Medical Aesthetics Market Analysis

Explore In-Depth Medical Aesthetics Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 10795

Explore In-Depth Medical Aesthetics Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

The injectables category held the largest revenue share, of 40%, in 2024, owing to the rising sales of injectables, such as botulinum toxin, neurotoxin, and dermal fillers. Additionally, the injectables are in high demand due to various factors such as minimal scarring, short procedure time, minimally invasive, instant result, and cost-effectiveness of the products. According to the ISAPS, Botulinum toxin was the most-popular non-surgical aesthetic procedure in 2023, with 8,877,991 performed worldwide.

The forecast period, the energy-based aesthetic category is projected to grow at the highest rate, due to the rising adoption of radiofrequency and laser devices for beauty purposes. These procedures are quick, painless, non-invasive, and often, permanent. Another factor that drives this category is the versatility of energy-based devices for hair removal, photorejuvenation of the face and skin, body contouring, fat reduction, cellulite reduction, and skin tightening. Moreover, the increasing number of dermatology and aesthetics centers in developing countries enhances the access to such procedures. The American Society of Plastic Surgeons that that 3,101,772 laser-based skin procedures were performed in the U.S. in 2023, compared to 2,915,199 the previous year.

These product types are covered in the report:

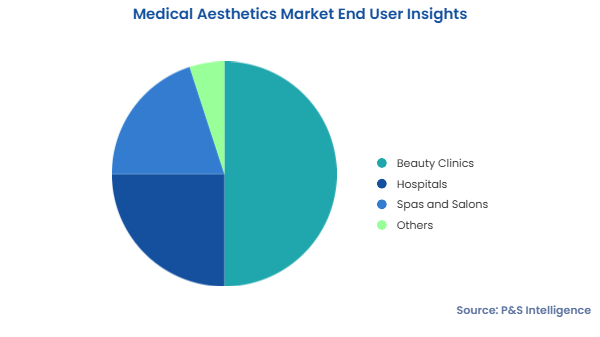

The beauty clinics category held the largest revenue share in 2024, and it will also have the highest CAGR over the forecast period, of 12%. This is due to the increasing disposable income of several countries, along with the increasing number of beauty clinics and centers across the globe. These centers offer numerous aesthetic treatments, such as scar removal, wrinkle treatment, and body enhancement and augmentation. These increase the usage of different products especially neurotoxin and dermal fillers in beauty clinics and centers.

Moreover, the rising awareness of aesthetic procedures, the increasing number of clinics and surgeons offering this treatment, the emergence of advanced products, the surging comfort level among patients, and the growing patient preference for minimally invasive cosmetic procedures are also driving the market in this category.

In addition, the spas and salons category hold the second-largest market share, due to the rising demand for energy-based aesthetic devices in these facilities for epidermal skin and hair treatment. However, the spas and salons are no longer restricted to non-prescribed beauty treatments, they offer specific aesthetic treatments and procedures, including injectables.

We studied these end users:

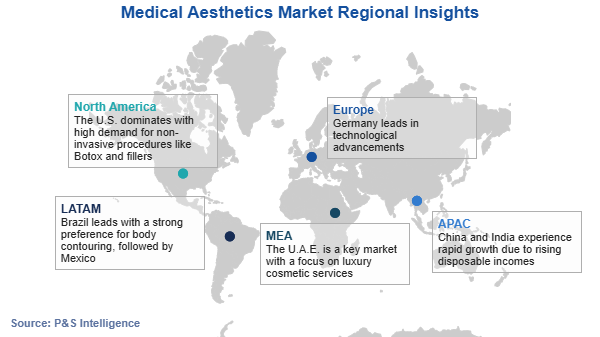

North America has the leading position in the medical aesthetics market, and it will hold the same position in the coming years, with a value of around USD 17 billion in 2032. This is because it is considered the key region for innovation in cosmetic procedures since a majority of established and upcoming key players are either headquartered or have a significant geographical presence in the region. This is also because of the surging spending on aesthetic plastic surgeries and the increasing number of surgical and non-surgical procedures in the region.

As per the ISAPS, the U.S. had 7,750 aesthetic surgeons in 2023, the most in the world. Further, the country accounted for the highest count of non-surgical aesthetic procedures in 2023, at 4,405,599. Consumer patterns suggest that they do not hesitate in undergoing expensive aesthetic products and treatments. Additionally, according to the American Academy of Facial Plastic and Reconstructive Surgery, almost 1,575,244 surgical and non-surgical procedures were performed in the country in 2023, which was 5% more than in 2022. The region also remains the significant leader in various medical procedures, such as implantation, body contouring, and liposuction, addressing the needs of the growing population of obese people, due to poor eating habits and lifestyles.

Furthermore, the rising investments in the healthcare industry, the governments’ favorable regulations for inviting foreign investments, and the increasing research and product development through advanced technologies are aiding the growth of the regional market.

In North America, the U.S. market holds the leading position, and it will continue to dominate the regional market during the forecast period. This is due to the advanced healthcare system, technological advancements, and strong financial support from the government. Moreover, the increasing geriatric population, peer pressure to look younger, and the rising obese or overweight population are driving the growth of the market in the country.

The APAC market is expected to witness significant growth in the coming years, as regional countries are experiencing a significant increase in the use of cosmetic treatments, driven by factors such as expanding middle-class population with rising disposable income, the surging awareness about skin treatments, the growing aging population, the decreasing social stigma and taboo attached with these treatments, and the increasing number of medical tourists in the region opting for cosmetic procedures.

The ISAPS says that 1,028,723 non-surgical and surgical aesthetic procedures were performed in India in 2023. The numbers stood at 172,840 for Thailand, 23,923 for Malaysia, and 21,928 for Bangladesh. Moreover, Singapore, Japan, India, Thailand, Taiwan, and South Korea are popular destinations for medical tourism, which continues to drive product demand in APAC.

The regional breakdown of the market is as follows:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages