approximately 25% of the revenue is spent on the billing process by healthcare providers or businesses.

Drive strategic growth with comprehensive market analysis

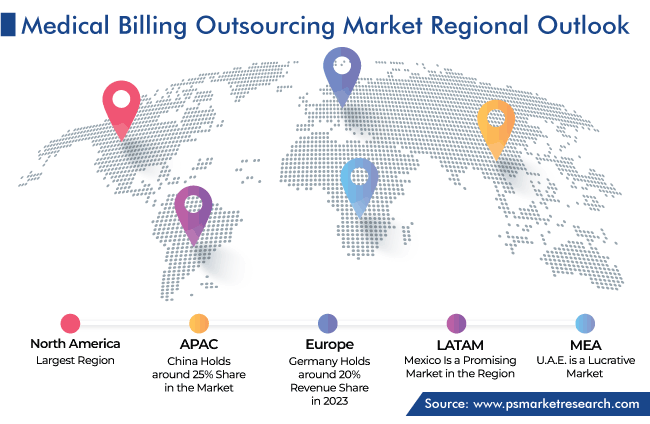

North America leads the global market for medical billing outsourcing, with a revenue share of 55% in 2023. This is due to the rapid adoption of technologically advanced solutions, high research and development investments, and the presence of major industry players and their efforts to come up with great services and customer satisfaction in the region.

During the past years, the focus of healthcare providers has shifted toward end-to-end outsourcing companies for the management of billing processes. This shift is due to the rising awareness about the advantages provided by these firms, and as a result, medical providers are relying on them to boost operating margins and administer high-volume transactions.

This report offers deep insights into the medical billing outsourcing market, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Service Type

Based on Bill Type

Based on Billing System

Based on End User

Geographical Analysis

The medical billing outsourcing market size stood at USD 15.6 billion in 2024.

During 2024–2030, the growth rate of the medical billing outsourcing market will be around 12.3%.

Hospitals is the largest end user in the medical billing outsourcing market.

The major drivers of the medical billing outsourcing market include the growing focus on compliance and risk management via regulators, the surging demand for better patient experience, the rising government initiatives to support the adoption of digital tools in the healthcare sector, and the advent of new technological solutions for managing uncollectible data.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages